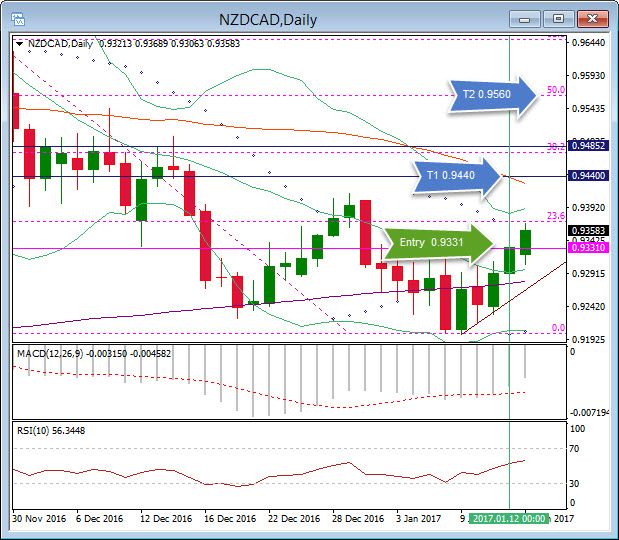

NZDCAD, Daily

Yesterday I wrote how Target 2 for AUDCHF remained “within reach as the gold rally continues; earlier today it breached the key $1200.00 level”. Although gold drifted back from that key level overnight, target 2 for AUDCHF (0.7580) was breached for a further gain of 90 pips and making the total net gain for the trade 169 pips.

NZD and AUD strength continues, and NZDCAD looks very interesting. The pair formed a tweezer bottom on Monday (December 9), broke and closed above the key 200 DMA on Wednesday (December 11) and yesterday (December 12) broke, breached and closed above the 20 DMA, the Parabolic Sar turned and a LONG position was opened last night’s close 0.9331. The longer term Monthly trend remains positive and the Weekly trend found support last week at a key July 2016 low (0.9206). The daily chart trade is with the longer term trend, so target 1 is north of the 14 DATR and around the 50 DMA at 0.9440. Target 2 is at the 50.0 Fibonacci retracement level of the recent down move from November 6 high (0.9920) at 0.9560. The RSI at 56.34 is bullish and rising.

https://analysis.hotforex.com/ has had a good start to 2017 with all four trades achieving at least target 1 for a total net gain of 736 pips.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2017/01/17 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.