USDJPY, H1 and H4

The 4k initial claims drop to 226k in the second week of March trimmed last week’s 20k bounce to 230k, as holds above the 48-year low of 210k at the end of February. Claims have tightened sharply in 2018 despite the lift over the last two weeks, with likely help from tax reform and anticipated spending related to the budget bill that is filling the void of diminishing disaster rebuilding. Meanwhile, U.S. import prices rose 0.4% in February with export prices up 0.2%. The 1.0% jump in January import prices was revised down to 0.8%, while the 0.8% export price gain was not revised. On a 12-month basis, import prices rose to a 3.5% y/y pace versus 3.4% y/y (revised from 3.6% y/y) while export prices slowed to a 3.3% y/y rate from 3.4% y/y. The Philly Fed slipped to 22.3 from 25.8 in February but a similar 22.2 in January, while the ISM-adjusted Philly Fed defied the headline and surged to a 45-year high of 61.8 from 56.3 in February and 57.3 in January.The U.S. Empire State manufacturing index bounced 9.4 points to 22.5 in March after February’s 4.6 point drop to 13.1. This breaks 4 straight months of declines after hitting 28.1 in October. It was 14.6 a year ago and over the last 2 years has ranged from a high of 28.1 (October 2017) to a low of -7.6 (October 2016).

The dollar was fractionally higher after the mix of data, where jobless claims were in line with expectations, the Philly Fed index was shy of forecasts, the Empire State index beat estimates, and import prices were slightly higher than consensus. EURUSD dipped a few points to 1.2334, while USDJPY edged up to 106.10 from 106.08.

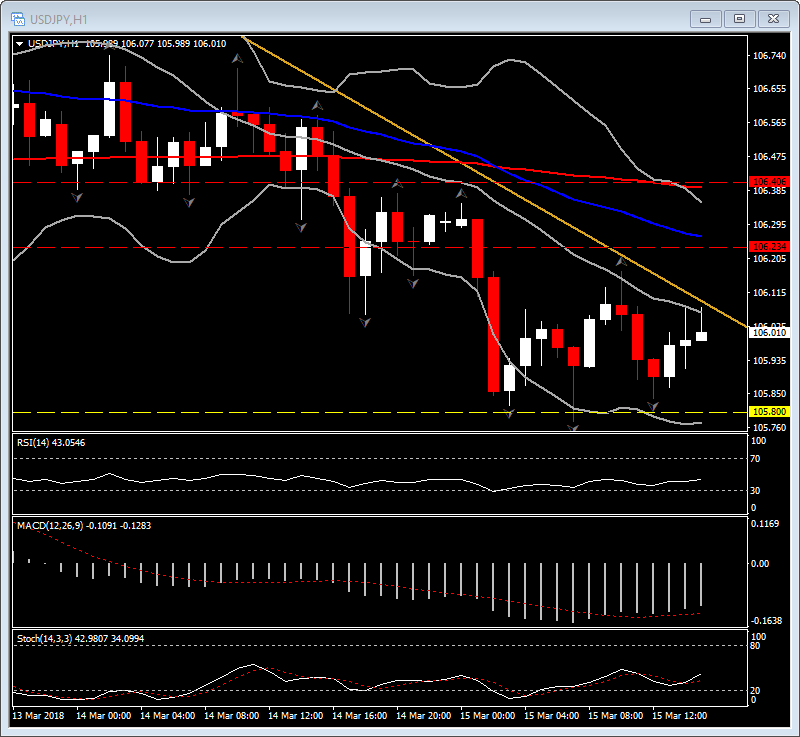

Yen despite the perk up seen on data release, it remained in general heavy today. After a rebound from intraday losses in Asian equity markets, and modest gains in European stocks helped stem yen buying. However, by considering the down channel that the pair is following this week, along with the fact that it is traded in the lower Bollinger Bands pattern, below all 3 Moving Averages, then the pair indicates that weakness will continue, with a possible retest this week of support levels at 105.80, 105.45 and 105.35. Momentum indicators confirm weakness with RSI near oversold teritorry, Stochastic below neutral and MACD strongly fluctuating at negative area.

Hence in a daily basis, only a break above the 20-DAY MA at 106.50 but more precisely above 107.00, could triggered a buying opportunity for USDJPY. In an intra-day basis, only a break above the recent swing high at 106.20, could suggests a retest of the resistance level at 200-period EMA at 106.40.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/20 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.