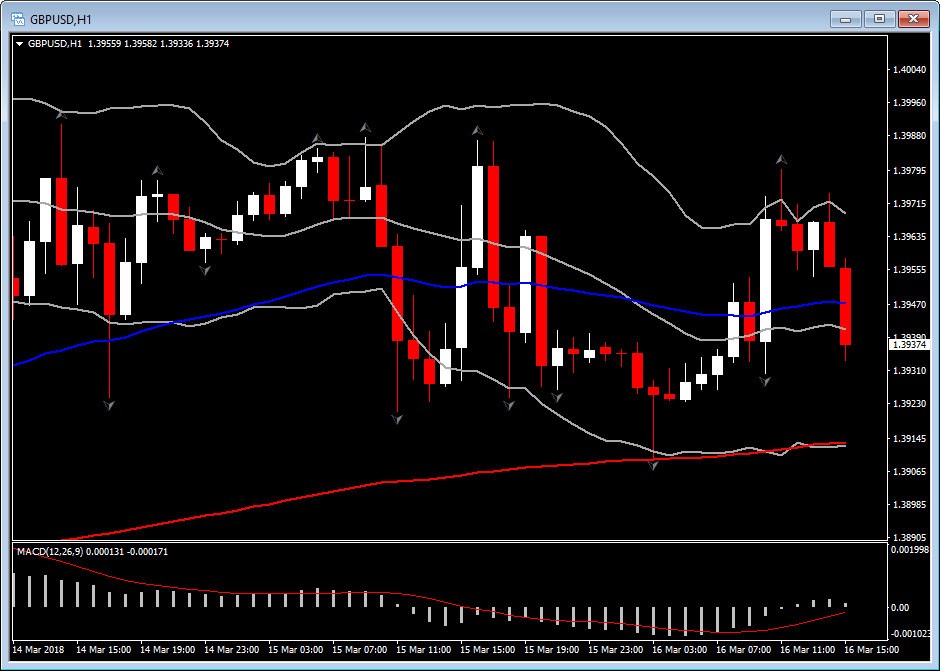

GBPUSD, H1

The pound is moderately higher today versus the dollar and euro, while down against the outperforming yen. The same picture is being seen in the week-on-week comparison. Cable has posted an intraday high at 1.3981, but has remain shy of the week’s highs at 1.3992-95, and EURGBP has been drifting steadily lower for over a week, logging a 17-day low earlier at 0.8816. There has been a lack of strong domestic drivers, with rapidly souring UK-Russian relations having cast little impact as yet, and with there have having been a dearth of UK data this week. Therefore the main driven today for cable was dollar weakness, which is currently converted into strength after the softer housing starts print and the surge in industrial production and capacity use. The dollar moved higher after the stronger industrial production outcome. EURUSD slid to lows of the week, bottoming at 1.2287, falling from 1.2325. USDJPY rallied to 105.98 from 105.85. GBPUSD slid to 1.3930 from 1.3958.

U.S. February industrial production jumped 1.1% with capacity rising to 78.1%, much better than expected and is the strongest reading since October’s 1.6% gain. This follows January’s 0.3% dip in production (revised from -0.1%, while December’s 0.4% gain was bumped up to 0.5%). Capacity utilization for January was revised to 77.4% from 77.5%. The January drop broke a string of four straight monthly gains.

Data, drift Cable lower down to 1.3930, while the next support for Cable is at 1.3911-1.3915. This pullback expected to be temporary since Political intrigue in the U.S. fed an ongoing fragile sentiment in global markets. Hence any indication of a return to the upside, could trigger a buying opportunity again. Meanwhile, Market focus is on next Tuesday’s UK inflation report for February, and the two-day EU leaders’ summit, starting next Thursday, where the 27 are expected to agree a roadmap for a post-Brexit transition period. Meanwhile, sterling markets are discounting about 80% odds for a May BoE rate hike (according to Barclays).

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/20 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.