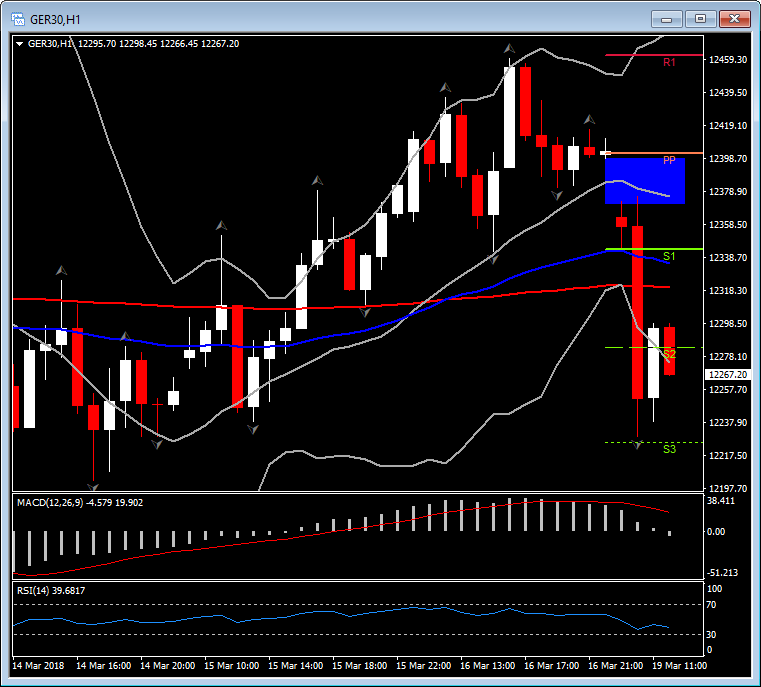

GER30, H1

European stock markets are selling off, with the UK100 down -1.04% and the GER30 down -1.20% as of 8:43GMT after a mixed session in Asia. Mining companies are heading south with commodities and tumbling ire ore prices. real estate is the only one of the Stoxx 600 sectors to rise. U.S. futures are also down ahead of Jerome Powell’s first meeting as Federal Reserve chairman later this week and amid concerns of an escalation of global trade tensions.

The GER30 has been seen today rebounding from 12229.37 low, up to 12300.00. However, on the announcement of Eurozone trade surplus which narrowed in January amid strong import growth, GER30 drifted again lower to 12267.97, moving again outside of the lower Bollinger pattern and the day’s S2. Data-wise, the seasonally adjusted trade surplus narrowed to EUR 19.9 bln, from EUR 23.2 bln in the previous month. Exports contracted, while import rose over the month.Mixed numbers then, with the ongoing surplus, which is largely thanks to Germany adding to the critics of Germany’s large trade surplus, while the fact that import growth actually outstripped export growth at the start of the year will back those defending current policies. Furthermore, this is nominal data, which is impacted by both oil price and exchange rate developments and thus gives a somewhat distorted picture of real trends.

Intra-day picture for the particular stock remain negative despite the gains seen on London open. the failure of breaking above 200-period EMA in the hourly chart earlier, along with the nevative momentum indicators, suggests that the asset is going to continue downwards, with the support levels at 12225.00, 12170.00 and 12105.00. The RSI is at 39, indicating that there is plenty of space downwards, while MACD signal line is still positive but is pointing down, with MACD histogram already turning into negative with negative momentum increasing. Everything is pointing to the continuation of the downtrend. Hence only a reversal at S3 at 12225.00 and a break above 200-period EMA could suggest a swing higher and a possibility of closing the gap seen today morning.

Nevertheless main focus remain on EU summit, with the German finance minister stating today that he is “seriously worried”, that free trade is at risk. Scholz told Germany’s Bild that protectionism isn’t the answer to the problems of our time and stressed that trade will be a key item on the agenda of the G20 meeting. Meanwhile EU President Tusk has also put Trump’s tariff plans on the agenda of this week’s EU summit – further signs that a world trade war is looming on the horizon. Tusk also proposed that EU leaders have an extraordinary trade debate at the summit in the light of the “risk of a serious trade dispute between the United States and the rest of the world, including the EU”, with the clear objective to keep world trade alive and “if necessary, to protect Europeans against trade turbulence, including by proportionate responses in accordance with the WTO”. So the summit could also further fuel lingering concerns about a world trade war.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/20 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.