AUDUSD, H4

Yesterday I wrote. “AUDUSD rallied to an eight-day high of 0.7556 in the wake of the statement, since ebbing to the 0.7530 area. The 0.7530 level is below the upper Bollinger Bands in the 4-hour chart. Hence by considering also that the pair moved in a downward channel since March 20th, a SHORT position was taken with entry at 0.7529. In the 4 hour- chart, RSI is at 58 sloping down, while MACD is negative since March 20th. The Fibonacci Channel which seems to fully confirm the particular trend, was used for setting Support level at 0.7570. Target 1 was set at 0.7490 and Target 2 at 0.7460.” – Targets were achieved today for a net gain of 70 pips.

The Aussie dollar is nursing a 1% loss versus US dollar, which has been concomitant with 1% decline in Australia’s ASX 200 equity index today, its biggest one-day drop in six weeks as it corrected from a two-year peak seen at the start of the week. Sub-par guidance from the Australian banking sector has weighed on the broader stock market down under, while weak manufacturing data out of China this week, cost Aussie.

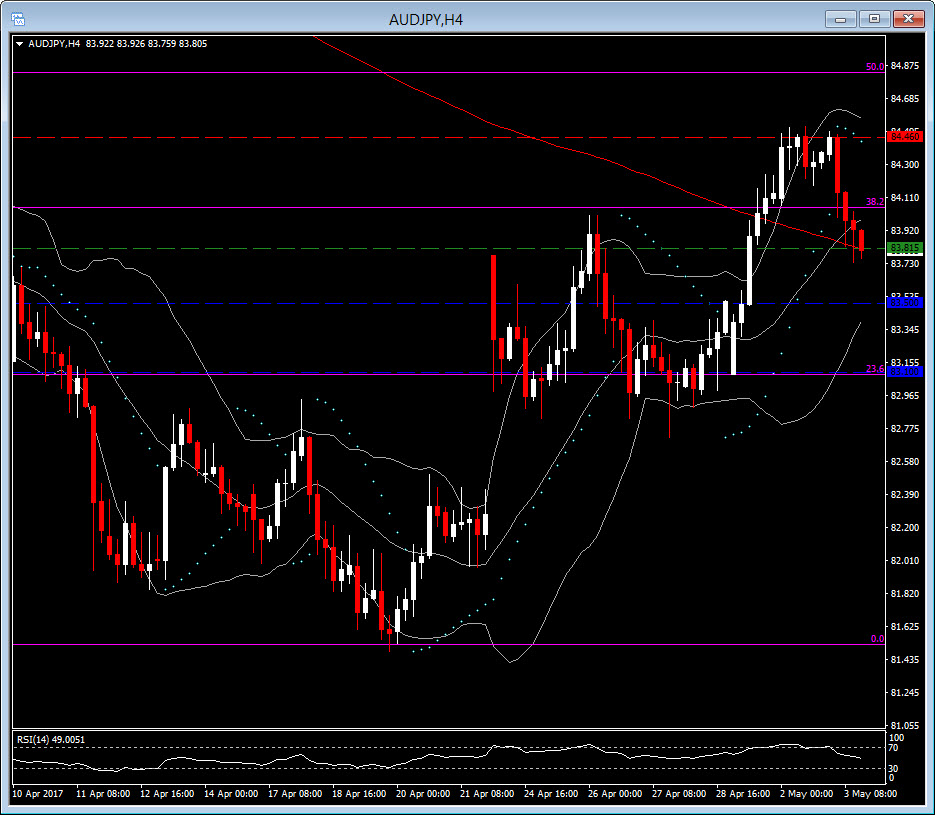

AUDUSD and AUDJPY remained heavy, with AUDJPY logging a three-session low at 0.7457 just earlier. AUDJPY seems extending its reduction further down, after failing to break above month’s resistance level at 84.50. During the day, the pair manage to break down the significant 200-period and 20-period EMA , in the 4-hour chart. RSI is at 50 looking down, after reaching the overbought territory. Hence by considering also the turn of Parabolic SAR earlier, a SHORT position was taken with entry at 83.81. Target 1 was set at 83.50 and Target 2 at 83.10.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/04 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.