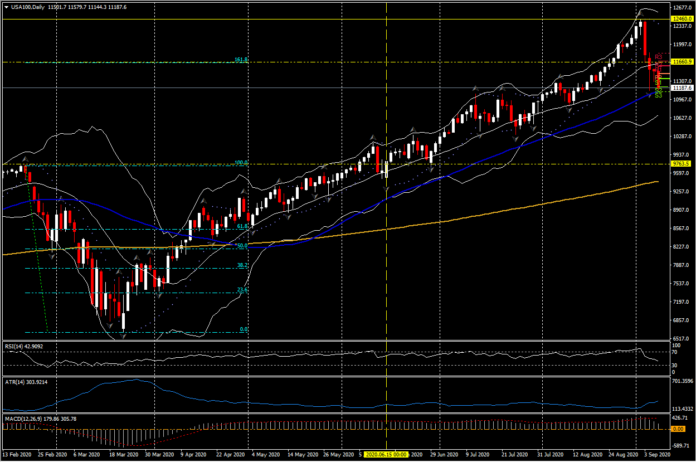

USA100, Daily

US equity futures are weaker, having reversed lower after posting gains overnight. The USA30 is down -0.8%, the USA500 has lost -1.5% and the USA100 has tumbled -3.2%. Declines in European bourses have weighed on US equity futures. Profit taking is also likely continuing to feature after the NASDAQ and S&P 500 posted all time highs just last Wednesday (September 1). However, Bloomberg reports that investors dumped billions of dollars into funds that track the NASDAQ last week as investors took advantage of the drop in the tech index. Also, the US 2020 campaign is going at full strength now, with uncertainty over the outcome and voting process adding to the market’s nervous mood of late. Notably, President Trump has vowed to scale back ties with China. Meanwhile, the Euro Stoxx has fallen -1.8%, Germany’s GER30 has tumbled -1.5% and France’s CAC is -1.9% weaker. The UK’s FTSE 100 has declined -0.6%. Brexit worries are the focus, eclipsing a rebound in German exports and a slight upward revision to Eurozone Q2 GDP. Stocks firmed in Asia, with Japan’s Nikkei rising 0.8%, China’s CSI 300 improving 0.5% and Hong Kong’s Hang Seng edging up 0.1%.

Technically, the US equity markets, a week into what is a traditionally volatile month, are all testing some key levels. Thursday’s (September 2) significant sell off and Tweezer Top was followed by Friday’s (September 4) close below the important 20-day SMA. So far today (September 8), following the long weekend, momentum continues to gather pace. Next key support sits at the 50-day moving averages; USA30 27,335, USA100 11,112 and the USA500 at 3,315. The leading technology companies in the guise of the USA100 that previously led the markets higher are now also leading the markets lower.

Click here to access the Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.