First of all a reminder: US and Canadian cash markets will be closed today because of the Labour Day celebration, obviously resulting in diminished flows this afternoon. Going back in chronological order, APAC is led by the excellent performance of the China50 and especially Hong Kong where a surge on real estate stocks helped the indices to add 2.5% and 1.8% respectively. This comes after embattled Country Garden reportedly won approval to extend payments for an onshore Private Bond and is now up 7.9% (just out the wire they are trying to get financing in Malaysian Ringgit); the overall Mainland Properties Index is +7.32%. This week there will be important data from this hemisphere with the RBA rate decision and the Chinese trade balance.

Friday’s NFP figure was slightly better than expected (+187k vs +170k expected) but at the same time the previous two readings were revised downwards by 100k, while the unemployment rate surprisingly jumped to 3.8% (3.5% expected) also as a result of an increase in labour force participation (62.8% vs 62.6%). There are more people seeking employment and this is probably one of the factors that led to a fractional decrease in Average Hourly Earnings. Overall, we emerge from the week with the impression that the labour market is finally starting to slow down.

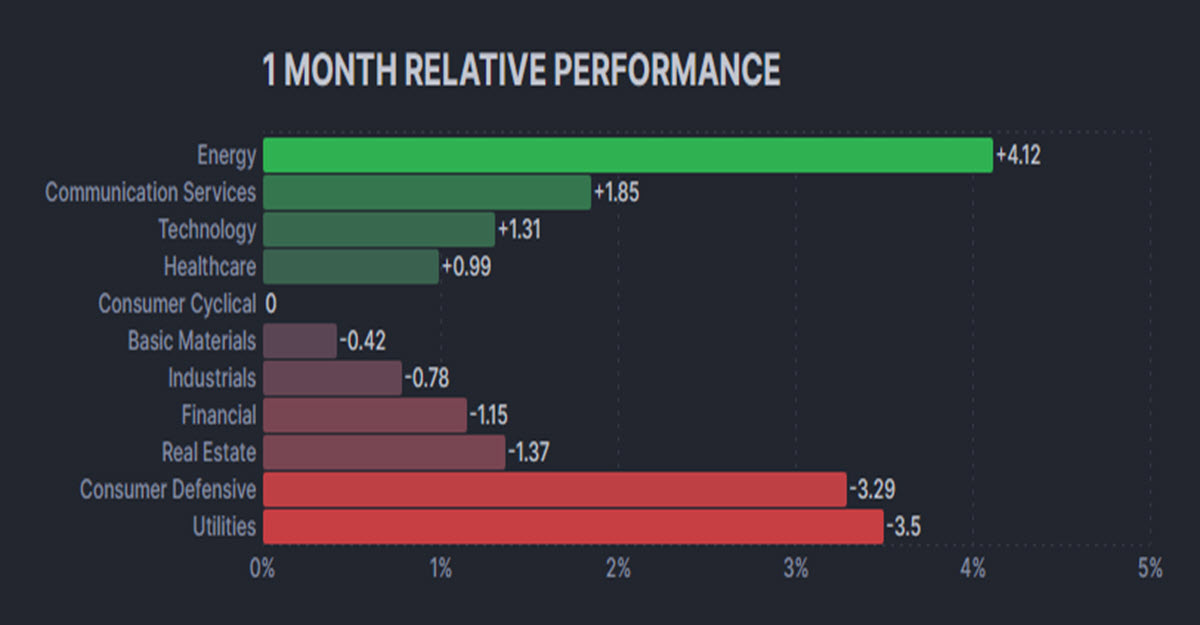

Relative Performances by Sector, August

Yields and USD reacted by plummeting shortly after the data, before totally reverting the move and ending the day up; the long-end has experienced the heavier selling pressure, resulting in the curve steepening.

Crude oil soared again (+2.30%) with the EIA and API data showing considerable pressure on stocks during the week probably due to the effect of several months of production cuts. At the same time, Copper hit $390 before sellers emerged, adding to its 6.50% rally since mid August on decent Chinese Manufacturing data.

-

FX – USDIndex recovered 104 (104.09 now), EURUSD turned below 1.08 (1.07865, GBPUSD just north of 1.26 (1.2609). USDJPY sits above 146 once again, USDCNH 7.2667.

-

Stocks – US30 closed higher on Friday and notched its best week since July. US500 +0.2%, US100 -0.02% but still up +3.67% on the week. In Europe GER40 closed -0.6%, CAC40 – 0.29%.

-

Commodities – USOil is digesting last Friday’s rally, now -0.61% at $85.48, the spread against UKOil has reduced to $2.97. Copper flat at $385 after sellers emerged at $390 on Friday.

-

Gold – still hovering around $1940, XAG pulled back powerfully from $25 ($24.18 now).

LATER TODAY: German Trade Balance, Switzerland GDP, EU Sentix confidence, ECB’s Lagarde speech

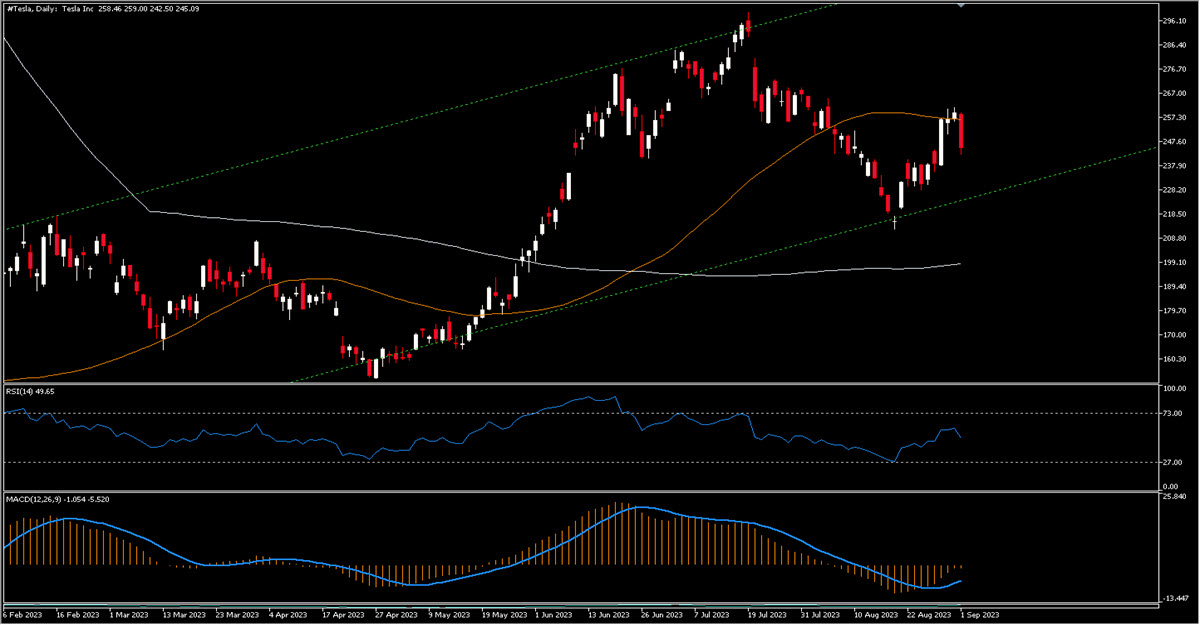

INTERESTING MOVER: TESLA -5.06% at $245.01 after lowering the US prices of its Model S and X for the seventh time in 2023, now $30k and $40k respectively cheaper than at the beginning of the year. The price was rejected by the 50MA and the MACD is negative.

Click here to access our Economic Calendar

Marco Turatti

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.