FX News Today

- Overall dovish signals from central banks yesterday underpinned Asian markets, which are mostly posting fractional gains.

- Bund futures are fractionally higher in pre-market trading, while GER30 and UK100 futures are slightly lower.

- Japan inflation hit a two year low, with CPI excluding fresh food coming in at just 0.5%, in line with estimates and the lowest rate since 2017.

- BOJ: This may complicate the outlook for the BoJ, although excluding energy, prices actually nudged higher. The data will add to easing expectations after BoJ head Kuroda signalled a review of the overall situation and the impact of slowing world growth on price momentum in Japan.

- Brexit developments: Negotiators from both sides are set to meet today, after the European Commission confirmed that it received some technical papers on alternative arrangements to the backstop.

- German PPI inflation much weaker than expected at 0.3% y/y (median 0.6%).

- OECD cut its 2019 and 2020 outlooks for growth globally, and across most of the world, versus the prior May estimates. And it indicated growth is set to slip to its slowest since the financial crisis thanks to the trade tumult.

Charts of the Day

Technician’s Corner

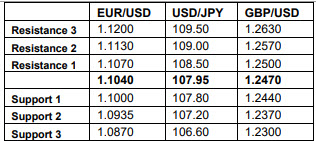

- GBPUSD rallied from 1.2490 to over 1.2570, a 2-month high after EU commission president Juncker told Sky News he believes “we can have a deal” on Brexit by October 31. It remains to be seen, how Mr. Juncker plans to make a deal, since there has been no movement from the EU side in months. Cable had been languishing in the upper 1.25s.

- USDJPY has again been range-bound through the session, sticking to a 107.90 to 108.08 trading band. Improved expectations for movement on the US-China trade war may limit USDJPY downside for now. Support comes at Monday’s 107.45 low, with Resistance at 108.50.

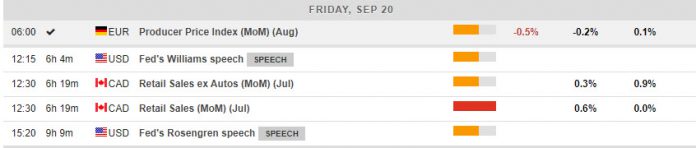

Main Macro Events Today

- Retail Sales ex Autos (CAD, GMT 12:30) – Retail sales and Core for August are seen steady, while the headline is anticipated to drop to 2.9% y/y from 3.3% and core to 2.5% from 2.9%.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.