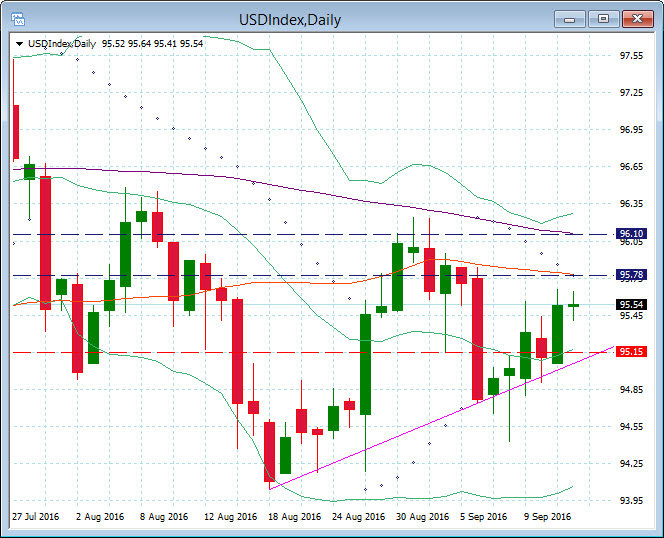

USDIndex, Daily

U.S. August import prices fell 0.2% with export prices down 0.8%, with the latter weaker than expected (the largest decline since January). The 0.1% increase in July import prices was not revised, but the 0.6% June gain was bumped up to 0.7%. The 0.2% increase in July export prices was left unchanged, but June’s 0.8% increase was revised down to 0.7%. On an annual basis, import prices are down 2.2% y/y, versus -3.7% y/y previously. Export prices are down 2.4% y/y For imports, declines were broad-based but led by petroleum prices which declined 2.8% following the prior 3.6% drop, which followed double digit gains since March. Excluding petroleum, import prices were flat versus 0.5% previously. Import prices with Canada slid 0.9% and were down 0.2% with China. As for exports, agriculture prices dropped 3.4% from -0.3% in July (revised from -0.4%). Excluding ag, export prices fell 0.4% from 0.2% (revised from 0.3%). The data are going the wrong way for the Fed hawks.

The dollar was unmoved by the softer export prices, with EURUSD static at 1.1220, USDJPY unmoved near 102.80 and the USDIndex at 95.54. The USDIndex but remains bullish this week having reached, breached and broken the 20 DMA. Resistance is around 95.80 and the 50 DMA and the 96.00 – 96.10 zone and the 200 DMA. The 95.15 – 95.00 levels could now provide near term support.

Click here to access the HotForex Economic calendar.

Want to learn to trade and analyse the markets? Join our webinars and get analysis and trading ideas combined with better understanding on how markets work.

Click HERE to register for FREE! The next webinar will start in:[ujicountdown id=”Next Webinar” expire=”2016/09/15 13:00″ hide=”true” url=”” subscr=”” recurring=”” rectype=”second” repeats=””]

Stuart Cowell

Market Analyst

HotForex

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.