With European countries accelerating the easing of virus restrictions, the focus turned to recovery programs and German-French proposals for an EU recovery fund last week. That was a signal that the Eurozone is on the way to debt-mutualisation as some hope it to be, but it nevertheless an important step that signals the willingness to move towards greater – not less integration going forward. It also signals though that joint financing also means closer cooperation and centralised agreements on economic policies.

German Chancellor Merkel and French Prime Minister Macron last Monday proposed a EUR 500 bln recovery fund for the EU that for some signals that first step towards Eurobonds and finally debt mutualisation. The proposal would see the EU raising funds directly on the market and thus the creation of EU debt instruments. The money would then be channeled to member states in the form of EU “budgetary expenditure”. The European Commission has borrowed monies before but never to this extent and the Eurozone’s ESM funds are a Eurozone instrument, not an EU-wide one. And while the EU’s €1tn seven-year budget already redistributes funding received from member states to poorer regions via its cohesion program, it is mostly up to member states to finance these contributions.

Over the weekend however the optimism over joint action was abandoned, after the “frugal four”, i.e. Sweden, Denmark, the Netherlands and Austria threatened to derail the plans for a EUR 500 bln emergency fund that could hand out grants to the countries most hit by Covid-19. The grants are anathema to the EU’s self-styled “frugal four”, who generally oppose big spending and fear the proposal will lead to a mutualization of member states’ debt.

The “frugal four” propose preferential loans financed through the EU’s budget rather than a directly funded rescue pot, which could deepen the divisions that emerged during the crisis.

According to Bloomberg, “in a joint paper, the leaders of Austria, Denmark, Sweden and the Netherlands — net donors to the EU budget and traditionally skeptical of its expansion — reiterated their opposition to debt mutualization and emphasized that any aid program must have a time limit.” The statement was pretty much clear for non mutualisation debt, loans for loans’ approach for the Emergency Recovery Fund and an explicit sunset clause of the fund after two years. However, the four countries have left some room for further discussion and an interim deal despite the pro-austerity approach. Hence there are still signs of compromise that could unlock Macron-Merkel’s agreement.

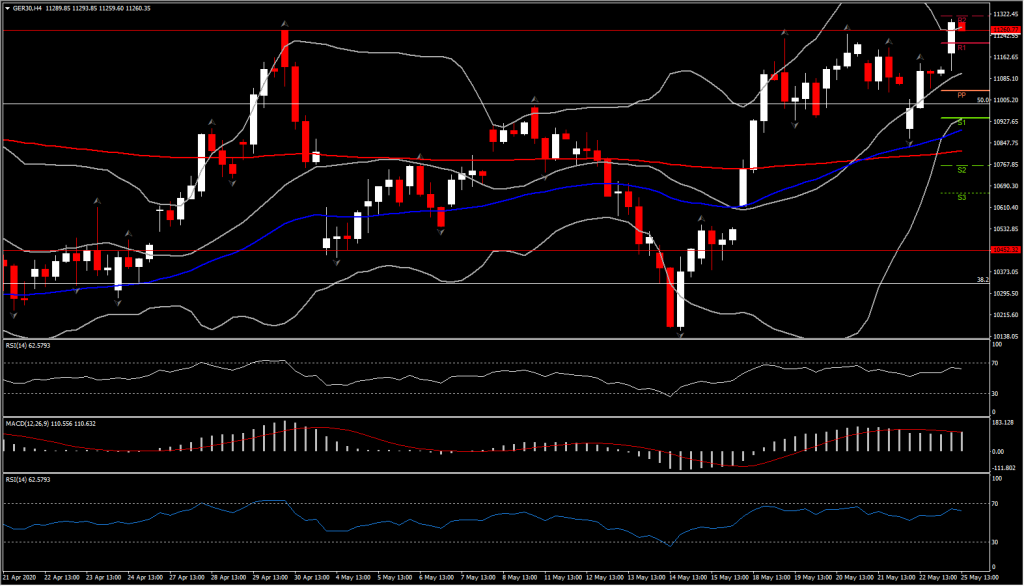

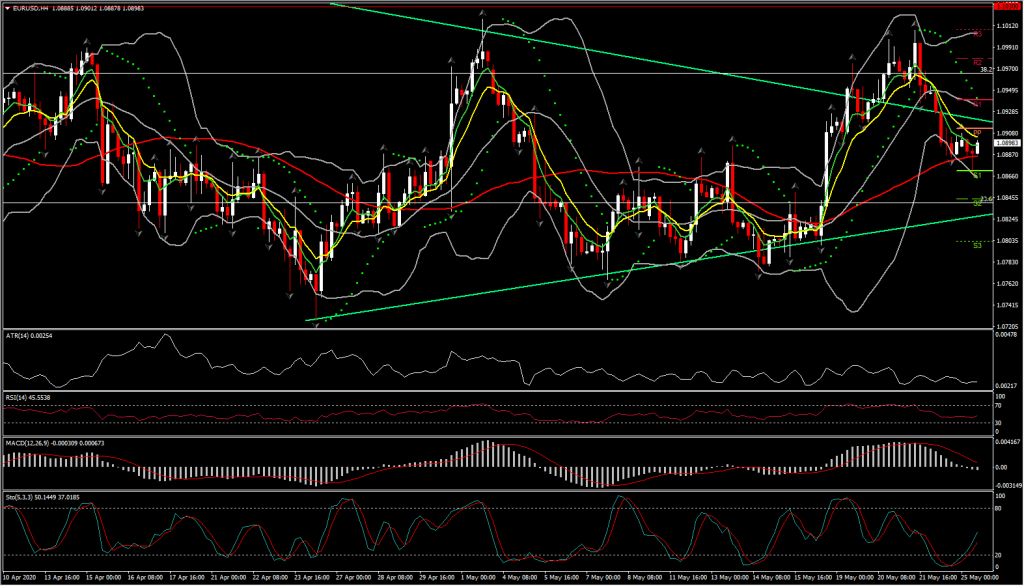

The GER30 futures are up by 0.9% today, outperforming versus US futures, which are up around 0.4 to 0.5%, while EURUSD has fallen back to the 1.0880-1.0890 area, after German Q1 GDP contracted 2.2% q/q as expected but more precisely due to the buoyancy in the USD, which is finding a degree of safe haven demand as weekend developments showed a continued rise in US-China tensions. Hong Kong has re-emerged as a flash point in US-China, and West-China, relations. The narrow trade-weighted USD index edged out a one-week high at 99.97.

The rebound in May of German Ifo business confidence boosted EURUSD slightly higher however, as overall conditions are somewhat quieter than usual and Eurozone bond markets are also mostly higher, the Euro remains under pressure with limited upwards movement, as political tensions among Eurozone members, coupled with the Dollar’s role as a haven, suggest the risks are to the downside. There is little divergence in central bank policy currently, with both the ECB and the Fed pursuing aggressively accommodative policy, with both Europe and the US facing significant economic headwinds from virus-containing lockdown measures. Both are amid the early stages of reopening from lockdowns.

Nonetheless, EURUSD continues to trade in a broad consolidation range near the halfway mark of the volatile range that was seen during the height of the global market panic in March, which was marked by 1.0637 on the downside and 1.1494 on the upside.

The German 10-year yield is down -0.9 bp at -0.50% and while the Italian 10-year rate is slightly lower, spreads have widened generally amid the controversy of the German-French proposal for a EUR 500 bln emergency fund.

Nevertheless, the creation of a safe asset for the EU could indeed be seen as a first stepping stone towards a fiscal union, although clearly EUR 500 bln are too little to really make a splash on debt markets and of course the recovery fund is intended as a limited exercise with a clear purpose, which in itself does not change the constitutional set up. Indeed, the proposal operates within the current treaties, while any wider ranging changes would require lengthy discussion and ultimate changes to the existing or new treaties.

As such the recovery fund is first and foremost part of the wider efforts to bring the EU and the Eurozone through the current crisis and guarantee a swift recovery once economies have fully re-opened. These have already included the suspension of the Stability and Growth Pact and of infringement procedures; unprecedented monetary stimulus from the European Central Bank, which is increasingly focused on keeping spreads in; the European Commission’s SURE unemployment instrument, new guarantees for companies from the European Investment Bank, and a new credit line from the European Stability Mechanism (ESM).

The European Commission is also working on additional projects as part of the EU’s new multi-annual budget. The Franco-German proposal would add another package and with €500bn it would be worth nearly 4% of EU gross national income and thus a pretty chunky fiscal boost – especially if it is handed out as grants, as the proposal suggests. For the receiving countries it would be far superior to the credit lines that the ESM offers despite the criticism.

At the same time the recovery funds will have a clear purpose and while they may not come with the same type of strict oversight that the original bailout funds required, it is unlikely that there won’t be some sort of economic guidance attached in the final version.

For sure the proposal is still far away from the type of debt-mutualisation.

Click here to access the HotForex Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.