FX News

European Outlook: Asian stock markets are mostly down, as oil related stocks were under pressure. The front end Nymex future is slightly up on the day, but at USD 50.61 per barrel remains far below recent highs. Japan outperformed and the Nikkei closed with a 0.34% gain, as the Dollar strengthened amid positive signals ahead of tomorrow’s jobs data and the weaker yen underpinned exporters. U.K. and U.S. stock futures are down on the day, after the FTSE 100 already underperformed other European markets yesterday, but continues to hold the 7300 mark. The DAX meanwhile managed marginal gains yesterday, but is still holding below 12000, as markets hold their breath ahead of today’s ECB meeting, amid speculation that Draghi could tweak the forward guidance on rates and remove the implicit easing bias as growth and inflation data continues to rise. Released overnight, the U.K. RICS house price balance remained steady at 24. ECB meeting aside, the calendar still has final non-farm payroll numbers from France, as well as Swiss unemployment and the Bank of France business confidence indicator.

US reports: ADP private payrolls surged 298k in February after rising 261k in January (revised up from 246k). The service sector added 193k jobs, while the goods sector added 106k. As for the more detailed breakdown, strength in services was paced by professional business services, up 66k, with leisure and education up 40k. IT added 25k. For the goods sector, construction added a huge 66k, while manufacturing increased 32k. Mining was up 8k. This is a much better than expected report and adds upside risk to Friday’s BLS numbers. The data should also confirm a Fed rate hike next Wednesday. Furthermore, yesterday oil rallied to $53.80 from $53.45 following the EIA inventory data which showed an 8.2 mln bbl rise in crude stocks. Oil gains following the EIA report were short-lived, with the contract now on fresh one-month lows of $52.14. Prices initially moved higher on the inventory figures, with the smaller than API crude build and larger than forecast product draws giving oil bulls a leg up. It turned out however, that the gains were quickly sold into, on the realization that U.S. crude stocks posted yet another all-time high.

Canada: Canada housing starts improved to 210.2k in February from a revised 208.9k unit rate pace in January (was 207.4k). The pick-up in starts was contrary to expectations for a moderation in February. Single detached starts grew 12.1% to 71.9k units in February while multi urban starts fell 4.7% to 121.2k units. The six-month moving average for total starts picked-up to a 204.7k clip in February from 200.3k in January. The CMHC’s report notes that the uptrend in home construction this winter has been mostly due to increased home construction in Ontario, where single detached home construction is near the pace last seen in July of 2008. Canada building permit values rose 5.4% in January, better than expected, following a revised 4.4% drop in December (was -6.6%).

UK: The UK government announced its mid-year budget update, coordinated with the release of official economic projection updates from the independent Office for Budget Responsibility. The 2017 growth forecast was raised to 2.0% from 1.4%, but in the four-year outlook growth was revised lower. Inflation is seen peaking at 2.4% this year before ebbing slightly to an average rate of 2.3% in 2018, and then to 2.0% in 2019. Borrowing for this year is seen below that previously forecast, though is seen broadly unchanged over the next three years. Among the details are plans to increase spending on the health service and a reduction in the tax-free dividend.

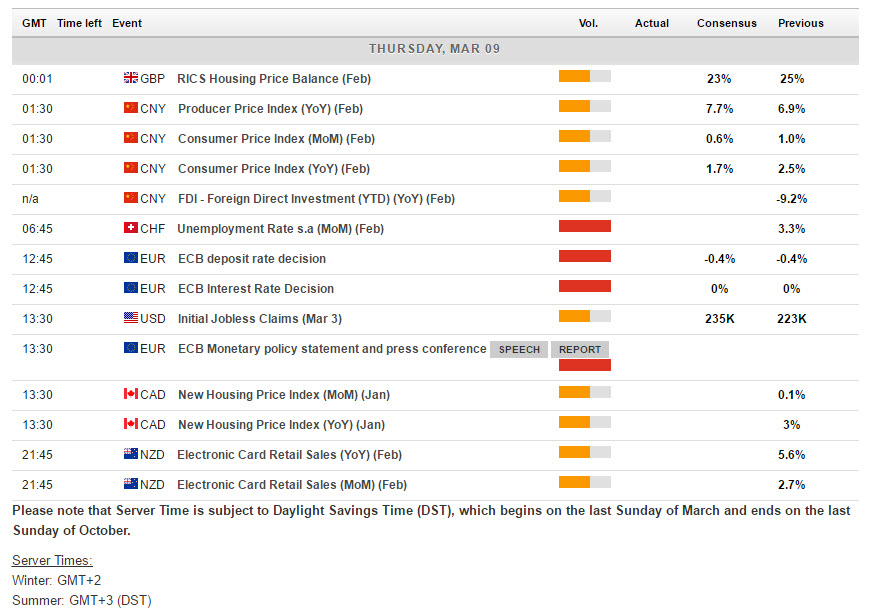

Main Macro Events Today

- ECB Rate Decision – ECB is widely expected to keep policy unchanged and confirm the QE schedule, which promises ongoing asset purchases through to the end of the year, but at a reduced monthly volume of EUR 60 bln from April. Given that much of this is also an insurance policy to prevent a renewed pick up in market volatility amid heightened political risks, Draghi is also likely to stress again that this doesn’t constitute real tapering and that the central bank has not yet set eyes on a phasing out of asset purchases. The focus will be on whether the central bank will take a more neutral stance on rates, however, and remove the reference to the possibility of another rate cut, as suggested by the hawks at the council in light of rising inflation and strong growth numbers.

- US Unemployment Claims – Initial claims data for the week of March 4 is out today and should reveal a headline increase to 235k from 223k last week and 242k in the week prior.

- Canadian NHPI – New Housing Price index expected to remain unchanged at 0.1% for January.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/03/14 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.