FX News Today

European Fixed Income Outlook: the 10-year Bund yield is down -1.3 bp at 0.655% in early trade, the 2-year down -1.4 bp at 0.58%. The correction comes amid a wider decline in long yields globally, led by Treasuries. European stock futures are heading south in tandem with U.S. futures and after a sell off in equities during the Asian session as concerns about a global trade war pick up again. S&P 500 futures are down over 1% on Cohn resignation, the head of the National Economic Council, and who had been key figure in Trump’s administration. Many White House watchers say Cohn his departure is over Trump’s sudden push toward trade protectionism. The news broke after the close of the regular session on Wall Street yesterday, and the losses in index futures foreshadow to a sharp decline at the open later today. The narrative is that Cohn’s departure effectively signals that the protectionist cohort of advisers in the administration, led by the head of the Office of Trade, Navarro, have won out, leaving the White House without a heavyweight advocate of globalization sentiment, suggesting that Trump will go the distance with his trade protectionist campaign pledge, risking a trade war that most economists, see as negative for the U.S. and global economies. Today’s calendar has the final reading of Eurozone Q4 GDP as well as U.K. house price data from the Halifa

FX Update: The yen has rallied on a safe haven bid following the resignation of Gary Cohn, the head of the National Economic Council, which many onlookers are taking as effectively signalling that the Trump administration will go the distance in trade protectionism. The biggest movers out of the main yen crosses have been CADJPY and AUDJPY, with the Canadian and Australian economies seen as being exposed to a global trade war. The confirmation hearings of the new BoJ deputy governors today produced more dovish rhetoric, with Amamiya, for instance, saying that it is “very regrettable” that inflation hasn’t hit target yet, though to little impact on the yen.

Charts of the Day

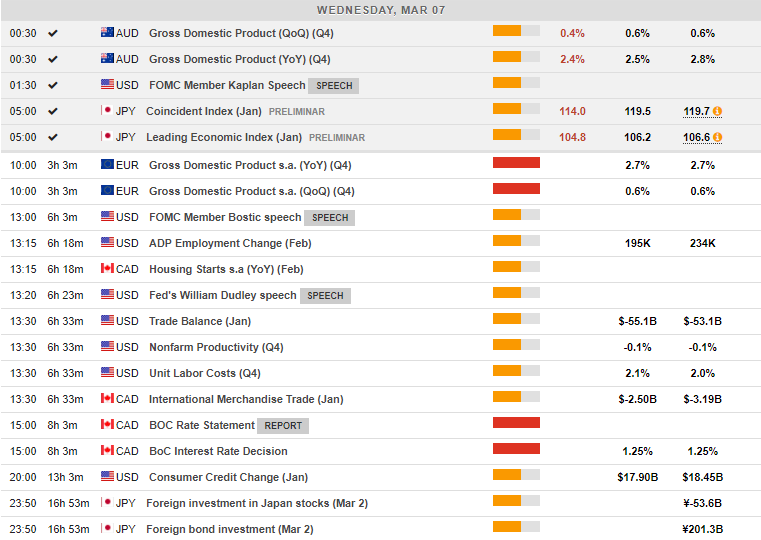

Main Macro Events Today

- Eurozone GDP – Q4 GDP is widely expected to be confirmed at 0.6% q/q, and 2.7% y/y, in line with the preliminary reading. This leaves the focus on the full breakdown, which will be released for the first time and is likely to show ongoing investment and a pick up in exports, with the latter helping to underpin growth at the end of last year.

- ADP Non-Farm Employment Change , Trade Balance – The January trade deficit should post its 5th consecutive month of widening, to -$54.1 bln from December’s -$53.1 bln, amid declines in imports and exports. Q4 Productivity in Q4 should be unrevised at -0.1%, while Unit labor costs are expected to be bumped up to 2.1%. Tthe February ADP private payroll survey, expected to reveal 195K jobs excluding the farming industry and government, from 234K last month.

- Canadian Trade Balance – The January trade deficit is seen narrowing to -C$2.5 bln from -C$3.2 bln in December. Productivity is expected to edge 0.1% higher in Q4 (q/q, sa) after the 0.6% drop in Q3.

- BOC Rate Statement & Interest rate Decision – The main event is the BoC’s rate announcement , which is expected to result in no change to the current 1.25% rate setting. In January, strong recent data, an economy operating close to capacity and inflation close to target was cited alongside the decision to reduce accommodation. Economic data since the January announcement have been somewhat disappointing, with the 1.7% gain in Q4 GDP undershooting the BoC’s 2.5% estimateUncertainties remain elevated, especially after the proposed steel and aluminum tariffs from President Trump raised the specter of a trade war while lending a bit of pessimism to the ongoing NAFTA talks. The BoC will not hold a press conference, while the next MPR is in April, leaving a short and sweet announcement for the market to mull.

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/03/07 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.