FX News Today

European Fixed Income Outlook: Asian stock markets are ending another volatile week on a positive note. Nikkei and Topix gained 0.72% and 0.82% respectively, the ASX 200 was also up 0.82%. In Europe, Bund yields are heading south in opening trade, with the 10-year down -0.8 bp at 0.693% as of 7.27 GMT. Peripherals continue to underperform, but also quickly lost opening gains, amid a broader correction in long yields across most of Asia. The 10-year Treasury yields also continues to come down from the highs seen in the wake of the FOMC minutes, but remains at high levels above 2.9%. Curves are flattening and European stock futures are mostly higher, with markets set to end another volatile week on a slightly more optimistic note. Released at the start of the session German Q4 GDP was confirmed at 0.6% q/q and 2.9% y/y, as expected. Still to come final Eurozone January HICP is widely expected to be confirmed at 1.3% y/y, far below the ECB’s upper limit for price stability.

FX Update: The dollar has traded moderately higher, heading into the London interbank open with a 0.3% advance versed the euro, Swiss franc and yen, and comparatively more modest gains against the Australian and Canadian dollars. The New Zealand dollar has stood out as the weakness currency of the units, with a 0.7% loss versus the U.S. buck. The losses in the antipodean currency came despite above-forecast retail sales data out of New Zealand, with the dynamic reportedly coming amid position jigging in NZDAUD, which has rebounded some over the last day following a period of notably underperformance that drove the cross to a six-month low earlier in the week. EURUSD has ebbed back to around 1.2280, correcting from yesterday’s 1.2352 high. USDJPY has traded firmer today after two consecutive down days, lifting to the lower 107.0s from yesterday’s four-session low at 106.59. The forex market has been continuing to factor in the recent revival of Fed tightening expectations and the associated lift in U.S. Treasury yields, which this week have pushed to multi-year highs across the curve. And while stock markets have picked up over since last week, the rebound has been moderate and key indexes remain well off the record highs that were seen in late January. In the current climate, the dollar is tending to rally during phases of pronounced risk-off sentiment in global markets, or phases of muted risk-on. Japanese January inflation data had limited impact.

Charts of the Day

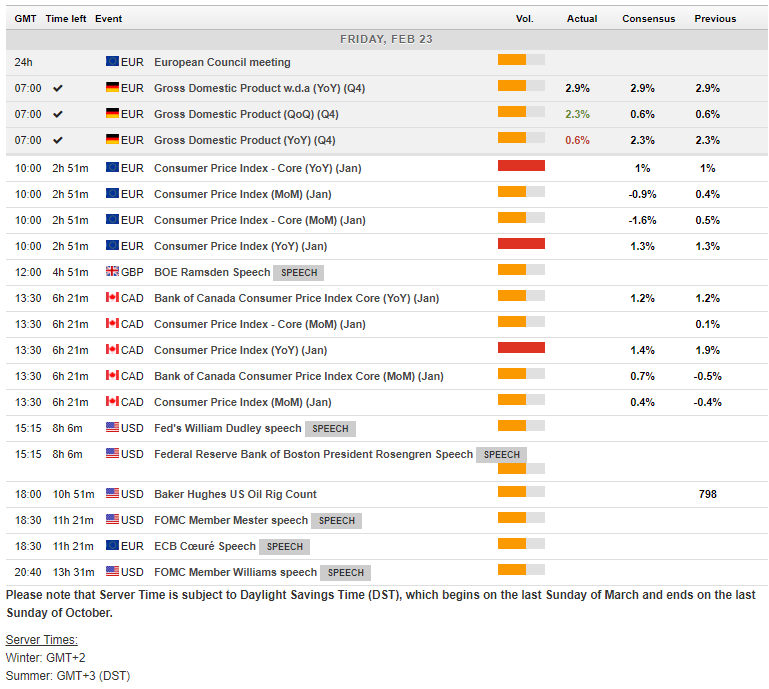

Main Macro Events Today

- Eurozone CPI – should be confirmed at just 1.3 % y/y, with core inflation at just 1.0% y/y, far below the ECB’s 2% target.

- Canadian CPI – The CPI projected to rebound 0.4% m/m in January after the 0.4% drop in December. The CPI should slow to a 1.4% y/y pace from 1.9% y/y thanks to an easy comparison with an elevated January of 2017, which was when CPI jumped 0.9% m/m and expanded at a 2.1% clip due to sharply higher energy prices.

- Fed Monetary Policy Report – the release of the text of the Monetary Policy Report will be an important introduction to the Jay Powell Fed. The MPR will be the basis for his congressional testimony next week. Jay Powell expected to support the notion of a gradualist policy approach doubt he’ll suggest a more hawkish leaning, which many in the markets fear, but will be mindful of the upside risks to the economy in the wake of tax reform and the improvement in global growth.

- FED’s speeches – Dudley is joined by Boston Fed hawk Rosengren (non-voter) for a panel discussion on the Fed balance sheet. Cleveland Fed hawk Mester (voter) discusses “A Review of the Objectives for Monetary Policy” and SF Fed centrist Williams (voter) mulls the economic outlook and its impact on monetary policy also today.

Support and Resistance Levels

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/02/27 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.