FX News

European Outlook: Asian stock markets mostly headed south with Nikkei and Topix under pressure as a stronger Yen dragged down exporters and financials. Australia’s ASX was a notable outperformer in Asia. U.S. and European stock futures are also in the red, and oil prices have corrected from levels above USD 53 per barrel with the front end Nymex future currently trading at USD 52.95. Already released U.K. BRC retail sales data came in weaker than expected and showed like for like sales down -1.0%. Still to come the European calendar has German ZEW investor confidence as well as U.K. inflation data and Eurozone production numbers.

Fed Chair Yellen said it’s appropriate for the Fed to gradually raise rates if the economy continues to perform as expected, reiterating a long-standing policy view. She added that the economy is “pretty healthy.” She expects the economy to continue growing at a moderate pace. The global economy is also operating in a more robust way. Inflation is also reasonably close to the FOMC’s target. She noted the drop in the unemployment rate to 4.5% in the March report, and said inflation is reasonably close” though still a little under the 2% goal. The 5-year price measure does show price expectations ticking up however. Most on the FOMC don’t believe inflation is a significant problem at all. So far she hasn’t revealed anything new, nor has she discussed the balance sheet.

White House statements on Syria form the loose outlines of a policy in the region, suggesting that more strikes are possible and containing the Islamic State offers the greatest potential to provide relief to Syria’s citizens. ISIS’ defeat would bring about conditions for new leadership in Syria through the political process. The DoD meanwhile claimed that U.S. missile strikes destroyed 20% of Syria’s operational aircraft. Reality may be a bit more complex, however, since Syria’s Assad is also fighting ISIS, however reprehensible his attacks on his own people. There’s also no room for mistakes, with Russian personnel and equipment on the battle field. Market risk aversion remains elevated and volatility higher, but there’s been limited immediate reaction to these headlines. Oil and gold are settling near the highs of the month.

Melenchon overtakes Fillon in latest French poll. The latest Ifop poll for the first round of the French Presidential election April 23 confirms the trend already seen yesterday, namely that Le Pen and Macron are falling back, while leftist EU critic Melenchon is catching up. The Ifop poll today showed Le Pen and Macron down 2.5% points compared to the last poll at 24% and 23% respectively. Decisively though, unlike the polls so far Fillon is no longer in third place, but leftist EU critic Melenchon has overtaken him and is now polling 19%. So far nothing has changed and Macron and Le Pen are set to go through to the second round, where Macron is tipped to win with a large margin. However, is Melenchon also manages to overtake Macron, the contest would be between two EU critics from either side of the spectrum, difficult to call and poison for markets. French yields already blew out yesterday and are likely to remain under upward pressure ahead of the election.

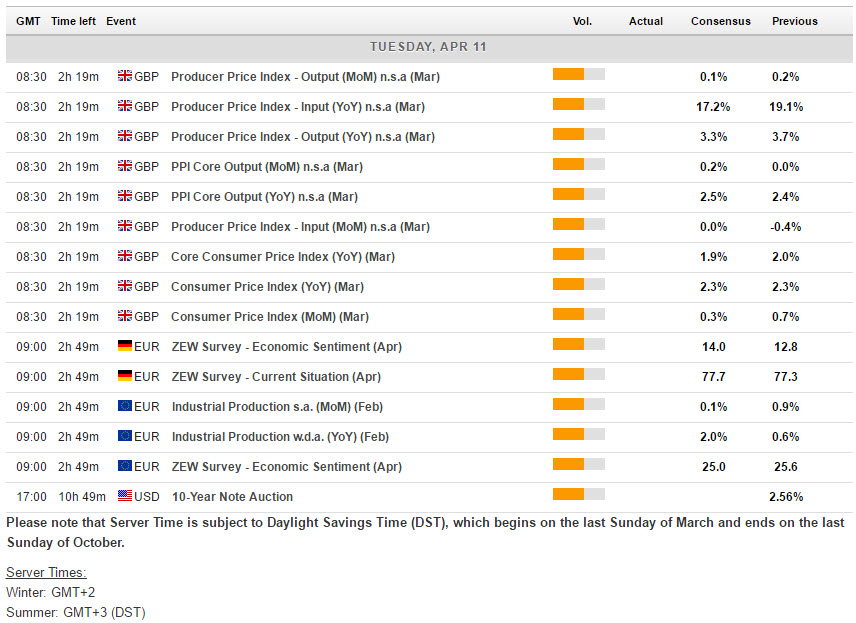

Main Macro Events Today

UK Inflation – Consumer prices expected to come in at 2.3% y/y, unchanged from February. Producer Prices input expected to fall to 3.3% from 3.7% on February.

German ZEW – A slight rise is expected in the headline ZEW expectations reading to 14.0 from 12.8, with geo-political risk factors, the prospect of further Fed tightening, and the ECB’s discussions on rates and tapering expected to weigh on sentiment and prevent a more pronounced improvement.

FOMC – The dovish voter Kashkari will participate in a Q&A session, at the Minnesota Business Partnership, in Minneapolis.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/04/11 14:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.