GBPUSD, H1

Sterling has continued to lack directional ambition, as are all the main currencies, presently exchanging hands at near net unchanged levels on the day versus the dollar, euro and other currencies. Over the last week, the pound is showing moderate gains versus the euro, a fractional advance on the dollar and a 0.8% loss to the yen. UK labour data were mixed relative to expectations, with the claimant count rising 25.5k in March, more than offsetting a downward revision to February data, while the claimant rate ticked higher, to 2.2% from 2.1%. The official ILO unemployment rate for February remained at its cycle low of 4.7%, while average household earnings were 2.3% y/y (including bonuses) in the three months to February, though ex-bonus figure ebbed to a seven-month low. There are no key data releases until after the Easter weekend, while Brexit-related issues are unlikely to remain on a backburner from the perspective of markets until the late-April EU summit, domestically-driven trading impulse is likely to remain weak.

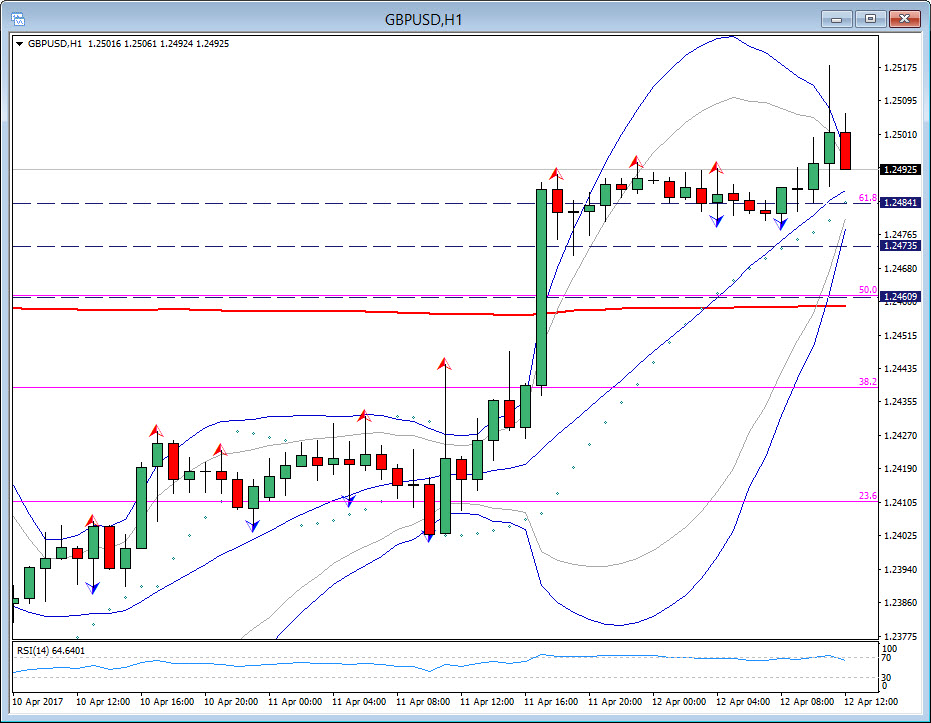

During the day however, the pound rose in the immediate wake of the data as the market responded to the above-forecast with-bonus earnings figure, though quickly gave back most of the gains as the details of the report were digested. Cable manage to break the key level of 1.2500. However, it seems that pair run out of steam, based in the hourly chart, by spiking down again to 1.2480 level. RSI is at 65 sloping downwards, while Parabolic SAR turn to negative. Hence a Short position was taken in the hourly chart, with Target 1 at 1.2470. Target 2 was set at 50.0 Fibonacci level and close to 200 period EMA, which is at 1.2460. In higher time-frames, a break of 1.2450 level which is a confluence of 20-Day EMA, within the week, will indicate a further weakness back to 1.2400-1.2430 area.

Short position decision was confirmed also by the break of 20 period EMA, but most importantly by the creation of a hummingbird by Bollinger bands pattern, which indicates a bearish signal in short term timeframes. Resistance is at 1.2530-1.2540 area.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/04/12 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.