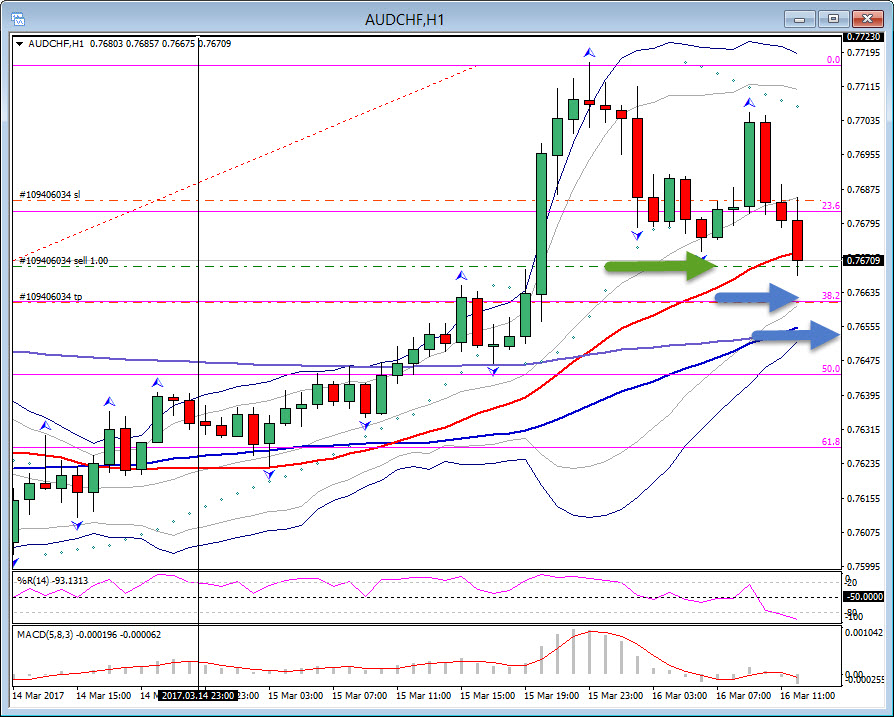

AUDCHF, H1

SNB leaves policy on hold, as expected. SNB kept official policy parameters unchanged and re-affirmed its threat to intervene on currency markets as it keeps a watchful eye on the “significantly overvalued” currency amid the multitude of political risks hitting Europe this year. The SNB projections see the first positive annual inflation rate since 2011 this year, with the CPI forecast lifted to 0.3% from the 0.1% expected back in December. For 2018 the central bank sees a slight acceleration to 0.4%, with the headline rate seen reaching 1.1% in 2019.

The Swiss Franc surged slightly higher after SNB Monetary Policy assessment. The hourly weakness in the AUDCHF prompted a short position due to tweezer top earlier today. An entry was taken at 0.76695 with target 0.76610, which is the confluence of the 38.2 Fibonacci level. Target 2 is at 0.7653, which is the mid of 38.2 and 50.0 Fibonacci levels and the significant 200 period EMA. Today’s weakness has breached and broken the 30-period moving average which might attract more short sellers. The parabolic SAR remain negative and Williams’ Percentage range moves in the oversold territory, In the 4-hour chart, RSI is neutral at 57, sloping downwards, while MACD is positive since its turn on Tuesday. However, the break of the last negative fractal, in the 1 hour chart, suggests more downward momentum in short term trading.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/03/16 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.