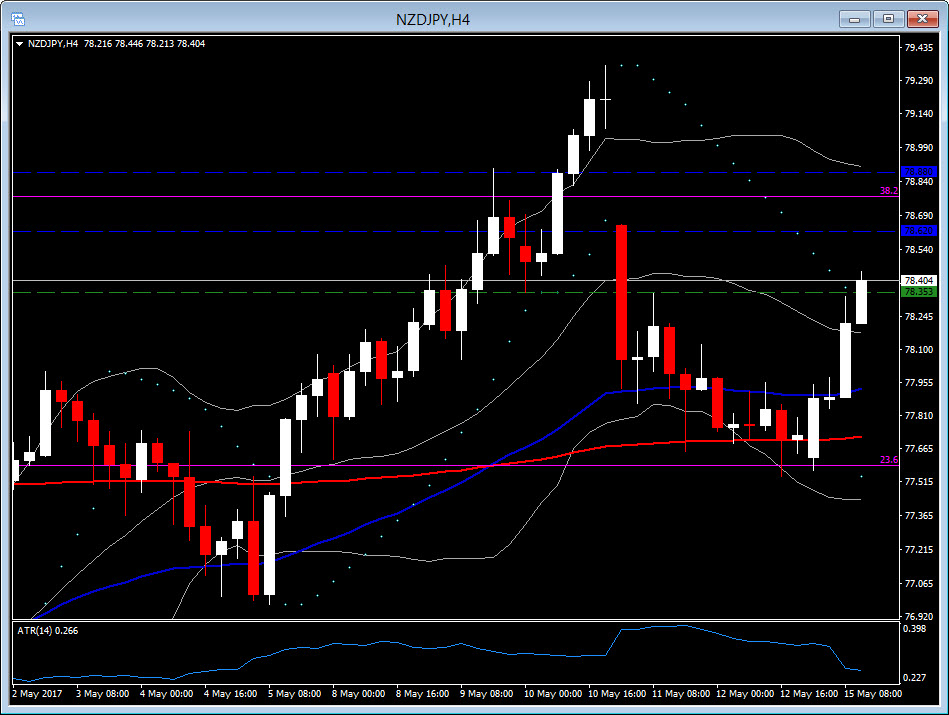

NZDJPY, H4

North Korean successfully launched a mid-range missile, taunting that it would be able to carry a nuclear warhead, but market impact was limited after an initial jolt to stock markets in Asia. However, the Japanese currency underperforming today. The USDJPY has retreated to around 113.50 after logging an intraday peak at 113.73 following a 60-pip-plus rally from the lows seen at the open in the Asia-Pacific market. EURJPY rallied quite strongly earlier, capping out at 124.48, six pips shy of last week’s one-year peak. The yen correlated as European stocks rose in early trade, though this move has since flagged, taking the steam out of the bullish moves in USDJPY and yen crosses.

NZDJPY lifted to a 4-session high of 78.47, in 4-hour chart, prompting a Long position with entry at 78.35. Geopolitical risk and the good Retail Sales data from New Zealand, gave today a boost to NZDJPY, which lifted from past week’s low of 77.53. In the Daily chart, pair broke earlier the 50 Day and 200 Day EMA, while MACD turned positive. In the 4-hour chart, RSI is at 58 sloping up, while Parabolic SAR turned positive earlier. Therefore, with the pair looking ready to close the 11th of May gap, target 1 was set at 78.62 and Target 2 at 78.88, using ATR(14) in the 4-hour chart. Support was set at 20-Day EMA, i.e. at 77.35.

Nevertheless, pair is likely to be volatile this week by Q1 PPI from New Zealand to be released on Tuesday. Meanwhile, there is nothing from the Reserve Bank of New Zealand this week. Last week saw the Bank hold rates steady at 1.75%, as expected, but leave a dovish tone in place amid the “numerous uncertainties” that remain. A somewhat more balanced outlook was anticipated from the Bank.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/16 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.