USOIL, H4

On Friday, Baker-Hughes released its weekly oil rig count report, revealing a 7-rig increase, to 798, and up 201 from a year ago. This marks the 4th consecutive week of increases, and indicates further gains in U.S. production, which last week topped at a record 10.25 mln bpd. USOIL fell to $61.20 from near $61.86 after the report.

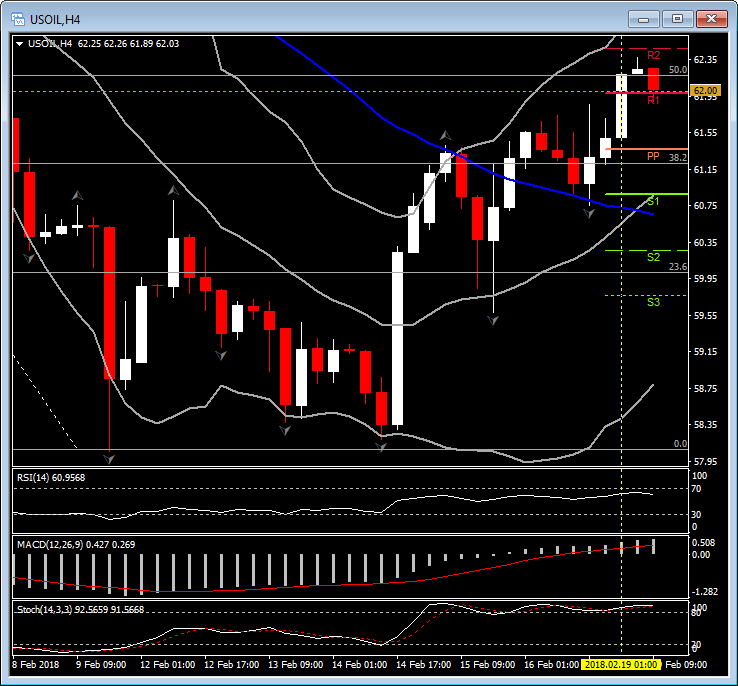

The USoil is outperforming since then, and manage to climbed up to $62.00 area. It is currently consolidating between $62.00 – 62.30 area, with a slight weakness notices on London open. This area, coincides with the 50% Fibonacci retracement level set since the drop noticed from February 2.

In short-term, the market, however, indicates positive sentiment as technical indicators suggest that a move to the upside is quite possible within the day. The RSI and MACD fluctuate above neutral , presenting that positive momentum still holds, while Stochastic remain in the overbought territory. Moreover, the price action signals a bullish intra-day picture, as it remains on the upper Bollinger Bands pattern, above the 20 and 50-period SMA, while the 20-period MA has confirmed a crossing above the 50-period MA. The latter strengthens the short-term Bullish view.

In the bigger picture, the USOil gives a mixed sign, with the price moving above the Pivot Point level and 50-Day SMA, but still in the Lower Daily Bollinger Bands pattern. The momentum indicators are mixed as well, and closer to a negative momentum, with RSI and Stochastic at neutral, while MACD remains negative since Ferbuary 9.

Therefore, as Fibonacci levels behave aslso as retracement levels, and with Oil finding resistance at the 50% Fibonacci, a break today above this area, would probably triggers a spike higher to the 20-DAY SMA and the 61.8% Fibonacci of $63.13. Otherwise if bearish move dominates, the area between Daily PP level found from Pivot Point analysis and the 38.2% Fibonacci level, at 61.00 – 61.37, could provide immediate support for the future.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/02/20 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.