FX News Today

- RISK-OFF again, trade tensions, Huawei court case and weak sentiment. JPY & CHF were the main movers in the Asian session with USDJPY once again testing 109.20 and USDCHF down to 1.0060. US equities markets fell into the close (S&P down 0.84%), while Asian equities have followed lower (Nikkei down over 1%). Bonds rallied as sentiment continues to be fragile.

- USD firmer elsewhere; EURUSD dipped to 1.1160, GBPUSD breached 1.2650, and USDCAD attempted 1.3500 again, before slipping back to 1.3480. The Kiwi is firmer following the RBNZ FSR and Governor Orr’s speech, where he avoided monetary policy comments completely. The NZDUSD currently trades off overnight highs of 0.6552 at 0.6544. The AUDUSD supported by pivot point at 0.6972

- Oil prices gave up highs at $59.33 yesterday following comments by Russia that they will consider an extension of the production cap deal with OPEC – USOil currently holds $58.50. Gold, from lows at $1276 yesterday, has recovered to a key resistance at $1281.80.

Charts of the Day

Technician’s Corner

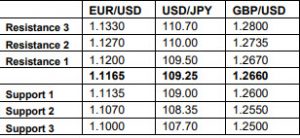

- EURUSD – H1 – another leg lower from 15:00 GMT yesterday R1 at 1.1185 and the 200 ema at 1.1180 are key resistance areas. Daily Pivot sits at 1.1172. RSI (35) and Stochastic (31) are weak an falling. S1 and the lower Bollinger band are at 1.1145

- GBPUSD – H1 – Under key daily pivot and 161.8 Fibonacci extension at 1.2676. 1.2650 is a key psychological level. S1 at 1.2648, the lower Bollinger band at 1.2642 and S2 1.2627 provide further support.

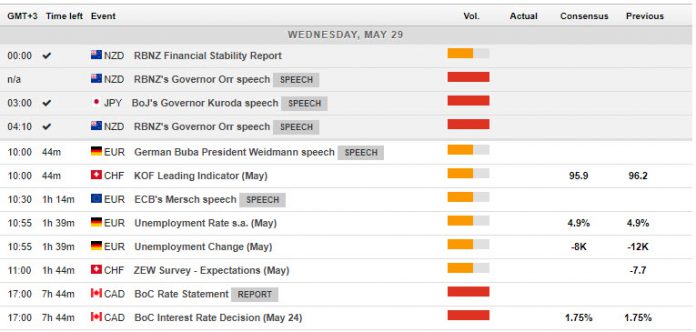

Main Macro Events Today

- Unemployment (EUR, GMT 07:55) – The German unemployment rate is expected to remain unchanged at 4.9% in May, however the number of vacancies is expected to drop to -7k.

- Event of the week – BoC Interest Rate Decision (CAD, GMT 14:00) – At the BoC meeting, consensus expectations are that there should be no interest rate change. However, the abandonment of the mild tightening bias in the last meeting, opened the door to both rate hikes and rate cuts, depending on the flow of data.

Support and Resistance levels

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.