FX News Today

European Outlook: Asian stock markets are mixed, with Japan and ASX moving higher as the BoJ left policy unchanged, and the Yen retreated. Hang Seng and mainland China markets remain under pressure with oil producers and banks leading the way. U.S. stock futures are up and FTSE 100 futures are little changed, as events in Ankara and Berlin add to political uncertainty in Europe. With elections in France, the Netherlands and Germany next year especially the suspected terror attack at a German Christmas market in Berlin is likely to further boost populist movements. A fresh bout of risk aversion could see Bund futures extending gains, after the March contract managed to break the downtrend yesterday and closed at 163.15, while extending gains in after hour trade. The next target is the 163.79, the high from November 28. It will likely overshadow today’s data calendar, which includes German producer price inflation at the start of the session, followed by Eurozone current account and BoP data as well as Swiss trade and the U.K. CBI distributive trade survey.

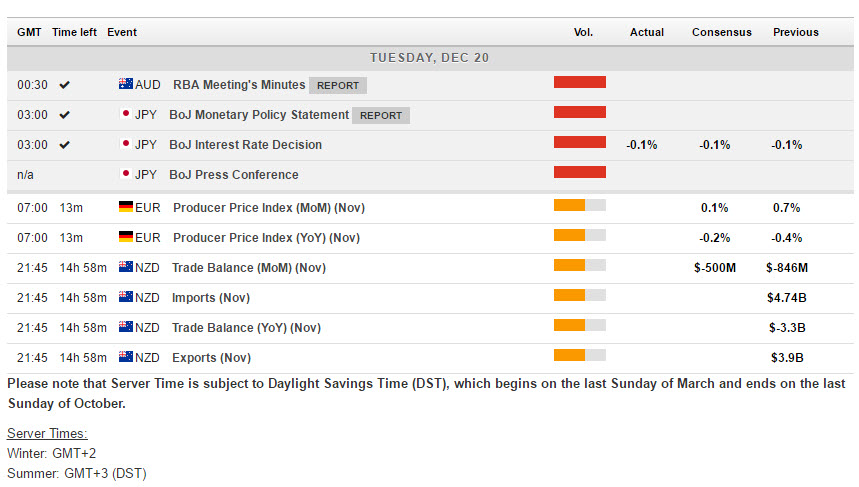

BoJ Rates & QQE Unchanged Outlook upgrade: The Bank of Japan December meeting concluded today, with the bank upgrading its outlook for the economy but leaving policy unchanged: The short-term interest rate target unchanged at -0.1%, The 10-year JGB yield target is left at around zero %, Buying of JGBs is still targeted at an annual pace of 80tln yen. The “inflation-overshooting commitment,” also first announced in September and where the BoJ is committing to expanding the money base until CPI exceeds the y/y target of 2% and stays above target, was also reaffirmed. The central bank noted that the economy “continued its moderate recovery trend,” highlighting a pick up in exports. Overall, no surprises from the BoJ. The general view now is that the central bank is in a wait-and-see stance while it monitors a long-awaited reflation expected to be driven by a weaker yen and higher oil prices. The yen has declined by 6.2% m/m versus the dollar, while Brent crude prices are up 12.2% m/m (and by 50.9% y/y). The BoJ also last week announced a ramp-up in purchases of debt maturing in 10 to 25 years as part of its yield curve control operations.

The U.S. Data Yesterday: U.S. Markit flash services PMI fell 1.2 points to 53.4 in December after dipping 0.2 points to 54.6 in November. It was 54.3 a year ago, and is the lowest since September. The employment sub-index rose to 53.4 from 52.1 previously and is the highest since March. Prices charged also increased. The composite index also declined 1.2 points to 53.7 from 54.9, and is also the lowest since September. But new orders fell to 54.4 from 55.5, while input prices also increased. These are some of the few indicators that haven’t bounced further on the Trump-effect, though the indexes were already at relative highs in October.

Yellen: She didn’t offer anything new or any fresh policy insight in her commencement speech at the University of Baltimore. She repeated that the labor market is strong, indeed the best in nearly a decade and that job creation is continuing at a steady pace, with layoffs low. She does see indications of a pick up in wages, especially for younger workers, while productivity growth remains disappointing. While economic gains are raising most living standards, she did acknowledge there challenges remain, including the fact that the recovery has been so slow.

Main Macro Events Today

- German Producer Price Index (PPI) – Expected to fall to 0.1% from 0.7% last time (MoM) whilst YoY figure expected to improve to -0.2% from -0.4% in October.

- NZD GDT – Twice monthly Global Diary Trade auction announce later today along with New Zealand trdae balance and the monthly Visitor arrivals. The GDT improve last time to 3.5%, expectations are for a similar demand this time, NZ trade balance is expected to improve to -500million NZD from – 846milliom NZD as export prices have improved. Visitor arrivals expected to increase to 2.5% from 2.2% last month. The NZD has been under pressure over the last few trading sessions.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register the next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2016/12/20 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.