AMEX, Daily and Weekly

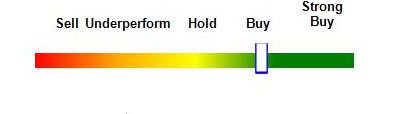

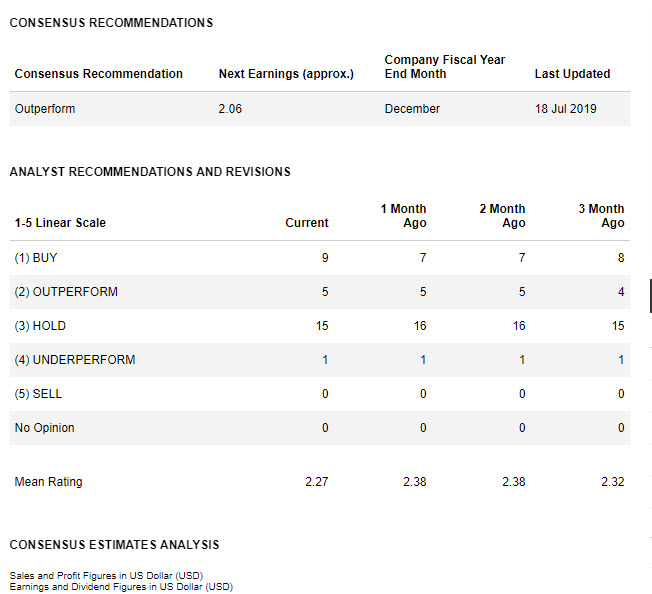

American Express’ second Quarter earnings for 2019 will be reported before the US Market opens today. The consensus recommendation for the company is “neutral to buy” corresponding to the majority of the consensus recommendation for the Online Services peer group , as 15 out of 30 Analyst Firms recommend remaining on hold and 14 suggest “Buy” possibility.

Figure 1: Data Provider: Data is provided by Zacks Investment Research and Reuters

According to Zacks Investment Research, the company is expected to report $2.06 earnings per share this quarter, which represents a quarterly change of 2%. The Revenues number is projected to climb 8.2% year over year to hit $10.82 billion. Similarly to last quarter, earnings should increase from a possible revenue growth, which is anticipated to be positively driven by a global rise in the Card members due to the customer referral program, the card optimisation and the launch of new products. Also the company’s investment strategy could continue to positively affect the second quarter earnings report.

The company’s strategy contains:

- Growing market share

- Driving scale by increasing customers and merchants

- Strengthening relevance by increasing engagement with card members, merchants and partners, especially digital engagement. Examples of partners are Hilton, Amazon, Delta, Air Canada etc., which could spike higher the overall revenues.

According to Zacks Equity Research, in the first quarter of 2019, the company reported 8.9% YoY grow in revenues reached $11.26 billion. The interest on loans revenue came at $2.73 billions. In this quarter revenues have been forecasted at $2.94 billions from the net of interest expenses.

Therefore it is widely expected that American Express is likely to beat quarterly earnings estimated for 9 out of 10 times since 2017. If the company achieved accuracy with its forecast, then a positive earnings outcome without any negative surprises on revenue could attract bulls back into the market, after 3 weeks of decline due to higher yields.

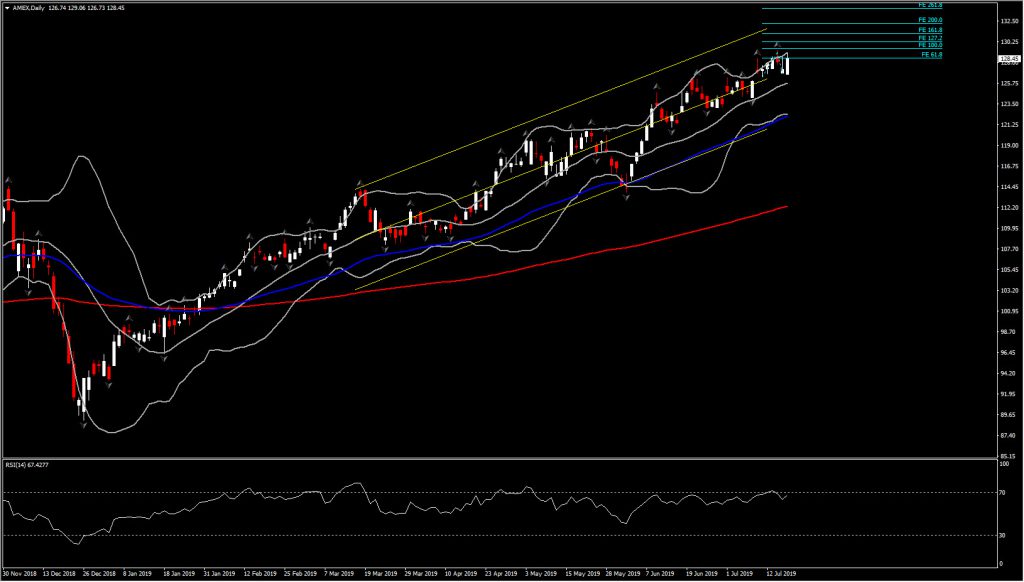

After the drop by 6% seen last month, the American Express AMX share price is currently gaining up to 38% for 2019, with the decisive turn in June reinforcing the positive momentum as of today. The asset is trading as high as $129.00 today.

A healthy financial report today could shift the attention further to the upside at record highs. The Fibonacci extension and the upper trendline of the standard deviation channel (the asset is moving within the channel since March 2019), could provide some immediate Resistance levels for the asset at 130.20 (also upper BB level), 130 and 131.70.

The asset is being strongly supported from 20-day SMA the past 7 weeks while in the long term the 50-day SMA provides strong support as well since January.

In case of an extension lower for AMEX price, prior to the earnings announcement or even disappointing earnings outcome, could find immediate Support at $125.70-$126.00 which is between the 20-day SMA and the midpoint of year’s channel and also 3-week’s Resistance which converted into support the past 7 days. Further to the downside a floor could be found at $124.15.

A break below this area could find Support at 50-week SMA at $99.50, which coexists with the latest weekly low fractal and the 61.8% Fib. level. Further decline could lead down to $98.30.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.