Economic Indicators & Central Banks:

- Expectations the FOMC is done hiking rates continued to support Wall Street even if aggressive rate cut bets have been trimmed, while earnings were mixed.

- Yields remain mostly higher, but off their peaks after the decent 2-year auction ($60 bln 2-year note sale). The Treasury is selling $61 bln in 5-year notes Wednesday and $41 bln in 7-year notes Thursday.

- Corporate supply has helped keep the market heavy. IADB priced a $4 bln 5-year SOFR. Also, Romania sold $4 bln in 5- and 10-year notes. Sweden sold a $2 bln 2-year. Bank of New Zealand priced a $750 mln 5-year. Cote d’Ivoire has a $2.6 bln 2-parter. CPPIB Capital offered $1.5 bln in 3-year SOFR.

- Japan reported its exports jumped nearly 10% in December.

- Japanese markets underperformed, with both stocks and bonds hit by speculation that the BOJ is laying the ground for an exit from the negative interest rate environment.

- The China Securities Regulatory Commission, called for better protections for investors and for instilling confidence in the potential for gains in the markets, which have faltered in recent months.

Market Trends:

- Asia: Hong Kong’s Hang Seng surged 2% to 15,569.39, helped by gains in technology companies like e-commerce giant Alibaba, which surged 3.8%. JPN225 (Nikkei) lost 0.8% to 36,226.48.

- The US500 added to its gains, rising 0.29% to its third straight fresh all-time high at 4864.6 US30 however was drag lower as 3M tumbled more than 10% on Tuesday after the company’s 2024 profit outlook came in below expectations.

- eBay will lay off about 9% of its full-time workforce.

- Procter & Gamble climbed 4.1% & United Airlines flew 5.3% higher after stronger profit for Q4 2023.

- Netflix rallied 8% afterhours after the video streaming service handily beat subscriber estimates in the Q4.

- ASML Holding, a chipmaking equipment maker, reported Q4 earnings that beat expectations and its best-ever quarterly orders, but it kept a cautious outlook for 2024 as it faces new restrictions on exports to China.

- Futures are higher across Europe and the US as Treasuries and Eurozone bonds advance.

Financial Markets Performance:

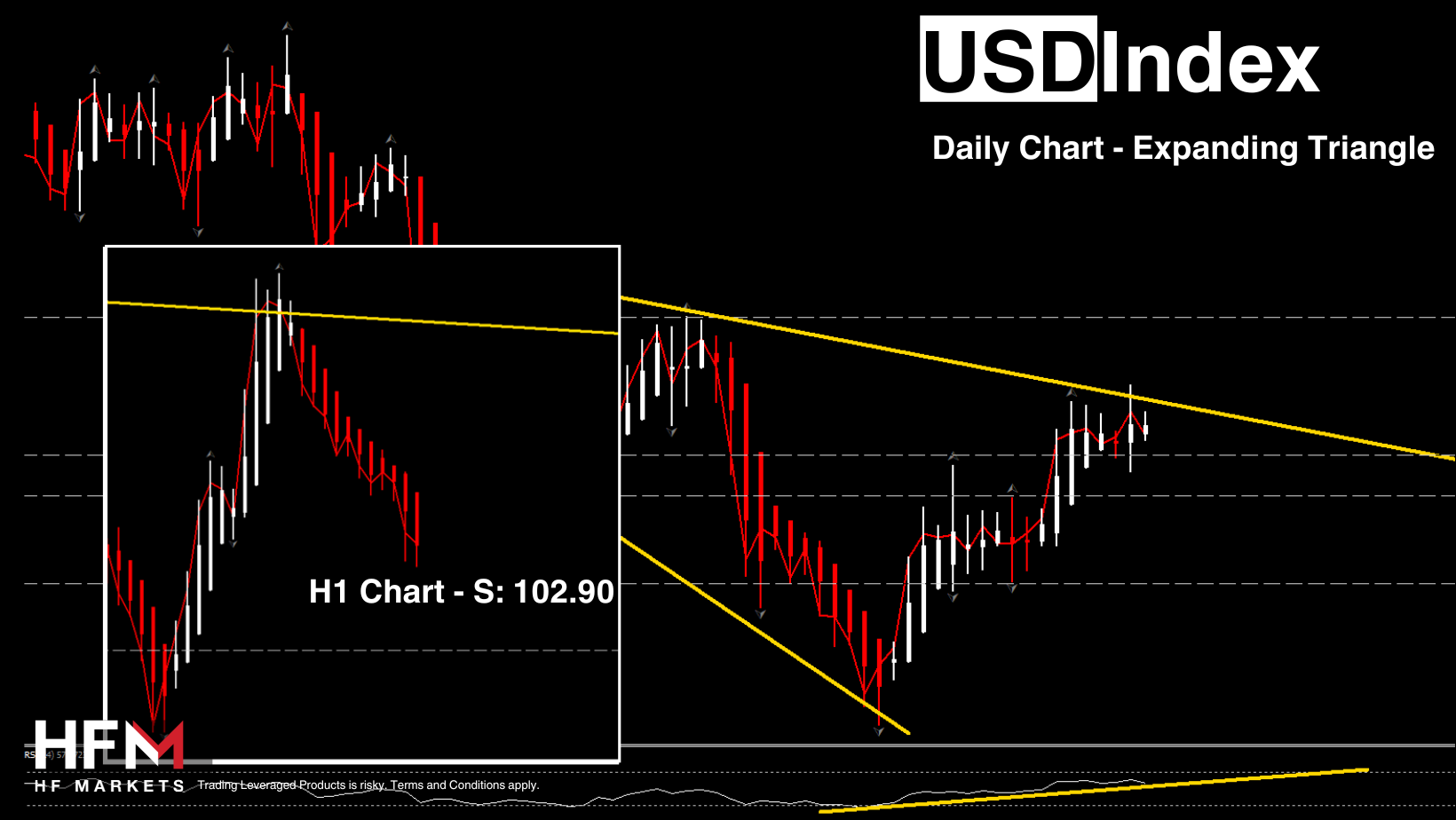

- The USDIndex found legs and rallied to 103.57. It was firmer against 7 of its G10 peers

- USDJPY steadied on 147.70 as Yen gained support after chief Kazuo Ueda said on Tuesday that the prospects of achieving the BOJ’s inflation target were gradually increasing.

- Oil finished -0.3% lower at $74.51 per barrel and Gold was 0.3% higher at $2028.34 per ounce.

- Bitcoin steadied around $39,700, after sliding as low as $38,505 on Tuesday for the first time since Dec. 1.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.