GBPUSD, H1

Today Sterling has been underperforming, showing losses versus the dollar, euro, yen, and other currencies over the last day. Yesterday’s sub-forecast UK manufacturing PMI data was the principal catalyst, with Markit, the survey’s compiler, noting that momentum is slowing, and would likely continue to do so in the quarter ahead, pointing to rising costs and weak wage growth. This has had some resonance in markets, which are now factoring in downside risk to Wednesday’s release of the March services PMI report. Downside risk has been confirmed also by UK March construction PMI data underwhelmed, earlier, coming in at 52.2 after 52.5 in February. The forecast had been for an unchanged 52.5 reading. The data again points to slowing growth momentum in the sector, painting the same picture as yesterday. Weakening in residential construction activity more than offset a rise in civil engineering activity. Hence Markit, noted that respondents remained “relatively upbeat,” but also highlighted that costs are rising and slackening new orders.

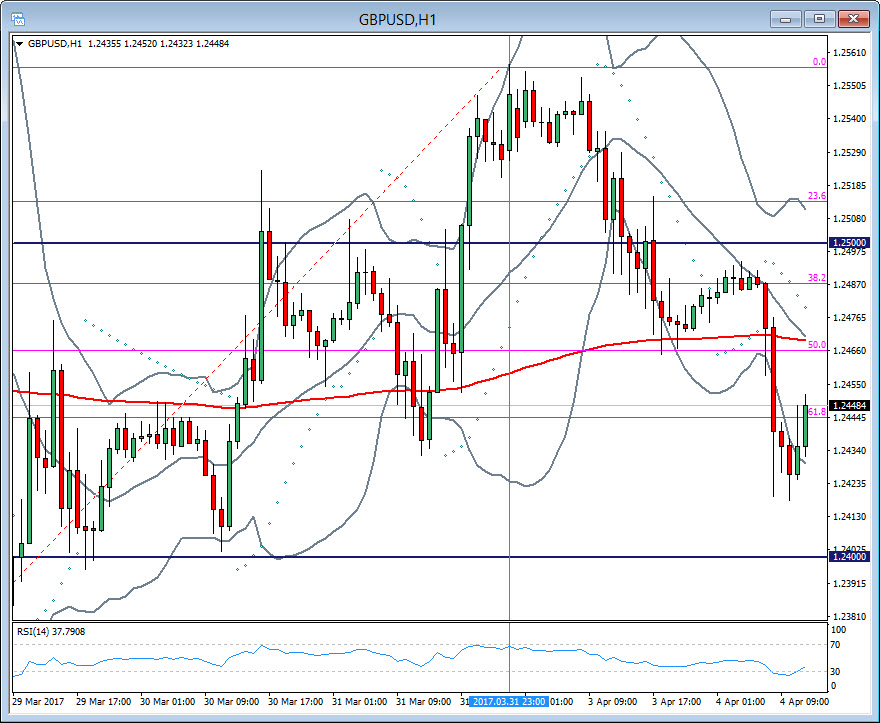

Consequently, Cable came logged a low at 1.2418 on the anticipation of the data, while after data released it turned back upwards to 1.2450 level. Hence by observing the 1-hour chart, cable is likely to present a small trend correction in-between 50.0 and 61.8 Fibonacci level, i.e. 1.2445-1.2465 area. However, the U.S. dollar on the other hand remained generally bid versus the euro, sterling and dollar bloc currencies since it seems that expectations for a solid U.S. jobs report on Friday is helping keep ot underpinned.

As for Pound, Brexit related news remains a potential market driver, while negotiations aren’t likely to start in earnest until after the German elections in September and therefore the downward trend noticed since London closing on Friday is likely to continue. In the 1-hour and 4 hour charts, Parabolic SAR remains negative and while lower Bollinger band broke down earlier. Next support area is at the key level of 1.2400, which it is the confluence of the significant 200-period EMA.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/04/04 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.