FX News Today

- Japan remains closed for holidays.

- Elsewhere, China’s April services PMI is due, seen at 54.5 from 54.4.

- In the Asia region risk aversion spiked after US President Trump issued threats of new tariffs on imports from China in a bid to up the pressure in trade negotiations.

- Chinese Vice Premier Liu He is scheduled to return to Washington for trade talks on Wednesday, but after Trump’s threat China is now considering cancelling this week’s round of talks.

- North Korea launched missiles over the weekend, which included the first ballistic missile launch since 2017; this saw investors heading for safety.

- Treasury futures are allying, while yields across Asia are plummeting sharply and stocks selling off.

- Australia’s 10-year bond yield fell nearly 5 bp amid the general flight for safety and as markets position for a rate cut ahead of tomorrow’s RBA decision.

- US futures are posting losses in the region of 1.8-1.9%.

- The front end WTI future is trading at USD 60.45 per barrel.

Charts of the Day

Technician’s Corner

- EURUSD retested 1.1200 highs, up from the 1.1135 lows seen immediately after the US jobs report. The Dollar overall took a hit on Friday and again today. Though the pair closed the week with modest gains (bullish weekly candle), it remains well off of Wednesday’s high of 1.1265 and within the lower BB area, while intraday indicators have been flattened suggesting intraday consolidation. The Resistance comes in at 1.1228, the 20-day MA and Support at 1.1166. As the US economy is in a solid growth with low inflation sweet spot, the EURUSD is seen following the 1-year downchannel forming lower highs and lower lows.

- AUDUSD fell below the round 0.7000 level below to recover yesterday. As Bollinger Bands extend southwards and momentum indicators are sloping towards oversold barrier, another negative session along with the continuation of lower highs, implies a move towards 0.6800-0.6900 area.

Main Macro Events Today

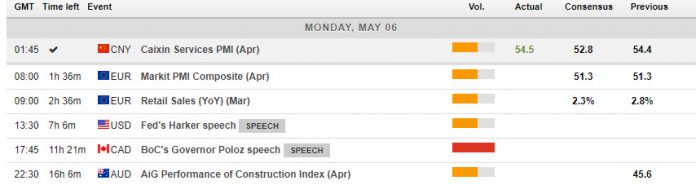

- Markit Composite PMI and Retail Sales (EUR, GMT 08:00-09:00) – The EU Composite PMI is expected to remain at the three-month low of 51.3 in April, while Retail Sales are forecast to slip to 0.1% m/m in March, with the annual rate decelerating to 2.3% y/y from 2.8% y/y.

- Fed speeches – Fed reports its Senior Loan Officer Survey. Fed President Harker discusses the economic outlook.

Click here to access the Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in FX and CFDs products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.