GBPNZD, H1

UK December trade data showed earlier a worse than expected deficit, with the goods deficit working out at GBP 13.6 bln, up from GBP 12.5 bln in the month prior and wrong footing the median forecast for a decline to a deficit of GBP 11.6 bln. The overall trade balance showed a deficit of GBP 4.9 bln, much worse than the GBP 2.4 bln deficit figure expected. At the same time, UK December production released as well and contracted more than expected, by 1.3% m/m after a 0.3% m/m gain in November. The y/y figure came in flat, below the median for 0.3% y/y growth and after a 2.6% gain in the month prior. Declines in mining and quarrying drove the headline industrial figure lower, while the narrower manufacturing output figure rose by 0.3% m/m and by 1.4% y/y, both up on expectations. BoE Governor Carney yesterday described the manufacturing sector as been in a sweet spot, benefiting from robust demand and burgeoning growth in export demand, in turn aided by past depreciation of sterling.

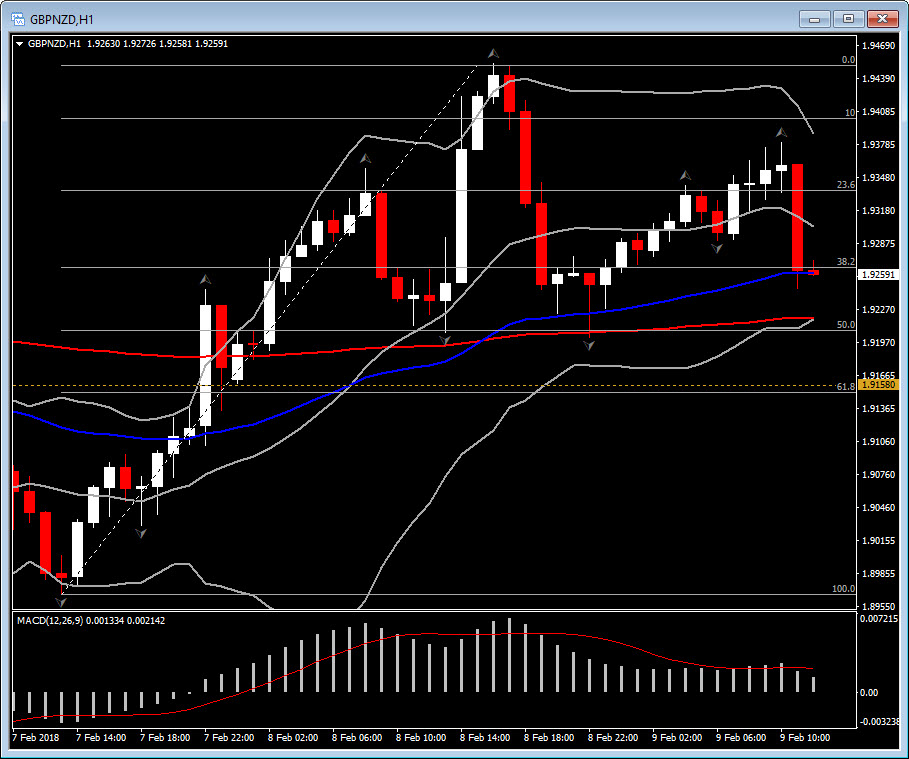

In short-term, Sterling is seen falling on the data announcement, with Cable driven by nearly 50 pips down. GBPNZD and other pound crosses have been seeing a similar intra-day price action. GBPNZD has ebbed by around 115 pips to the 1.9250 level, following a break of the 20 and 50-period EMA in the hourly chart. The pair rose this week as high as the 1.9452, on the anticipation and release of the RBNZ Monetary Policy Statement, along with the hawkish BoE comments. However, since yesterday’s peak, its seen bouncing between 1.9370 and 1.9210 area. The latest could be consider as an immediate intra-day support area, since it has been hit several times since Wednesday, while it is also the confluence of 50% Fibonacci retracement level and 200-period EMA.

Short-term momentum indicators are pointing to a continuation of the upwards price action seen since February 7. The MACD oscillator supports the positive momentum , as it is moving in the positive area, in both Daily and intra-day charts. Meanwhile, short-term RSI and Stochastic are sloping downwards below neutral, however they remain positive in the Daily time-frame. This suggests that the weakness seen today, could signal a correction lower before the continuation of its upwards movement.

Therefore, in short-term, only a break below 1.9188- 1.9200, could triggered a short position, with a possible retesting of 61.8% Fibonacci retracement level at 1.9150. In longer timeframe, a break below the 1.9150 level which coincides with the 20-Day MA and 61.8% Fibonacci retracement level, could indicate that bears are in control and therefore is liekly to retest February’s swing low at 1.8965 and January’s lows at 1.8670.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2018/02/13 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.