FX News Today

- Stock markets remain cautious ahead of Powell’s testimony, after jobs data reduced hopes of big rate cuts from the Fed.

- Tech stocks were hit by a slump in Apple Inc. after a broker downgrade.

- Topix and Nikkei pared early gains in the course of the session and are currently down -0.22% and up 0.06% respectively.

- Central bank expectations remain a major force for stock market moves, amid lingering geopolitical trade tensions, which are far from over despite the restart of US-Sino talks.

- European futures as well as US futures are down -0.3-0.4% with the Nasdaq underperforming.

- In Europe, BTPs are currently outperforming, but Greek bonds, which rallied yesterday on the election result, are paring some of the gains.

- Released overnight, UK BRC retail sales came in weaker than expected and fell back -1.6% m/m in the same store measure. Still to come are Italian retail sales numbers and an I/L auction in Germany.

- Oil prices meanwhile continue to hold in the USD 57-58 range, with the WTI future currently trading at USD 57.50.

Charts of the Day

Technician’s Corner

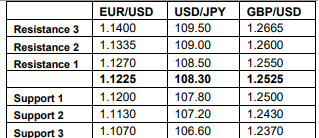

- GBPUSD retests again the 6-month low into EU open, at 1.2483. EURGBP remained buoyant, but markets still lacked the muster for a test of the recent six-month high at 0.8992. A 0.3% m/m contraction in the Halifax measure of UK house prices (released Friday) was the latest in a series of data disappointments out of the UK. As for Brexit, the news flow has remained quiet in terms of substantive developments. That will change as soon as the new prime minister, most likely no-deal-Brexit-if-necessary Boris Johnson, takes up the reins (which will be later in the month). Cable has resistance at 1.2510-20. Next Support at 1.2420.

- Silver: Despite the decline seen the last 2 days, Silver managed to be held above the 20- and 50-week SMA, sustaining more than 50% of the gains seen in June. Breaching the uptrend Support at 14.90 and also the small bounce up to $15.10 suggest that the corrective pressure is growing again. The RSI is sloping to the upside again but still remains below 50 in the daily chart, while MACD remains within the positive area following a bear cross last week. The key level at $15.10 is now a Resistance whilst traction below the $14.90 would open $14.60 as the next Support. A break above Resistance could retest the $15.25-$15.35 area.

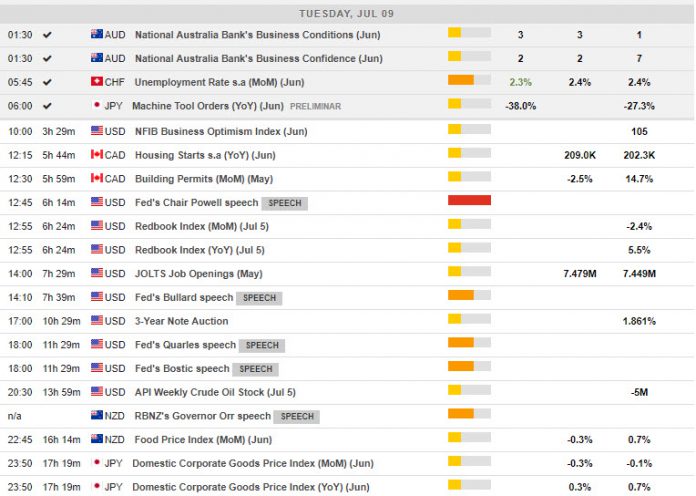

Main Macro Events Today

- Fed Chair Powell Speech on Boston (USD, GMT 12:45)

- JOLTS Job Openings (USD, GMT 14:00) – JOLTS define Job Openings as all positions that have not been filled on the last business day of the month. May’s JOLTS job openings is expected to rise slightly at 7.479M, following the 7.44M in April.

Support and Resistance levels

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.