FX News

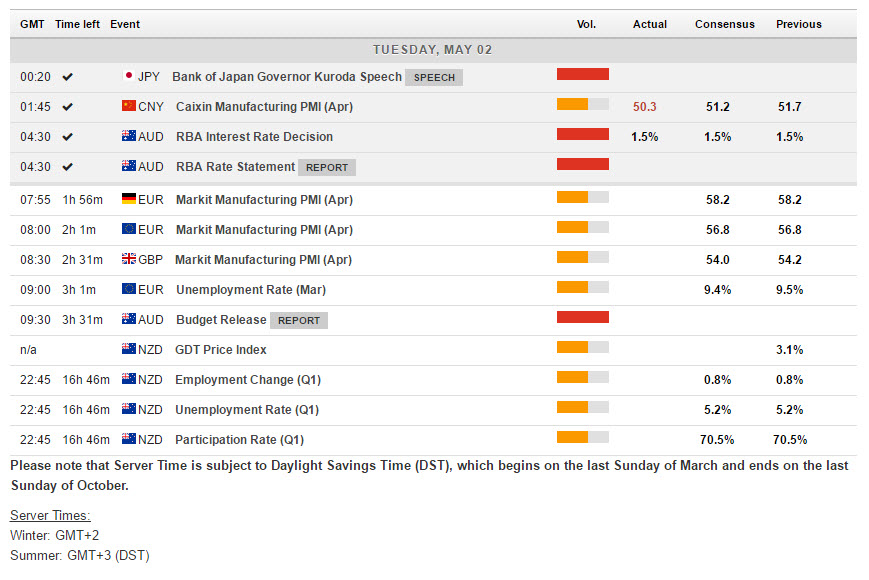

European Outlook: Asian stock markets tried to move higher after the holidays, but Hang Seng and ASX are now slightly in the red, as is the CSI 300, while the Nikkei outperforms and is posting a 0.58% gain, helped by a weaker Yen and testing the ceiling that has been in place since December ahead of the holidays. The RBA left the cash rate unchanged, while highlighting the high level of debt in China as a medium term risk. FTSE 100 futures are moving higher after yesterday’s holiday, while U.S. futures are down, with investors looking ahead to the FOMC decision. Today’s European calendar has the final readings of Eurozone manufacturing PMIs, which are expected to confirm preliminary numbers, while the U.K. manufacturing PMI is expected to dip slightly to 54.0 from 54.2 in the previous month. The Eurozone also has Eurozone unemployment data for March and there is ECB speak from Noy and Nowotny.

FX Update: USDJPY has lifted for a second consecutive day, this time logging a new six-month peak at 112.10. EURJPY and other yen crosses are also up quite sharply, reflecting general underperformance of the Japanese currency. EUR-PY clocked a seven-week high at 122.46. The reflects rising global investor risk appetite, which has been weighting on the safe haven yen in accordance with the normal pattern. This comes with various bellwether Wall Street and global indexes trading at or near record highs, with the CBOE implied vols “fear gauge” tipping to the lowest level since 2007 yesterday. News that Greece reached a deal with the IMF and EU, along with a continued strong lead in French opinion polls for pro-EU presidential candidate Macron, have helped maintain a general risk-on vibe, though stock markets have been mixed in Asia today, while U.S. and European equity indexes are slightly lower. The RBA did the expected and left monetary policy unchanged following its latest meeting, and upgraded the language on its outlook for employment in the statement, noting unemployment should “decline gradually over time” while saying that it expects a “gradual further increase in underlying inflation” as the economy strengthens. AUDUSD rallied to an eight-day high of 0.7556 in the wake of the statement, since ebbing to the 0.7530 area.

U.S. reports revealed weaker headlines than expected, but massive upward revisions in the January and February construction spending data left a stronger than expected data mix that lifted our Q1 GDP growth forecast to 0.9% from 0.7%. For construction, a 0.2% March drop followed boosts in the nonresidential, public, and home improvement components, with a firm new home construction trajectory. This accompanied a 0.2% personal income rise with flat consumption that modestly undershot assumptions, alongside a big 0.3% “real” increase thanks to weather-led firmness in service consumption and an expected 0.2% headline PCE chain price drop. An ISM drop to a 4-month low of 54.8 from 57.2 in March and a 30-month high of 57.7 in February still left a firm level, and the ISM-adjusted average of the major surveys is still on track for a solid 56 reading from a 57 cycle-high in February and March.

Main Macro Events Today

- UK Manufacturing PMI – The manufacturing PMI expected to reveal a fractional ebb to a 54.0 reading after the 54.2 outcome in March.

- EU Manufacturing PMI and Unemployment Rate – The final round of April PMI readings should confirm the Eurozone Manufacturing PMI at 56.8, while March’s unemployment rate expected to fall at 9.4% from 9.5% last time, although developments remain uneven across countries and the high rate of youth unemployment remains a key challenge for politicians going ahead.

- NZD employment report – New Zealand’s calendar has the Q1 employment report, projected to show a 0.8% gain (q/q, sa). The unemployment rate is seen to be unchanged at 5.2%.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar will start in:

[ujicountdown id=”Next Webinar” expire=”2017/05/02 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.