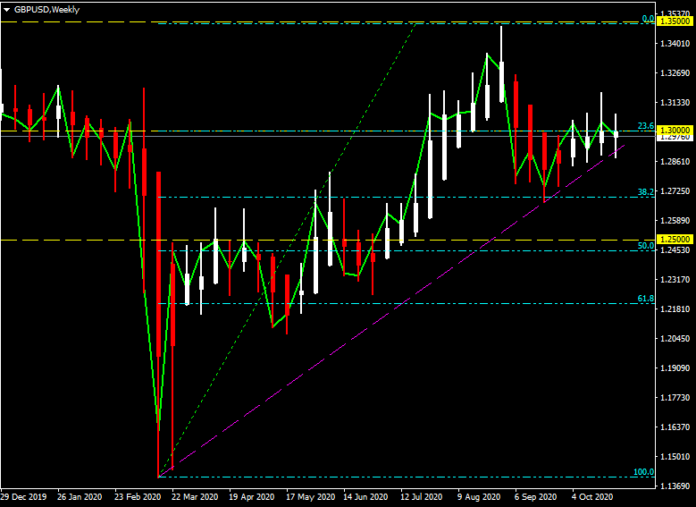

GBPUSD, Weekly

The Pound has continued to trade neutrally, lacking domestically-driven directional impetus. The UK currency was a big underperformer during the global lockdowns earlier in the year, and is again vulnerable given the trend to ever tightening restrictions and national lockdowns across both the UK and Europe.

The UK needs foreign capital inflows to offset outflows generated by the UK’s large current account deficit. The Brexit endgame is also in the mix. Negotiations are continuing, and the teams are reportedly working to a mid-November deadline. Market participants are cautiously optimistic that at least a narrow free trade deal will be reached, but still await concrete news that the two sides have reached a breakthrough on the key sticking points. With a no deal scenario now looking much less of a risk, the question now is more focused on how limited or how broad a deal might be between the EU and UK. The consensus is for a narrower rather than a broader deal, and we concur with this, though it should also be considered that the EU and UK might conceivably surprise everyone with a much more comprehensive deal than is generally being expected. The Covid situation may be a motivation for this, and it should be remembered that the two sides are starting from perfect equivalence, so a broad agreement is feasible. Even some Brexit ideologues in the UK have suggested that maintaining close alignment with EU rules — for now — may be the more pragmatic way forward given the Covid crisis, before diverging from EU rules in an evolving process over time. The central criteria for the pound’s future trajectory will be what impact any deal has on the UK’s terms of trade. The narrower any trade deal is, the bigger the impact on the UK’s trading position will be on January 1.

Technically and psychologically 1.3500, 1.3000 and 1.2500 are fundamental for Cable. The Q1 pandemic falls from 1.3200 to 1.1500, took until mid September before they were fully recovered, and breached (1.3350) but once again they have proved a move too far. The last 6 weeks has seen the seen the pair pivot below 1.3000 and tests of the trendline support. The 38.2 Fib and 50-period moving average at 1.2750 is currently key down side support. A break and hold of recent 1.3175 highs will be required to move the pair higher.

Click here to access the HotForex Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.