GBPUSD, Daily

U.S. housing starts underperformed with a 5.8% August drop after small upward revisions, with a 0.4% permits decline that left a weak report overall, though both measures appear poised for quarterly gains in Q3 with persistent growth in starts under construction. Starts weakness was concentrated in the south, though it was spread across the single and multi-family components. Starts and permits continue to ratchet higher from weak Q4 levels.

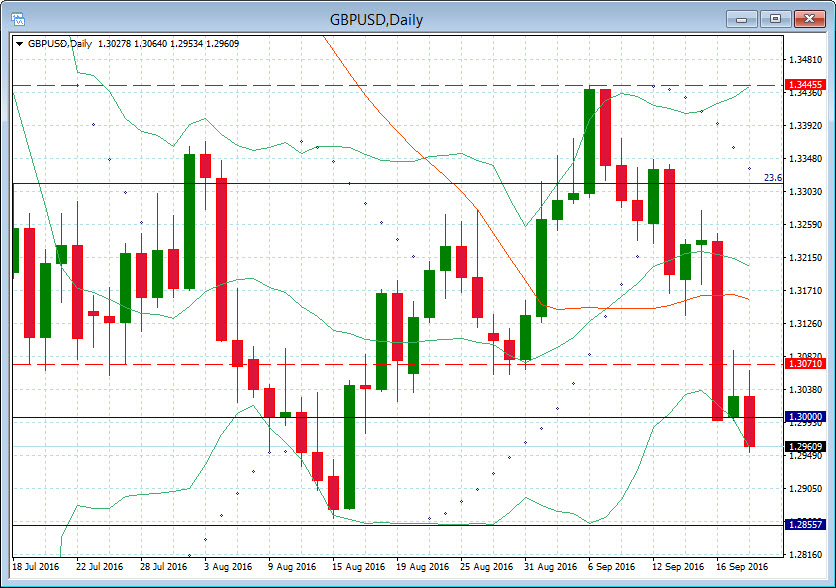

The dollar dipped following the housing starts data, which were much worse than expected. EURUSD ticked up 10 points to 1.1186, as USDJPY fell to 101.78 from over 101.85. However, the pound is the day’s loser, showing 0.5% declines versus the dollar and euro and a 0.6% fall versus the yen and trading at or near one-month lows against all of the G3 currencies. It’s all about Brexit, which, after a summer lull of political activity and a run of data showing a better than expected economic rebound from the initial post-vote wobble, is back at the centre of investors’ big-picture concerns. Earlier in the month, for instance, Japan’s foreign minister published a 15-page document warning that Japanese companies in the UK, which have created 440k jobs, would consider moving to the EU if Britain did not retain full access to the single market, avoids customs controls on exports, and continues “passporting” rights that allows UK-based non-EU businesses to trade across the EU. A report from the UK’s Financial Conduct Authority today, meanwhile, showed that 5,500 UK-registered firms rely on “passports” to do business in the EU. So far the only guidance from the UK government, which is grappling with the magnitude of task ahead, is that “Brexit means Brexit,” which has done little answer the core question of whether the Britain is heading for a hard exit or a soft exit, the latter being a scenario where full access to the single market remains, but at the likely cost of not taking back full border controls.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work. Click HERE to register for FREE! The next webinar “An Introduction to Elliot Wave Theory” will start in: [ujicountdown id=”Next Webinar” expire=”2016/09/21 11:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.