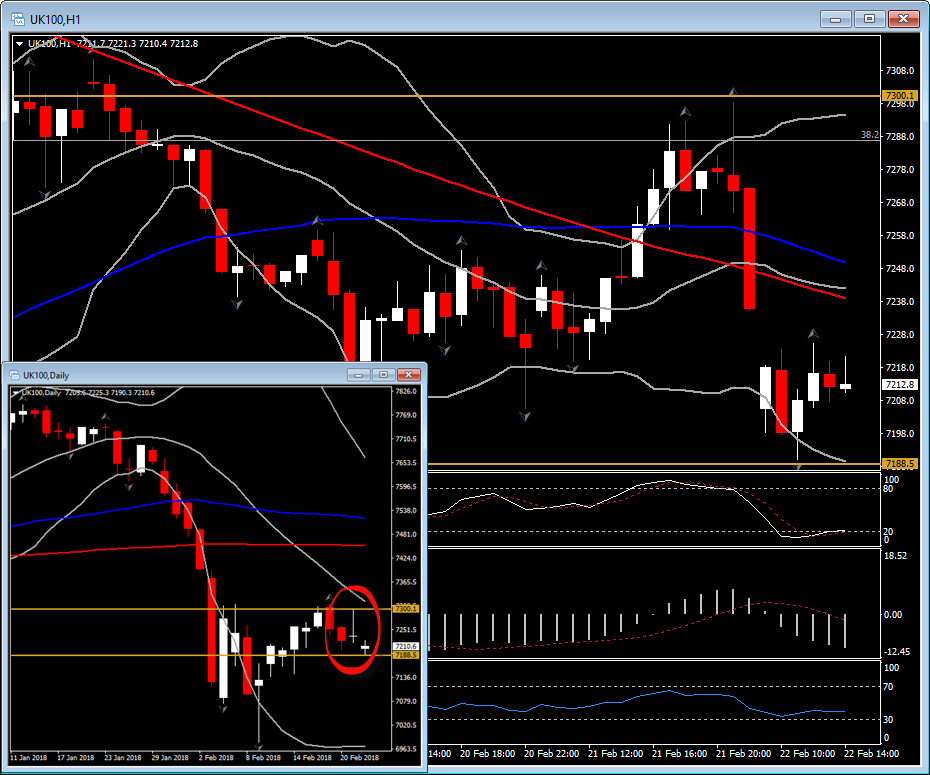

UK100, Daily

As seen on the closing of US Market yesterday, UK100, closed weakly forming a Doji Daily candle, despite the 0.48% gain seen yesterday during London session. The unexpected rise in U.K. jobless numbers helped Gilts to outperform and BoE comments that repeated that more rate hikes are underway had only a temporary impact. The stock dropped from 7298 high, back to 7236.00, while opened today at 7205, illustrating a gap between Wednesday’s and today’s price action. Like, every single gap seen, the market tends to fill the gaps at some point, however the move below 7200.00 overnight along with the fall after the test of 7300.00 high, increase the bearish trend of the instrument and therefore they do not indicate that the gap is likely to be filled so far today.

The UK100, retested the 7300.00 area for a 2nd week, reaching once again the 38.2% recovery of the 2018 losses, suggesting with theses moves present that the market is looking to be lifted back to 2017 highs. The decline on FOMC meeting, confirms that bears still have the major control. Hence the ending of the week of UK100, is likely to provide a clearer picture of the future direction of the price action.

If prices manage to be held above the immediate support at 7200.00, could provide further upwards hopes to the traders. Additionally, the perfect confirmation of positive momentum could come on the break of the immediate resistance at the confluence of 20-Day SMA, the latest up fractal and the 38.2% retracement Fibonacci level, at 7290.00-7300.00 area. To the downside, the break of the immediate support could suggest a retest of the 7000.00 key level .

The technical indicators confirm the negative momentum, wit MACD lines much lower than neutral zone, RSI pivoting around oversold crossing and Stochastic at neutral. The hourly indicators confirm negative momentum as well.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/02/22 12:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.