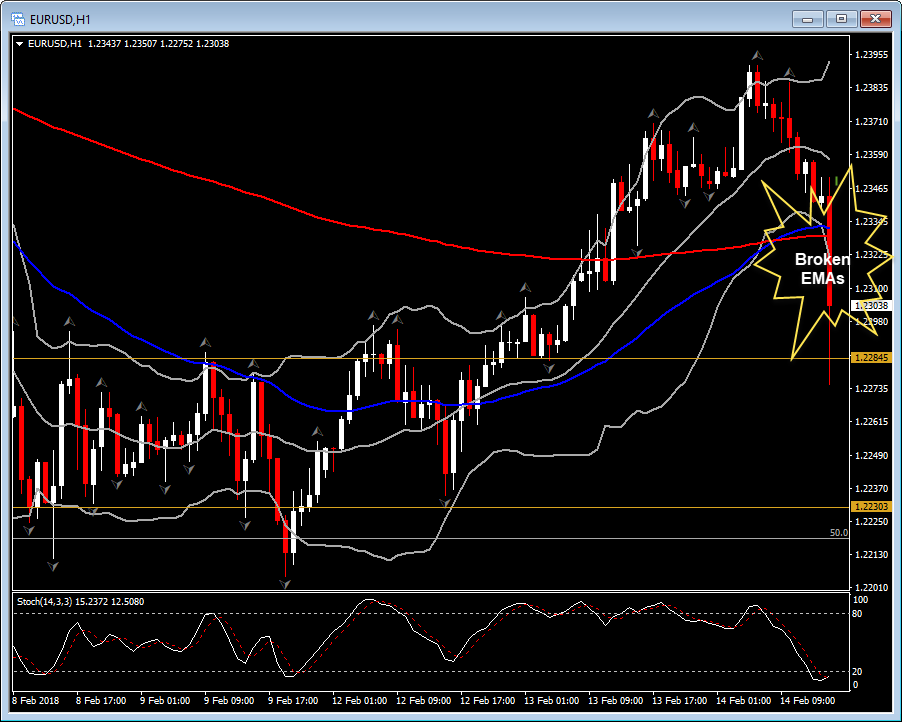

EURUSD, H1

The dollar rallied following the mix of data, where CPI headline and core came in firmer than forecasts, while retail sales were softer than expected. EURUSD fell from 1.2350 to 1.2275, as USDJPY popped to 107.55 from under 107.54. Equity futures plunged, now indicating a sharply lower Wall Street open. Dow futures had been up 150 points, and are now down 300 after the data.

U.S. January retail sales fell 0.3%, with the ex-auto component unchanged. U.S. CPI surged 0.5% in January with the core rate 0.3% higher, both hotter than expected. Gains were broadbased. The December headline and core rates were each 0.2% higher (revised from 0.1% and 0.3%, respectively following benchmarking). The 12-month headline rates were steady at 2.1% y/y for the headline and 1.8% y/y for the core. Internals showed energy rose 3.0% from the prior -0.2%. Services prices were 0.3% higher. Housing costs increased 0.2%, with the owners’ equivalent rent measure up 0.3%. Food/beverage prices edged up 0.2%. Apparel costs climbed 1.7%. Transportation costs were 1.8% higher. Medical care was up 0.4%. Tobacco prices increased 0.3%.

In my report published on Monday, I wrote : “Inflation worries should continue to weigh on Treasuries. Hence if the January CPI figure on Wednesday, ratifies that inflation is back and therefore a restriction on inflation is necessary, hence the concern of up to 4 tightenings this year might be reasonable enough. Based on this scenario, US equities could spike lower and thus USDIndex could be seen moving higher. Conversely, soft inflation outcome could provide some positive momentum for US equities and thus a downwards momentum on USDIndex.“

The hotter CPI data boost USDIndex higher and therefore EURUSD lower, with the latter next immediate support areas at 1.2280, 1.2230, 1.2200.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/02/14 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.