In the dynamic world of forex trading, the EURCHF pair is currently exhibiting interesting patterns and trends. This analysis delves into the recent Swiss CPI data, the Swiss National Bank’s (SNB) actions, and insights from the Eurozone Sentix Investor Confidence Index, shedding light on the potential for a triple bottom formation and divergence in the EURCHF pair.

Swiss CPI Data and SNB’s Influence:

In November, Swiss CPI fell more than expected, impacting the annualized rate and core CPI figures. Despite the SNB’s decision to maintain interest rates at 1.75% in September, its continued efforts to sell foreign currency have positioned the Swiss franc as the strongest G10 currency. This move is expected to persist, with the SNB likely to sell more foreign currency in the coming months.

Eurozone Economic Insights:

The Eurozone Sentix Investor Confidence Index provides a mixed but generally optimistic view of the region’s economic outlook. December witnessed an improvement in the index, albeit slightly below expectations. The Expectations Index showed a consecutive rise, hinting at a potential trend reversal. Sentix, while cautious about over-optimism, foresees significant improvement in the new year, driven by positive changes in the inflation outlook.

Eurozone consumer inflation expectations unchanged at a 5-month high. The latest ECB survey showed that median expectations for inflation over the next 12 months remained unchanged at 4.0%, while expectations for inflation three months ahead held steady at 2.5%. These rates are still clearly above the ECB’s 2% limit, even three years ahead, although at least there is the sense that inflation is expected to decelerate sharply. Expectations for nominal income growth as well as nominal spending growth over the next 12 months decelerated slightly.

Eurozone PPI inflation lifted to -9.4% y/y from -12.4% y/y in the previous month. Annual PPI rates turned negative in May, as base effects from the sharp rise in energy prices started to fall out of the equation. Surveys suggest the pick up in wage costs is putting pressure on producers to hike prices, although sluggish demand is limiting the room for companies to pass on higher costs.

EURCHF Technical Analysis:

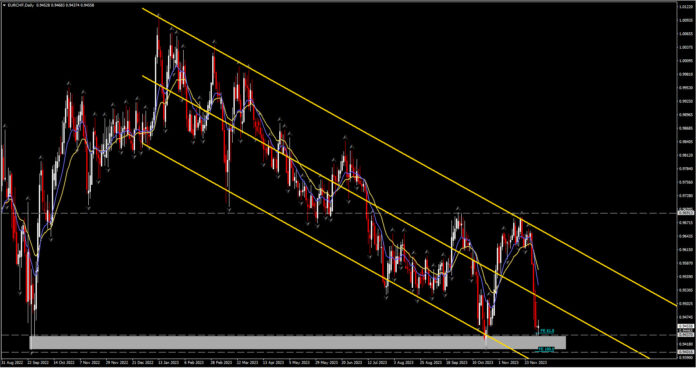

In the FX market, EURCHF has maintained its medium-term decline, facing resistance around the 0.9693 level. The 0.9402 support level is crucial, and a strong break could resume the long-term downtrend. The current outlook remains neutral within the 0.9417 – 0.9693 range, with the formation of a triple bottom and weekly divergence suggesting a potential reversal. However, a decisive move above the 0.9693 resistance is necessary to confirm a shift; otherwise, the bearish trend may persist.

As we navigate the complexities of EURCHF trading, keeping an eye on Swiss CPI, SNB’s actions, and the Eurozone Sentix Index is crucial. The potential triple bottom formation and divergence add a layer of intrigue to the neutral outlook, making it imperative for traders to stay informed and adapt their strategies accordingly.

Click here to access our Economic Calendar

Andria Pichidi

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.