FX News

European Outlook: Asian stock markets were mostly down overnight. The Nikkei managed to close with a marginal gain as the Yen declined, but elsewhere markets remained in a sombre mode, after mixed closes in the U.S. and Europe yesterday. Chinese stocks fell on the first trading day of the week. The Caixin manufacturing PMI came in weaker than expected, even though it remained in expansion territory, and the central bank raised interest rates in open market operations. Meanwhile international markets continue to look nervously to the U.S. and Trump’s new policies. U.S. and U.K. stock futures are also heading south. European yields came off yesterday and if the cautious mood prevails should remain underpinned going into the weekend. European spreads mostly narrowed yesterday, but France underperformed amid political concerns as the presidential elections draw nearer and Le Pen gains in the polls. The European calendar has final services PMI readings out of the Eurozone, as well as the U.K. CIPS services PMI.

China: China’s central bank sends tightening signal by lifting short term rtes. The first trading day after the long New Year holiday started with a bank in China as the bank lifted rates on open market operation repos by 10 basis points, effective today. Another signal that authorities are focusing on trying to control a real estate bubble, but some see it also as a way to try and halt the depreciation of the yuan, even if the rate rise focuses on reverse repos. According to Reuters two sources said authorities also raised the lending rates on its standing lending facility (SFL) short term loans.

UK: Sterling has followed Gilt yields lower in the wake of the BoE policy announcement and Inflation Report, which left the repo rate and QE settings unchanged, and detailed upgraded growth forecasts, as had been widely anticipated. The BoE retained its neutral policy bias, saying that the next move could be “in either direction”. The growth forecast has been lifted compared to the November inflation report, but the bank suggested that the equilibrium unemployment rate has dropped, which means the BoE can afford to accept a lower rate of unemployment without having to tighten policy. So, despite the better growth outlook, the bank remains firmly in neutral mode, leaving the door open to both further easing, or more tightening, depending how developments unfold. Cable had lifted from its lows, benefiting from the generally soft path of the dollar, though at 1.2575 bid presently remains a net 0.7% lower yesterday. The pound had remained heavier relative to the euro and yen, and although also off from earlier lows is still down by an average 1.1% versus the G3 currencies. A remark from BoE governor Carney during the BoE MPC’s post-meeting press conference, that “we think the economy can run with a lower rate of unemployment without us having to adjust policy” has been feeding a sterling-bearish narrative. Next domestic focus will be today’s December services PMI report, expected to dip to a 55.8 reading after 56.2 in December.

US: The dollar shrugged off the better jobless claims and productivity outcomes, leaving EUR-USD static just over 1.0800, and USD-JPY idling near 112.25. Yields were little changed, while equity futures remained moderately underwater. The 14k U.S. initial claims drop to 246k in the last week of January after climbing 23k to 260k the week before (revised from 259k). Claims are entering February on a tight trajectory following a 2-month period of holiday volatility that ended with last week’s report. Claims are averaging just 248k in January, versus higher prior averages of 258k in December. U.S. productivity posted a preliminary 1.3% growth rate in Q4, versus 3.5% in Q3. Furthermore, a 170K January nonfarm payroll rise expected in today’s report.

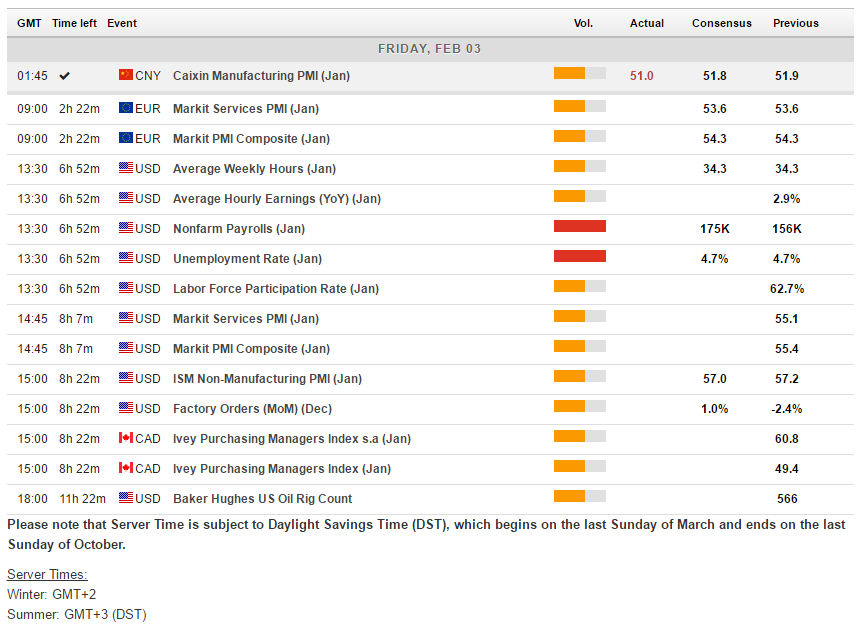

Main Macro Events Today

- Us Non-Manufacturing ISM – January ISM-NMI is out today to close out the January producer sentiment releases and it is expected to tick down to 57 from 57.2 in December. Most measures of producer sentiment managed to post gains in January and the ISM-adjusted average of all measure looks poised to finish at 54 for the month, up from 53 in December and November.

- US Employment – It is expected to post a 200k headline, up from 156k in December and about matching the 204k headline in November. The unemployment is expected to hold steady at 4.7% from November. The balance of risk is firmly to the upside as claims, consumer confidence and producer sentiment have all continued to strengthen in January.

- EU Markit PMI – Expected to be unchanged since last time i.e. 53.6.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our latest webinar and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/02/07 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Andria Pichidi

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.