Coinbase is a digital currency exchange platform that allows users to buy, sell and store various cryptocurrencies such as Bitcoin, Ethereum, Litecoin, etc. It was established in 2012 and, since that year, has become one of the most popular and widely used cryptocurrency exchange companies worldwide. The company is the most popular in its sector in the United States and has a market capitalisation of $23.13B.

Coinbase plans to report its earnings for the fiscal second quarter ending June 2023 on Thursday, August 3, after the market closes.

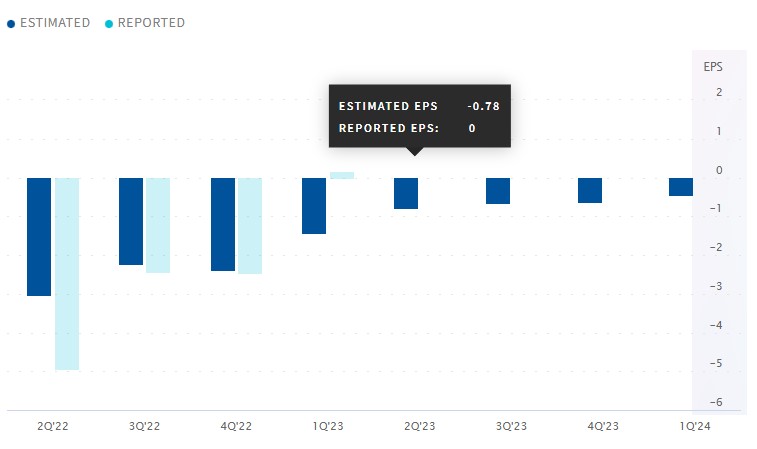

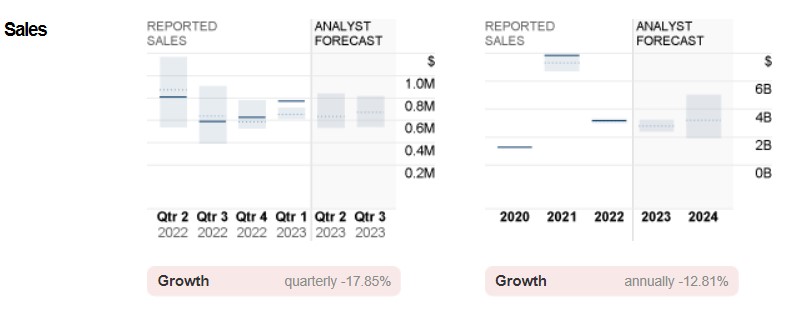

Zacks ranks Coinbase “Rank #3 – Hold” in the Top 9% at #22/251 in the Stocks & Equities industry. For this report, EPS is expected to be $-0.78 (same for Nasdaq) with an ESP of -3.68%, marking an 84.24% increase from -$4.95 in the same quarter last year. Profit of $643.36M is expected, which would be a drop of -20.41% YoY from $808.33M.

The estimate has 4 downward revisions and 1 upward revision in the last 60 days. The company has reported 6 results below the estimate of 9 it has published, the last quarter positive with a surprise EPS of 110.42%.

Last quarter the company reported EPS of $0.15 and revenue of $772.53M.

Regarding Coinbase’s stock price forecast for the next 12 months, we have the lowest forecast with a -71.3% drop at $27.00, the highest expectation is found with a +112.3% increase at $200.00, while the average price is found at -31.0% at $65.00.

Elements to consider

In June 2023, Coinbase revealed that it had obtained a digital asset trading licence from the Bermuda Monetary Authority. This licence will allow the company to offer its services in Bermuda and other regions as it continues to expand globally.

On the regulatory front, Coinbase continues to face regulatory scrutiny from the US Securities and Exchange Commission (SEC). In July 2023, the SEC ordered Coinbase to delist all tokens except Bitcoin due to the regulator’s assertion that 13 tokens traded on Coinbase qualify as securities. Following the SEC’s request, Coinbase removed certain tokens from its platform.

However, the company announced that it would continue to offer some of the disputed cryptocurrencies, claiming they were not securities, a move based on regulatory precedent from the RippleLabs case, where a federal judge ruled that the Ripple Labs token was not a security when sold to members of the general public on cryptocurrency exchanges, which sent Coinbase’s stock soaring recently.

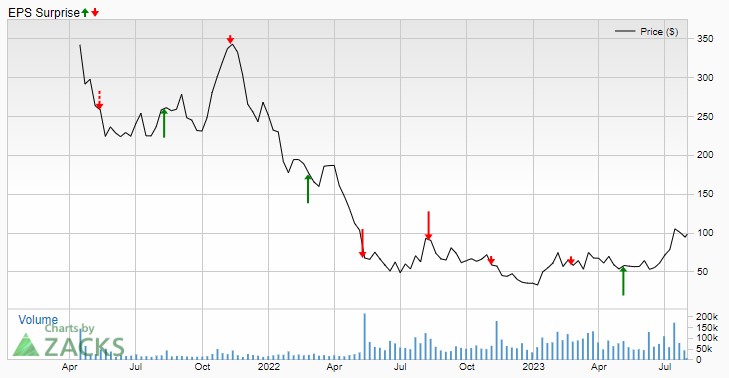

So far this year, COIN are up 198.42%. Investors perceived that decision as potentially favourable news for Coinbase, which had been sued by the SEC earlier in the year.

“We really had no choice at the time, divesting all assets other than bitcoin, which is certainly not what the law says, would have meant essentially the end of the crypto industry in the United States” – Brian Armstrong, CEO of Coinbase.”

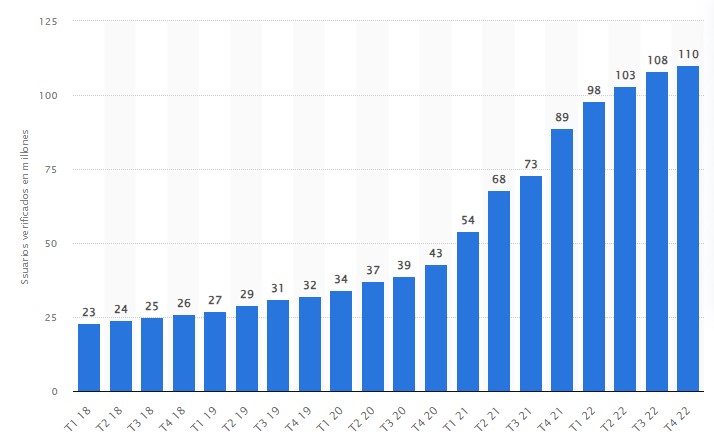

Coinbase’s user metrics, including the number of monthly active users and the amount of assets held on the platform, are closely monitored. It is expected that the number of users and assets could increase as people continue to adopt cryptocurrencies, the latest Q4-22 count was at 110 million verified users managing a traded volume this quarter of $145B. However, it will be interesting to see how regulatory developments, such as the removal of certain tokens, affect these metrics.

Despite regulatory pressure, Coinbase continues to push forward with new initiatives and offerings. In May 2023, the exchange revealed its intention to buy back 0.50% convertible senior notes due 2026, with the aim of reducing future dilution and optimising the capital structure. In addition, Coinbase participated in the Piper Sandler Global Exchange & FinTech Conference in late June 2023, where CEO Brian Armstrong led a discussion on the future of digital currencies.

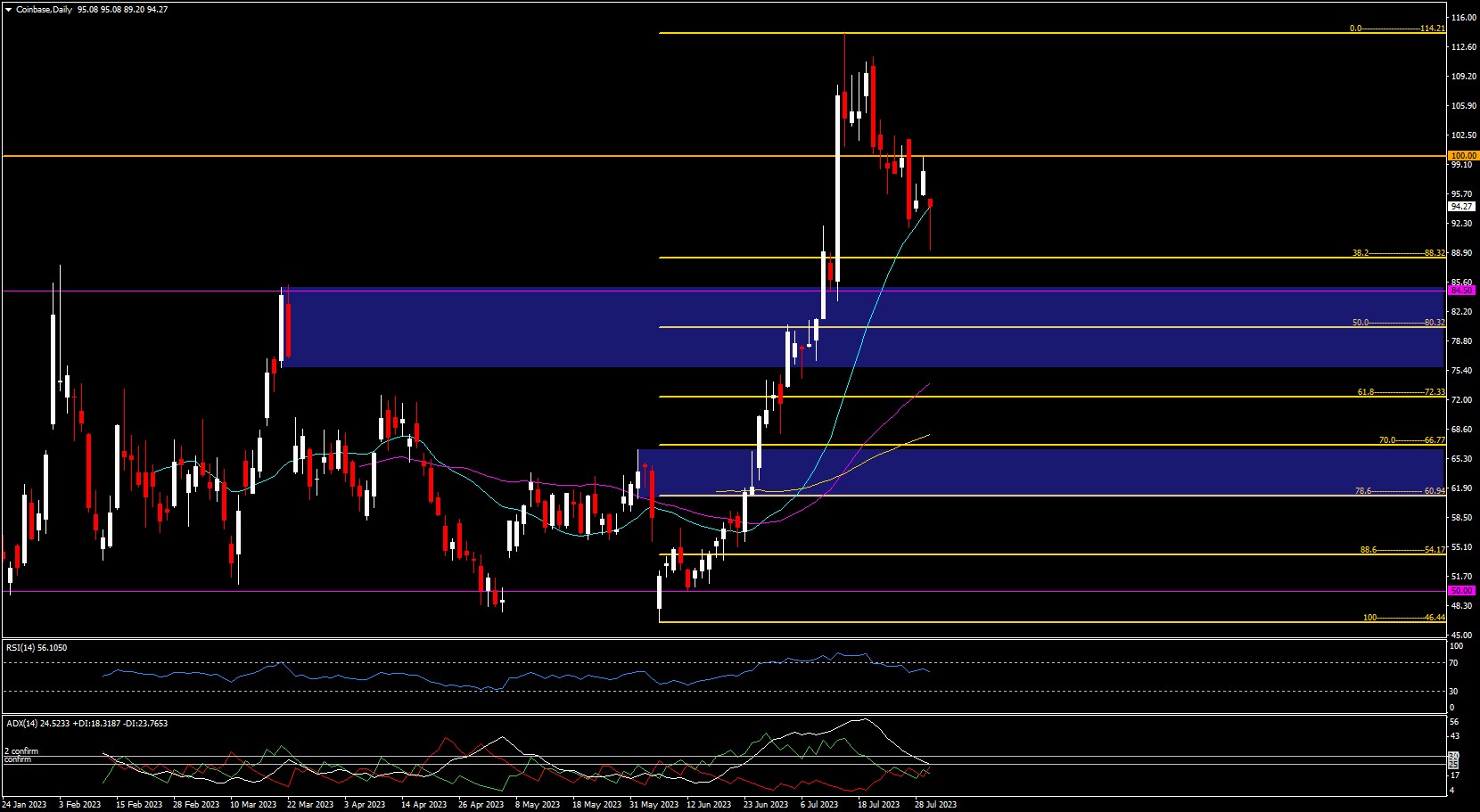

Technical Analysis – Coinbase D1 $94.15

During the first quarter Coinbase rose 177.75% to $87.63 from its lows at $31.55 before closing the quarter at $67.57. In the second quarter, the price dropped to a low of $46.43 in June for a 61.47% increase to close the quarter at $71.55. From the second quarter to the present, the price continued the momentum and reached highs at $114.43 (a level we have not seen since August 2022) giving a total increase of 146.46%.

Currently, the price has fallen below the key $100 level on retracement taking support at the daily 20 period SMA closing today with a Hammer candle awaiting its results.

Should the pullback continue we have 3 interesting zones: The first, which is the last high zone around the Fibo50% at $80.32 comprising from $75.75-$84.50. The second one, the highs prior to the second quarter low comprising from the Fibo78.6% at $60.94 to the 70% discount at $66.77. And lastly, the lows around the psychological level of $50 and up to $46.44.

In the event of further upside, we would first need to regain and hold the psychological $100 level, test and break the current highs at $114.43 in order to seek the March 2022 highs near the psychological $200.00 level at $206.79.

RSI crossed the 70 overbought level downwards and is currently at 56.10 marking the end of the momentum and showing the retracement. ADX at 24.52 with the +DI at 18.31 and the -DI at 23.76 marking the fall in the strength of the uptrend and awaiting further upward or downward momentum. 50 period daily SMA at $73.98 and 100 period daily SMA at $68.06, marking a “Golden cross” on the 14th of July.

Click here to access our Economic Calendar

Aldo W. Zapien

Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.