FX News

European Outlook: Asian stock markets moved sideways, with investors continuing to hold back ahead of the Fed rate review tomorrow. The Nikkei closed with a -0.12% loss, Hang Seng and CSI 300 are also posting slight gains, while the ASX was up 0.03% at the close. U.S. stock futures are slightly down and FTSE 100 futures are moving higher as Sterling continues to slide. Against that background Gilts are likely to continue to underperform, but Bunds, which still managed to rescue some gains into the close yesterday, continued to decline in after hour trade and could be under pressure at the open. U.K. Prime Minister May managed to secure backing from lawmakers to trigger Article 50 and start official divorce talks with the EU and will reportedly do so in the last week of May. The data calendar today has final inflation data from Germany and Spain as well as Eurozone industrial production and most importantly German ZEW investor confidence for March.

ECB: Tackling weak productivity is key. The central bank head, Mario Draghi, is once again highlighting the limits of monetary policy and the need for structural reforms to boost growth saying in Frankfurt that addressing weak productivity in the Eurozone is key. Draghi said “while some progress can be made in innovation, it is not my view the sole issue. Equally important for the euro area is to facilitate and encourage the spread of new technology”. He also highlighted that “much of the debate today about the true level of the real equilibrium interest rate, for example, is a debate about the outlook for productivity growth”. Furthermore, from ECB’s members, yesterday, Weidmann rejected criticism of Germany over EUR level. The Bundesbank President in an e-mail answer said the USD strength reflects the outlook for the U.S. economy, adding that recent USD movements are within the range of normal fluctuations.

Germany: German Feb HICP inflation was confirmed at 2.2% y/y as expected, up from 1.9% y/y in the previous month and clearly above the ECB’s upper limit for price stability of 2.0%. The breakdown confirmed that base effects from food and energy prices are mainly to blame. Food price inflation jumped to 4.4% y/y in February, from 3.2% y/y in January and just 0.5% y/y in September last year, after a late cold winter hit crops. Prices for heating oil surged 43.8% y/y in February, after falling through most of last year. Petrol price inflation hit 15.6% y/y. So the data back Draghi’s argument that the rise in the headline rate is mainly driven by temporary effects, while underlying inflation remains low, which means the central bank can still allow to take a relaxed stance for now, although officials will have to keep an eye on second round effects amid improving labour markets.

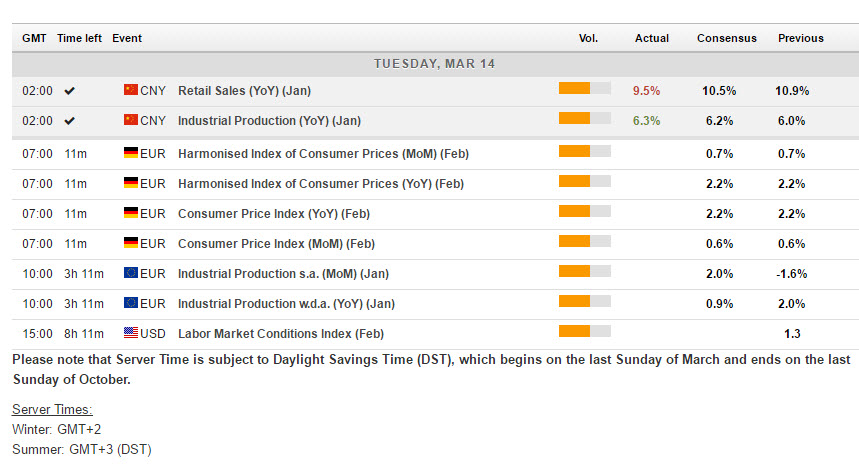

Main Macro Events Today

- US PPI – February PPI data expected to remain unchanged (median 0.1%) on the month with the core up 0.2%. This follows stronger January figures which had the headline up 0.6% with the core up 0.4% for the month.

- German ZEW – Germany’s investor confidence reading underperformed other sentiment numbers in February and now expected to bounce back somewhat this month to 13.2 from 10.4. Optimists are clearly outnumbering pessimists despite the multitude of political challenges and the ECB has proved that its eventual exit from stimulus measures will happen very gradually and with market reactions always in mind.

- EU Industrial Production – Eurozone industrial production numbers for January will seem too backward looking to change the outlook., since expected to rise to 1.2% m/m, after the -1.6% m/m decline in December.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/03/14 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.