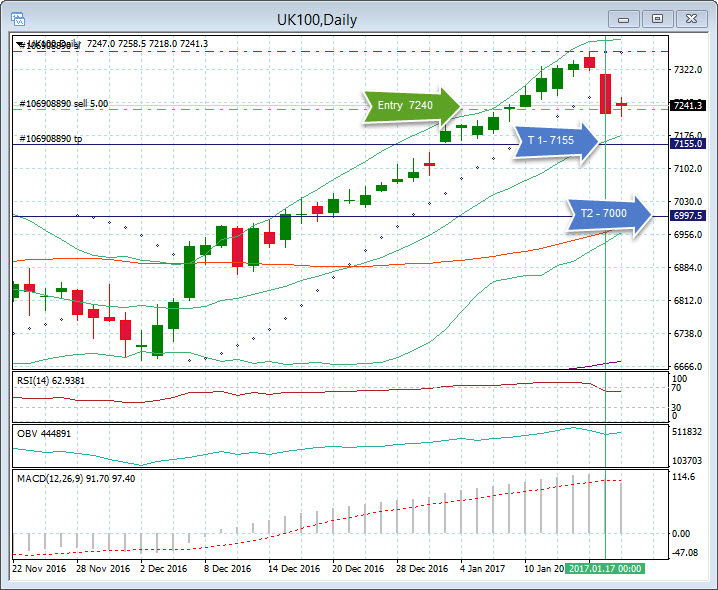

UK100, Daily

The European stock markets are narrowly mixed, today with DAX (GER30) and FTSE (UK100) posting slight gains, while CAC (FRA40) is down and the Euro Stoxx 50 up a marginal 0.04%. The UK100 is clawing back some of yesterday’s losses as Sterling retreats from yesterday’s highs seen in the wake of May’s Brexit speech. However, yesterday’s strong move south engulfed the six previous sessions and was a robust down candle at the close of the day. RSI having been in over bought territory for close to two weeks turned below 70, the MACD histogram failed to break the signal line and rolled over for the first time since mid-December, and the parabolic SAR turn yesterday too. All these technical moves are to be expected with such a strong move against the prevailing trend and they may be only short lived. However, the strength of the move was sufficient to suggest a SHORT position and entry was 7240 today, target 1 at the 14 DATR at 7155 and sits between the 23.6 and 50.0 Fibonacci level from the rise to Mondays high at 7360 and the gap from the beginning of the year between the 2016 close and the 2017 open. T2 is the 50 DMA and psychological 7000 level. The Weekly time frame remains positive; however there are overbought signs in the Monthly chart as the RSI breaches the 70 level.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/01/19 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.