Risk off trade dominated overnight after the disappointing FOMC minutes. US-China frictions are also rubbing the markets, though the two nations have again agreed to hold talks soon to discuss the Phase One trade deal.

So far today risk aversion is making a comeback and stock markets are heading south. Investors waiting for a dovish signal in the FOMC minutes were disappointed yesterday, with the framework review, and thus discussions on a more symmetric inflation target have not concluded yet. Coupled with a gloomy view on the outlook, that put pressure on stocks and supported bonds, leaving the German 10-year yield at -0.49%, the Gilt rate at 0.22% and the US 10-year rate at 0.66%. GER30 and UK100 have lost -0.93% and -1.16% respectively so far today as markets wait for weekly US claims numbers.

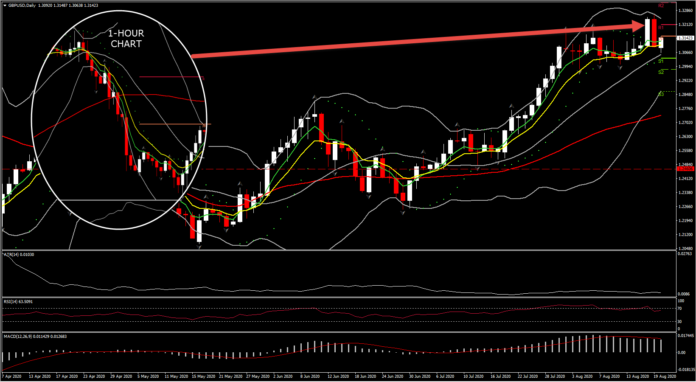

The Dollar has retained demand in the wake of the FOMC minutes, the bottom line from which was that there is no immediate plan to take unconventional stimulus measures in monetary policy. However it lost ground against the Pound. Cable has reversed to 1.3148, extending a correction from yesterday’s 6-day low at 1.3065. The Pound has in the meanwhile seen a down-then-up price action against the Euro, with EURGBP posting a high at 0.9068 before reversing to near 0.9010, recouped intraday losses against the Yen and is showing a 0.5% gain on the underperforming Australian Dollar.

The Pound’s outlook is seen to have a more circumspect view of the pound’s upside potential. The jump in July inflation data hasn’t materially affected the BoE policy outlook, other than to diminish the possibility of negative interest rates. We also take the view that trade discussions may not be going as well as has been publicly indicated recently by the UK prime minister’s spokesperson.

A well connected UK journalist for The Sun tabloid reported this week of “growing whispers” that the EU’s demands for the so-called “level-playing-field rules” — which will keep the UK bound to EU rules in return for a generous trade deal — could be too much to overcome for the UK government. It is also understood that Brussels is hoping that the UK will buckle in its demands on this front under the pressure of a deadline, which will be October’s EU leaders’ summit, which at the very least will keep the uncertainty going until then. Given the risks of a no deal, or only a narrow deal, we expect the pound’s upside to be limited from here, at least in trade-weighted terms.

We also anticipate the UK’s economic recovery from full lockdown to plateau in the weeks and months ahead. There are a number of localized lockdowns across the UK and new travel restrictions with foreign countries, while the government’s furlough scheme will end in late October, which is likely to cause a sizeable upward jolt to the unemployment rate, with the aviation, retail and hospitality sectors to be hard hit.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.