Asia-Pacific markets were lower on Friday as Japan released revised second quarter gross domestic product figures (+1.2% vs +1.3% expected, down from 1.5%) and Hong Kong cancelled the morning trading session due to a storm warning. Overnight the US100 fell for a 4th session, weighed by Apple after a report that China is allegedly banning government workers from using iPhones; NVDA, AMD, Qualcomm slipped as well. US30 managed to edge up 0.17% as defensive sectors outperformed (Utilities the best one). Initial Jobless claims fell to 216k last week, below estimates and hinting to a still tight job market after last week’s streak of data. Unit labor costs rose 2.2% (1.9%). A ”positive” note came from Walmart that announced it is lowering its workers entry pay. EU GDP and employment change in Q2 disappointed yesterday and EU stocks are down for the 7th day in a row. German CPI/HICP is just out, in line (CPI +6.1% y/y).

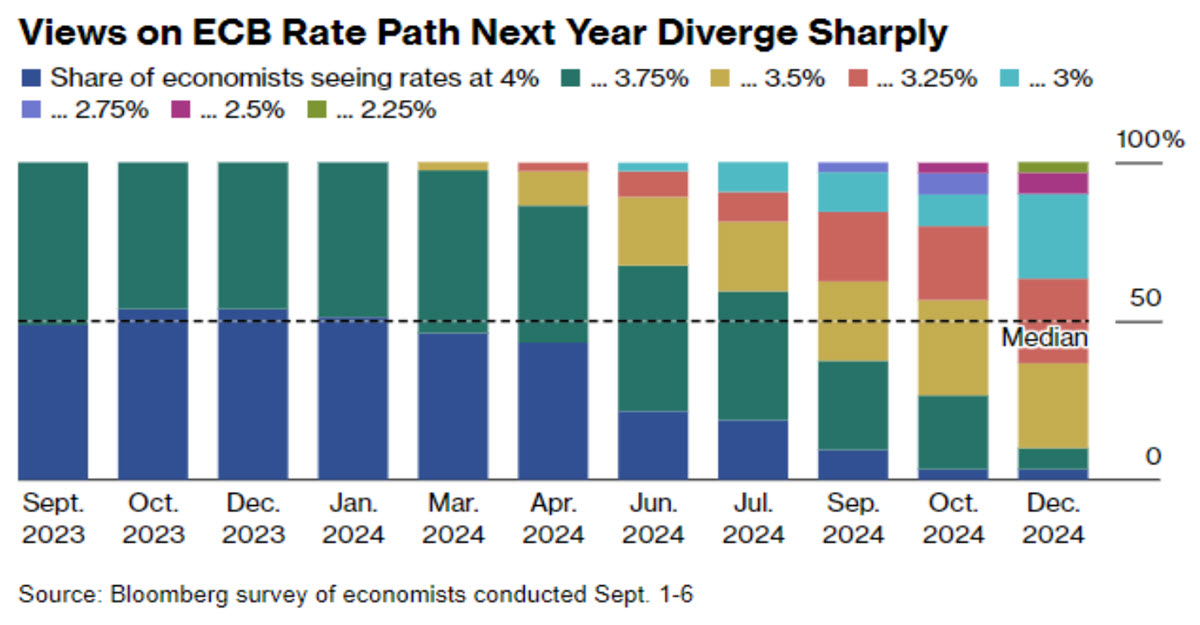

This morning a poll of 69 economists interviewed by Bloomberg showed that the majority of them (39) are seeing an ECB pause in September, with some odds (33) of a new hike by the end of the year. Finally, USDCNH is trading at 7.3528 and has broken 2023 highs the day after CNY did so, showing the Chinese authorities are giving up protecting the 7.30 barrier.

- FX – USDIndex -0.20% at 104.82 retreated back below 105, EURUSD sits in the low 1.07s, Cable lingers below 1.25 and USDJPY trades on a 147 handle (147.15).

- Stocks – EU Futures +0.3% (both GER40 and FRA40), US30 +0.14%, US100 +0.31%, AAPL – 2.92%, AMD -2.46%, Qualcomm – 7.22%.

- Commodities – USOil -0.36% at $86.43, UKOil loses $90, $89.59 now. Strikes began at Australian Chevron LNG plants.

- Gold – +0.38% at $1926.80, XAG +0.82% at $23.15, Palladium +1.15% at $1228 is trying to rebound from 2023 lows.

LATER TODAY: Canadian Unemployment Rate, Fed’s Bostic & Barr.

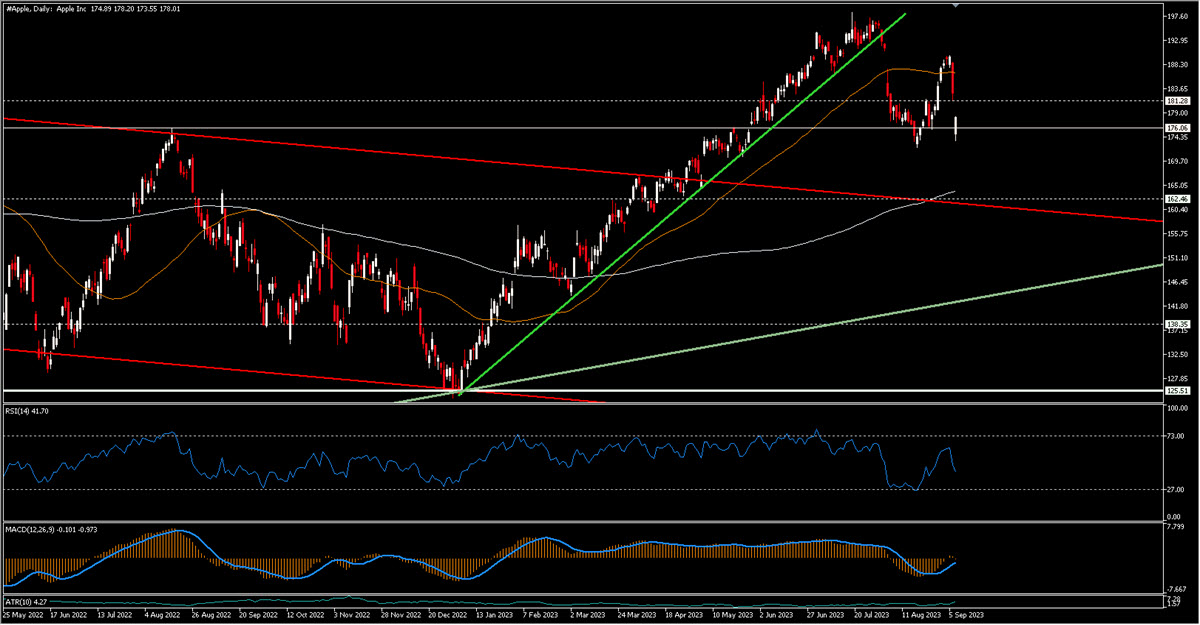

INTERESTING MOVER: Apple -2.92% at $177.56 is down -6.54% in 2 sessions on heavy volumes after US-China tech-related tensions arose again. It managed to recover the $176 level after opening at 175.18 and hitting a low at $173.54. The MACD is neutral and RSI slightly below 50. Price is between the MM50 ($186.50) and MM200 ($164).

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.