EURUSD, H1

The euro is up today, showing an average 0.45% gain versus the dollar, yen and sterling. The common currency has been aided by overall strong Eurozone PMI data for February which, despite the final reading of the services figure being revised slightly lower, point to a broadening in economic activity, feeding upside risk to Q1 GDP data. The rally was initiated by news from France showing that the latest ODOXA poll of voting intentions for the first round of the French Presidential elections shows independent candidate Macron ahead of Le Pen, for the first time. Other polls still show Le Pen ahead of Macron and while all suggest that Macron will beat Le Pen in a direct contest.

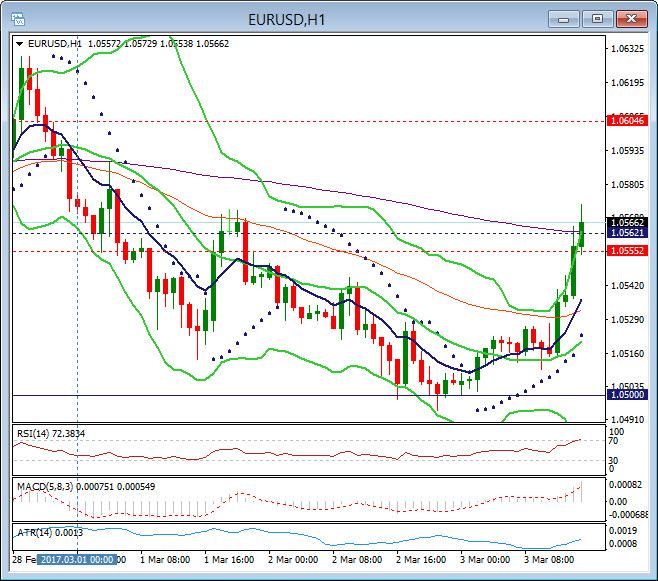

EURUSD slipped under 1.0500 last night and has rallied substantially today, the H4 has broken through the 10 and 20 period moving averages but is currently capped by the 50 period at 1.0562 and 200 period at 1.0600. The lower time frame H1 also has resistance at 1.0562 in the form of the 200 period moving average. A break and breach of this level and 1.0800 and 1.0600 become the next resistance areas. The H1 RSI is in overbought territory at 73 whilst the H4 has more upside potential at a reading of 56, so there could be an intraday retrace and consolidation from the 1.0560-70 zone.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/03/07 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Senior Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.