Gold prices stayed below $1,930 per ounce as investors were concerned about the Fed’s hawkish policy, the future of global economic expansion and dismal European economic data. The strengthening Dollar also reduced the metal’s appeal. At its latest meeting, the Fed kept interest rates on hold as expected, but also signalled another rate hike before this year ends and fewer rate cuts in 2024. Accordingly, members revised GDP growth expectations higher to 2.1% this year and 1.5% next year, while the unemployment rate in 2024 was revised lower to 4.1%.

US Treasury yields were virtually unchanged after the Fed’s latest policy meeting. The 10-year Treasury currently has a yield of 4.43%, while the 2-year Treasury is at 4.71%. The Fed’s stance is a result of inflationary pressures that warrant further scrutiny.

Meanwhile, the tightening cycle in Europe may have come to an end due to the BOE’s surprise decision to halt rate hikes. The PMI also showed how business activity in the Eurozone continues to shrink. The BOJ maintained its ultra-accommodative monetary policy as the board seeks to achieve its price stability target of 2% on a sustainable basis, which will be followed by wage hikes.

The metal’s gains were limited, as the dollar index rallied on Friday to a 6-month high. Moreover, hawkish central bank comments are bearish for the precious metal.

Technical Review

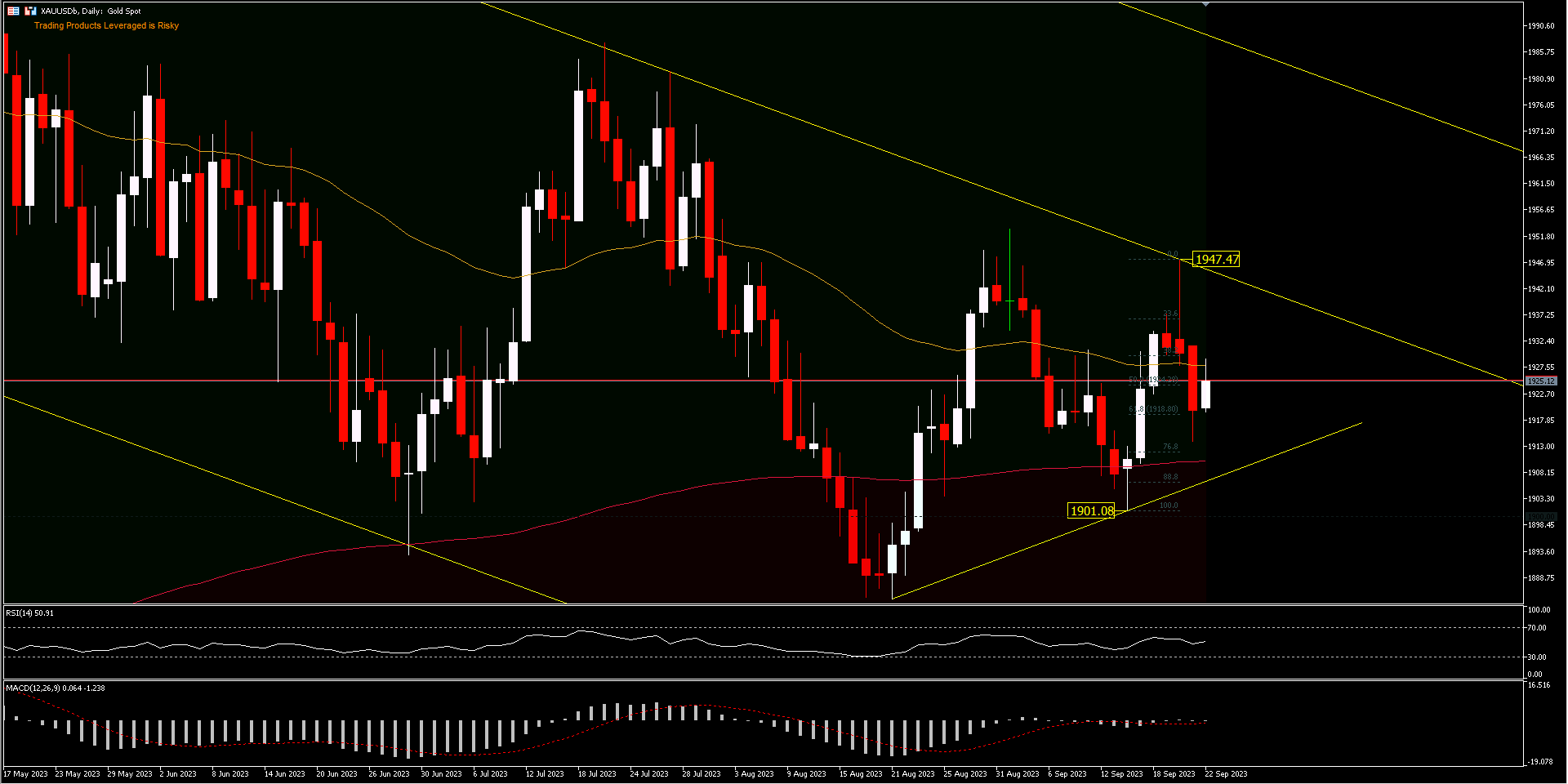

XAUUSD, D1 – Fresh weakness contributed to the formation of a reversal pattern on the daily chart, after Wednesday’s action was strongly rejected at the $1947.47 price level, leaving behind a daily shooting star candle with a long upper shadow and forming a bull trap pattern. Thursday’s acceleration lower reached over 61.8% FR of the $1901-$1947 upside, adding to the signals that the short-term bullish phase is most likely over. Nonetheless, precious metal prices on Friday [22/09] closed slightly higher, with Friday’s lower T-note yields lending support.

The weekend closing price of $1925 remains below the 52-day EMA near the 50% FR level and further declines are likely to test the 200-day EMA around $1910. The flattened slope of the 200-day EMA indicates a flatter price trend trading in late September. The RSI line range at the mid-50s and MACD only confirm the narrowing trading range of gold prices.

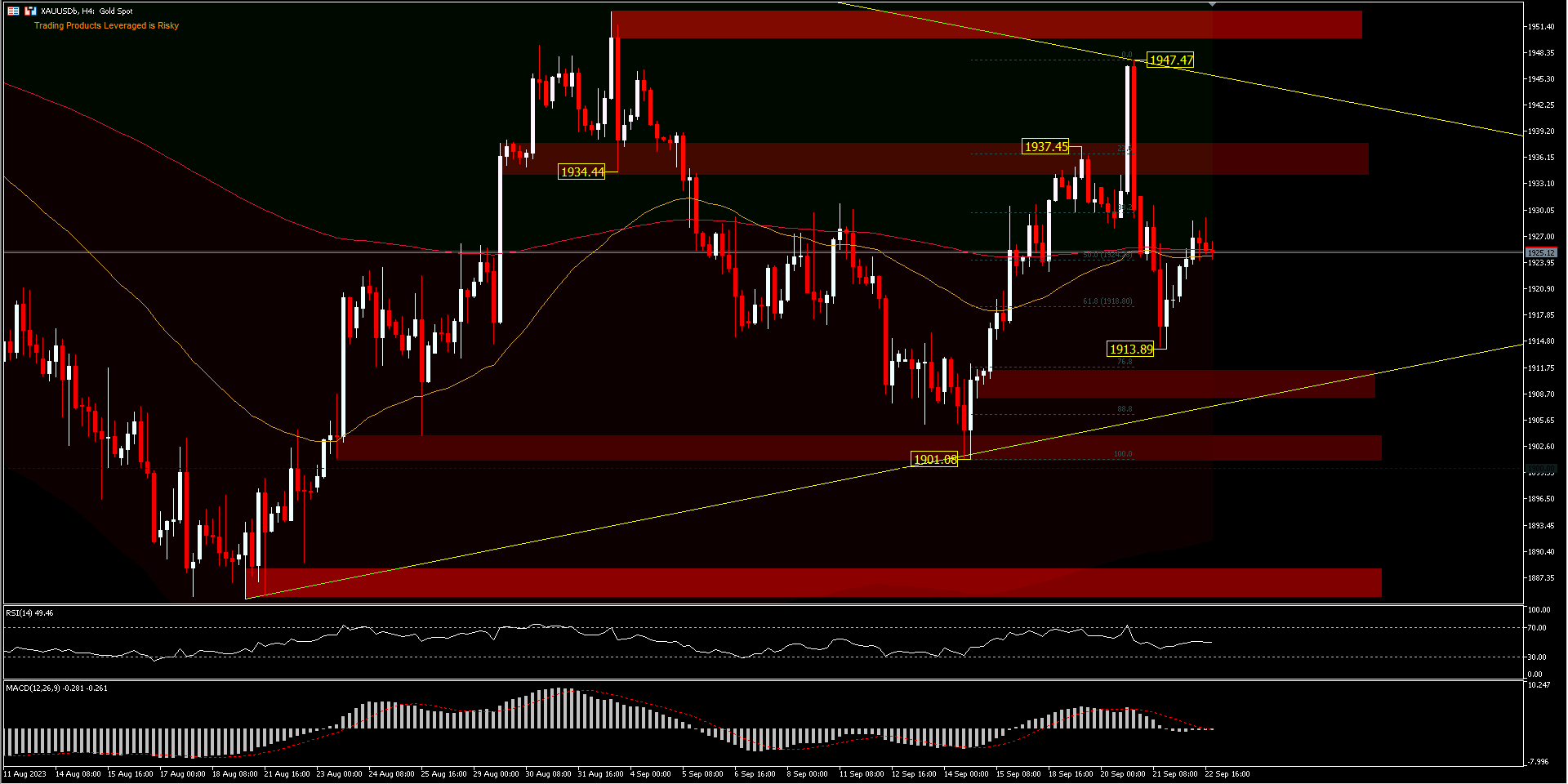

Intraday bias (H4) at the start of the week was neutral amid 200 EMA. The H4 bearish engulfing forming a daily shadow at least gives a hint of buying interest losing traction, although the past neckline and left shoulder, at $1934 and $1937 respectively, could be a hurdle to the upside rally. Meanwhile , the intraday support of $1913 and 76.8% FR could be the place to hold the downside, before reaching the $1900 round-figure.

Related articles: https://analysis.hfmint.com/id/732520/

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.