FX News

European Outlook: Stock markets moved mostly higher in Asia overnight, with Japan leading and posting the biggest gain in two weeks, as the Yen dipped following hawkish comments from Fed officials, which have boosted speculation of a March rate hike. U.S. and FTSE 100 futures are also moving higher. Trump’s eagerly awaited speech in Congress yesterday was short of details, but his first address to Congress seemed to convey a softer tone, designed to win over the political center. Stock markets seem to react in a positive way, but Japan aside any gains in Asia were muted as investors eye the Fed. The European calendar has German labour market and inflation data today, with the latter likely to bring the German headline rate above the ECB’s upper limit for price stability. Final manufacturing PMI readings are not expected to bring major surprises and confirm preliminary numbers. The U.K. has BoE lending data as well as the CIPS manufacturing PMI, which is expected to fall back to 55.5 from 55.9 in the previous month.

Fedspeak: SF Fed’s Williams said a March hike is very much on the table and should get “serious consideration.” The economy has made enormous progress and he’s confident that the economy will continue to continue growing at a healthy pace. “We’re very close to achieving our dual mandate goals. Yet monetary policy essentially still has the pedal to the metal,” and he thinks it’s time to start ease off the gas to avoid a “too hot” economy. Nationally, we’ve hit full employment, he said, but we’re still moving toward the 2% inflation goal. Williams, a non-voter this year, was one of the more dovish on the Committee, but he shifted to a more hawkish stance earlier last year.

US reports: revealed a disappointing 1.9% Q4 GDP growth clip, and the weak January trade and inventory data in the advance indictor report prompted a downward bump to our Q1 GDP estimate to 2.0% from 2.2%. Also, February consumer confidence pop to 114.8 that left the highest reading since July of 2001, and the GDP report included upward income revisions that will also raise consumption prospects into 2017. The producer sentiment climb is proving particularly intense, with a February Chicago PMI surge to a 2-year high of 57.4 that likely reflects an estimated 5% February vehicle assembly rate bounce. The Richmond Fed surged to an 11-month high of 17.0 from 12.0 in January with strength in the jobs components, and the ISM-adjusted measure surged to a 7-year high of 57.6 from 54.8 in January.

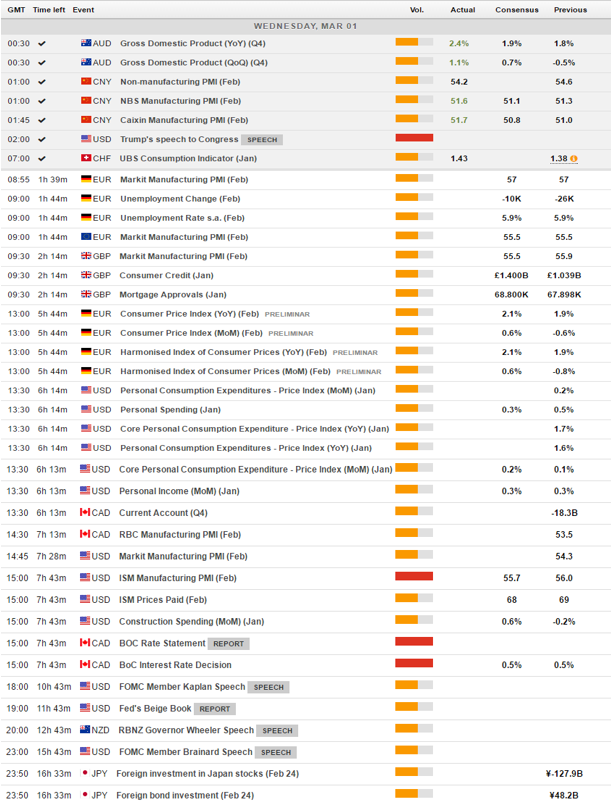

Main Macro Events Today

- German Inflation – German headline HICP inflation is expected to top the ECB’s upper limit for price stability and rise to 2.1% y/y with the preliminary February reading, from 1.9% y/y in January. . If German number comes in as expected, the Eurozone headline rate will likely pick up to at least 1.9% thus adding to pressure on Draghi ahead of next week’s council meeting.

- US ISM Manufacturing PMI – February ISM manufacturing index expected to slide to 55.5 after rising 1.5 points to 56.0 in January, the best reading since November 2014.

- CAN. Interest Rate Decision – BoC’s rate announcement is the main event today. No change to the current 0.50% rate setting is projected. The announcement stands alone, with a lack of press conference or Monetary Policy Report to fine tune.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/03/01 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Senior Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.