Wall St. closed lower on Wednesday [23/10], with the Dow Jones down -0.96%. Losses were driven by McDonald’s (-5.14%), 3M (-2.98%) and Amazon (-2.72%). The biggest gainers were Verizon (3.18%), J&J (1.47%) and Walmart (1.41%). The Nasdaq 100 fell -1.60%, with Arm leading the decline, down by -6.67%. The S&P 500 was down -0.92%, as Enphase fell by -14.94%.

During the session, tech giants were also weighed down such as Nvidia (-2.8%), Apple (-2.1%), and Qualcomm (-3.8%). Tesla (-1.98%) fell ahead of its earnings after the closing bell, with investors watching for signs of stabilising sales and progress in its AI switch.

Tesla Inc. announced on Wednesday, that its total revenue in the third quarter of fiscal year 2024 reached $25.1 billion, growing 8% year over year, and slightly missed analysts’ estimates. Meanwhile, diluted EPS was higher than analysts’ expectations, rising 17% compared to the same three-month period last year and reaching $0.62. Net income rose 17% on an annualised basis, to $2.1 billion.

Higher bond yields today pressured stocks, as the 10-year T-note yield rose to a fresh 2¾-month high (4.25%). In addition, some negative corporate news weighed on stocks, with McDonald’s down more than -5% after a severe E. coli outbreak was linked to its Quarter Pounder sandwich and sickened dozens of people in several states. In addition, Boeing fell more than -3% after reporting negative adjusted free cash flow in Q3 that was wider than expected. In addition, Coca-Cola fell over -2% after reporting an unexpected -1% decline in Q3 unit case volume.

On the positive side, Texas Instruments and Teledyne Technologies rose over +4% after reporting stronger than expected Q3 EPS. Additionally, Amphenol is up over +3% after reporting better than expected Q3 net sales and forecasting full-year sales above consensus.

Q3 corporate earnings impact US stocks. About 90 companies in the S&P 500 have released earnings so far, with 76% announcing profits that topped estimates. About 20% of S&P 500 companies will report earnings this week, including Tesla, Boeing, and United Parcel Service. According to Bloomberg Intelligence, companies in the S&P 500 are expected to report an average quarterly profit increase of +4.3% in Q3 from a year ago, down from the consensus +7.9% growth seen in July.

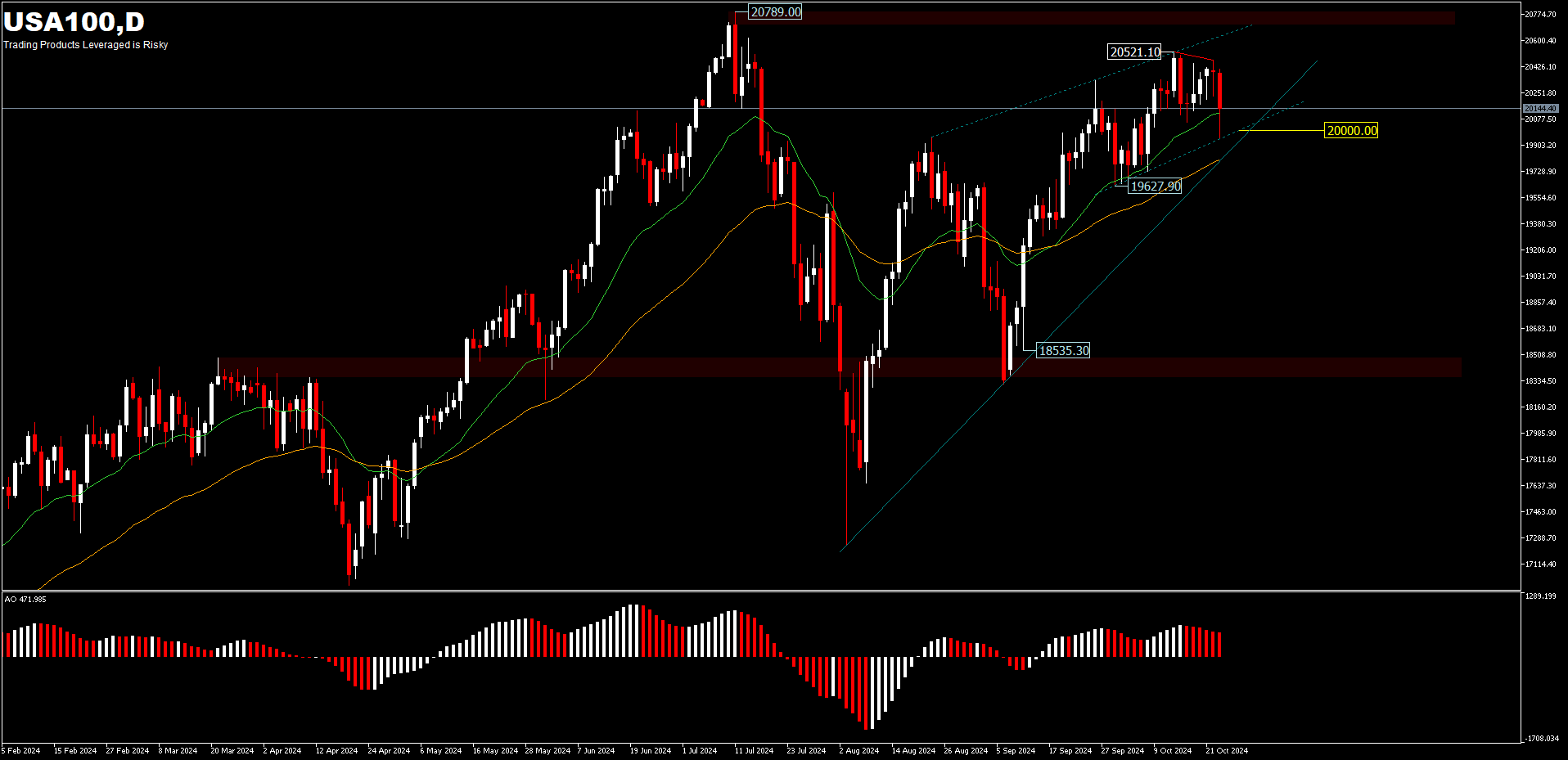

From a technical perspective, the USA100 [Nasdaq 100] is in a tricky equilibrium stage, with sentiment rising due to Big Tech earnings and concerns about interest rates keeping traders on their toes. If the index can break the key resistance of 20,789, it could be the start of a new bullish wave. However, if it drops below the support level of 19,627, then a short-term correction is about to materialise. The psychological price of 20,000 is for now a barometer, trend-wise it is still bullish moving above the 20 and 50-day EMA, but the momentum of the rally is starting to lose direction.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.