FX News

European Outlook: Asian stock markets mostly managed to move higher overnight, let by a nearly 1.5% gain in the Nikkei as the Yen weakened against the Dollar. U.S. futures are also up, as the focus shifts to today’s jobs data and next week’s Fed meeting. Yesterday was all about Draghi an, who managed to introduce subtle changes to signal a very gradual move towards a more neutral stance and not only helped stocks to move higher, but also to bring in Eurozone spreads amid a general rise in long term yields. Today’s calendar has already seen the German trade surplus shrink (see below) industrial production numbers from France and the U.K.. The U.K. also has trade data, but again the focus will be on the US calendar in the afternoon.

German Trade: The surplus narrows, as imports continue to rise. Exports managed to rebound from the slump in December and rose 2.7% m/m, but this was more than counterbalanced by a 3.0% m/m rise in nominal imports, which left the trade surplus at EUR 14.9 bln on a seasonally adjusted basis. The current account surplus dropped even more. The numbers highlight that much of last year’s improvement in trade data was impacted by price developments and the drop in oil prices, while real data actually showed a negative contribution to overall growth from the external sector.

US Data Yesterday revealed a firm set of initial claims and trade price data, though we did see a 20k bounce for claims to 243k after the prior 19k plunge to a 44-year low of 223k in the President’s Day week. For trade prices, we saw big February gains after upward revisions that reflected surprisingly little downward pressure from the dollar’s surge, with strength skewed toward exports as seen through most of 2016. Core export prices rose 0.5%, while core import prices rose 0.3%. The claims bounce still leaves a firm start for March, and we still expect a 225k February nonfarm payroll rise with upside risk from tight claims, firm consumer and small business confidence, and a robust 298k ADP rise. Vehicle sales were flat in February but we expect a bounce in output. For downside risk, we expect a 5k-10k monthly decline in government jobs due to the hiring freeze, versus the 16k average monthly gains through 2016, and we had an east coast storm in the BLS survey week.

ECB: Subtle changes at the central bank yesterday, with Draghi once again trying to keep both hawks and doves happy. The result was a shift in language, that was so subtle that it took Draghi to highlight it during the Q&A session, as QE schedule and easing bias on rates were left in place. This balancing act saw markets taking the hint, but leaving the ECB sufficient room to act and keep the insurance policy amid the multitude of political challenges hitting the Eurozone this year. On balance our central scenario for the ECB going ahead remains the same, with QE going ahead this year and rates remaining unchanged throughout the year. The ECB is maintaining its insurance policy as elections get underway and the Brexit talks start in earnest and it can afford to do so as base effects should see headline inflation rates starting to come off again later in the year.

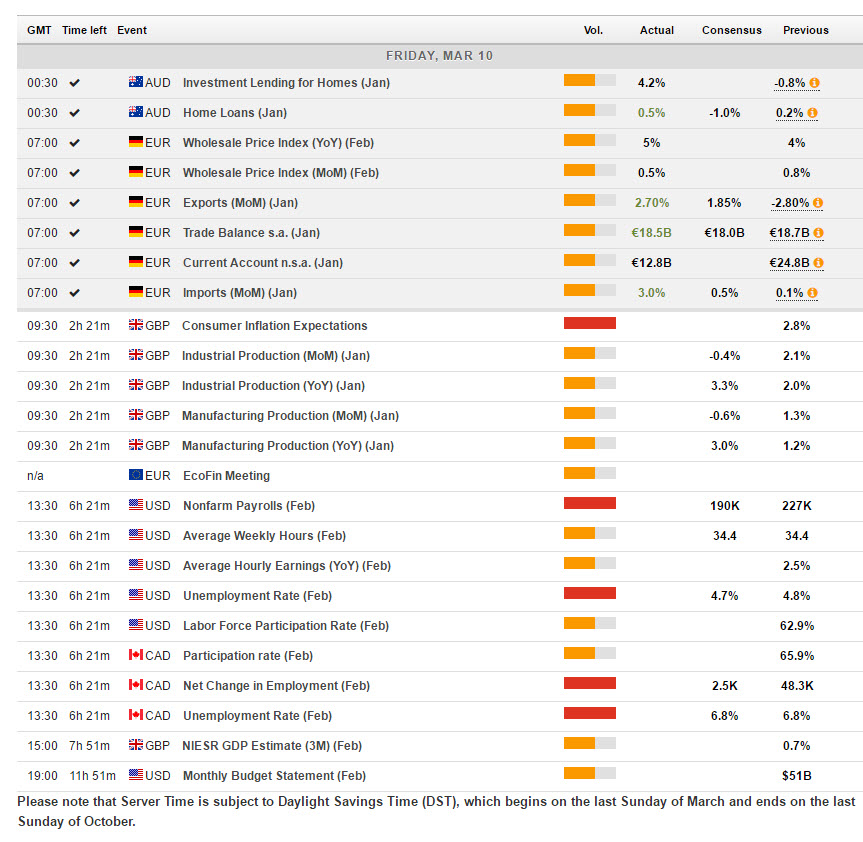

Main Macro Events Today

- US Non-farm payrolls – The median forecast of economists polled by Reuters is for the Non-Farm Payroll to rise by 195,000, however, there is significant risk to the upside following Wednesdays big rise in the ADP report. Expectations are as high as 285,000 with a number of estimates being raised to 225,000. The Earnings figure needs to recoup the 0.3% level and the unemployment is expected to fall from 4.8% to 4.7%.

- Canadian Employment – It is expected to rise 20k in February after the 48.3k surge in January. Canada posted employment gains from August to October of last year, saw a small decline in November and then revealed strong gains in December and January of this year. Unemployment rate is expected to remain stable at 6.8%.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/03/14 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Senior Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.