EURNZD, H4 and Daily

EURNZD retested today week’s high close to the round level of 1.7100. However intra- day weakness has been noticed, mainly after the release of the Eurozone Q4 GDP data, which Eurozone Q4 GDP was confirmed at 0.6% q/q and 2.7% y/y as expected. The breakdown, which was released for the first time, did not change the overall picture or the ECB outlook, with the main surprise the large revision to Q3 investment numbers.

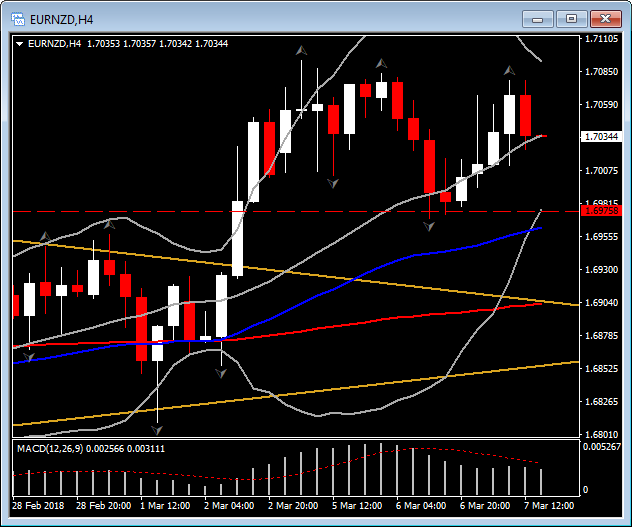

During the European session, EURNZD made its way down to 1.7024, forming a tweezer top in the 4-hour chart, and it currently crossed into the lower Bollinger Bands area. Despite the bearish Tweezer top pattern noticed earlier, the pair still moves above the recent swing low in the 4-hour chart at 1.6970, and the 50.0% Fibonacci retracement level of the down-leg from 1.7477 to 1.6517, in the Daily chart. Nevertheless, a significant breakout, is the upwards break of the Falling wedge (formed since December’s peak) noticed on Friday.

Technically-wise, intra-day momentum indicators, suggests consolidation to a negative momentum for the pair, with the MACD close to neutral Zone, while RSI and Stochastic crossed below 50 level. Therefore the pair is likely to retest today the 1.6970 level.

In a wider picture, the pair remains in a bullish trend, as long as it remains above 1.6935 but significantly above the confluence of 20-DAY SMA and the 38.2 Fibonacci level at 1.6900. Oppositely, if positive momentum continues in the longer time-frame, then the next level to watch is the 1.7210 resistance if there is a jump above the 61.8% Fibonacci mark.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/07 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.