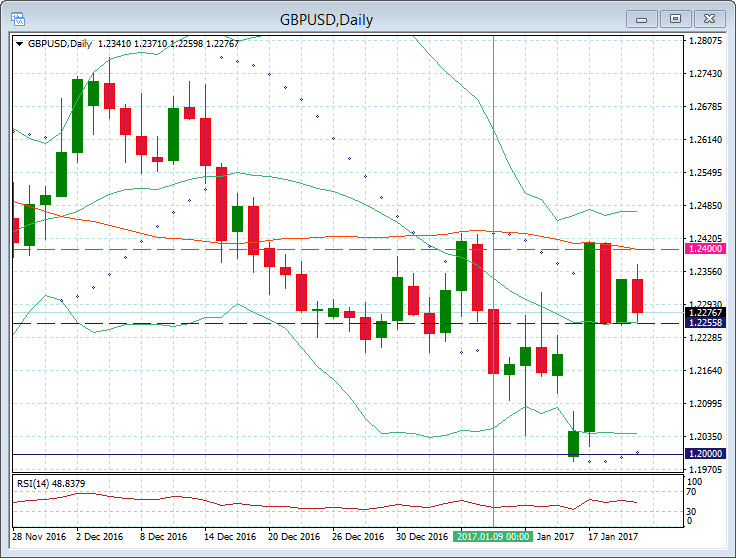

GBPUSD, Daily

Sterling shed about 30 pips versus the dollar and euro following the unexpected 1.9% m/m dive in retail sales, the biggest fall since 2011 and which came contrary to the median forecast for a 0.2% rise. This is a market mover as the consumer sector has been the driver of economic growth in the UK, and signs of weakness chimes with a declining pace of real income growth as rising inflation impacts. Cable has settled around 1.2290 versus pre-data levels above 1.2330. The pair remains sandwiched between its 20- and 50-day moving averages, at 1.2244 and 1.2399, respectively, both of which have a level profile, indicating a broadly directionless trend. Wednesday’s and Thursday’s lows at 1.2253 and 1.2257, ahead of the 20-day moving average at 1.2244, now mark a key near-term support zone. The risk remains for a return to sub-1.2000 levels on the back of Brexit concerns and expectations of a protracted Fed tightening cycle.

Meanwhile, GBPJPY also looks interesting as it breaks above the 200 DMA 141.00 and tries to break the 50 and 20 DMA area at 142.15. This could see a return to the 144.50 –145.50 zone. The Parabolic SAR has turned positive this week and the RSI remains neutral. One to watch over the next few trading days.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/01/24 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.