Another significant economic report for Sterling is the CPI inflation rate for June, which will influence the BOE’s decision on whether to raise interest rates by 50 basis points back in August. Sterling has strengthened throughout 2023, as UK inflation has proven to be more resilient than expected and prompted the BOE to take a firmer stance on monetary policy by raising interest rates and lowering its guidance cautiously.

CPI is expected to rise 8.2% y/y in June, down from 8.7% previously, with core inflation expected to fall to 6.8% from 7.1%. UK headline inflation is expected to ease with the continued fall in energy prices, but it is the core figure that will be in focus, especially after last week’s higher-than-expected wage figures. A fall in inflation should put pressure on Sterling and if inflation overshoots, Sterling should strengthen. However, the opposite reaction may also be possible due to prevailing market sentiment.

The release of the inflation data coincides with Sterling’s brilliant performance; consequently an unfavourable shock could have a greater negative impact than a positive one. Investors continue to be concerned, that the UK economy will contract due to interest rate rises in the coming months and the impact of the inflation announcement could exacerbate these concerns and weaken Sterling. The readjustment of lower rate hike expectations could result in Sterling’s underperformance.

However, falling inflation will also improve the outlook for the UK economy, as the pressure on households and businesses eases and the prospect of a growth-crippling rate hike at the BOE fades. Furthermore, Friday’s retail sales report will also come under the spotlight.

Technical Analysis

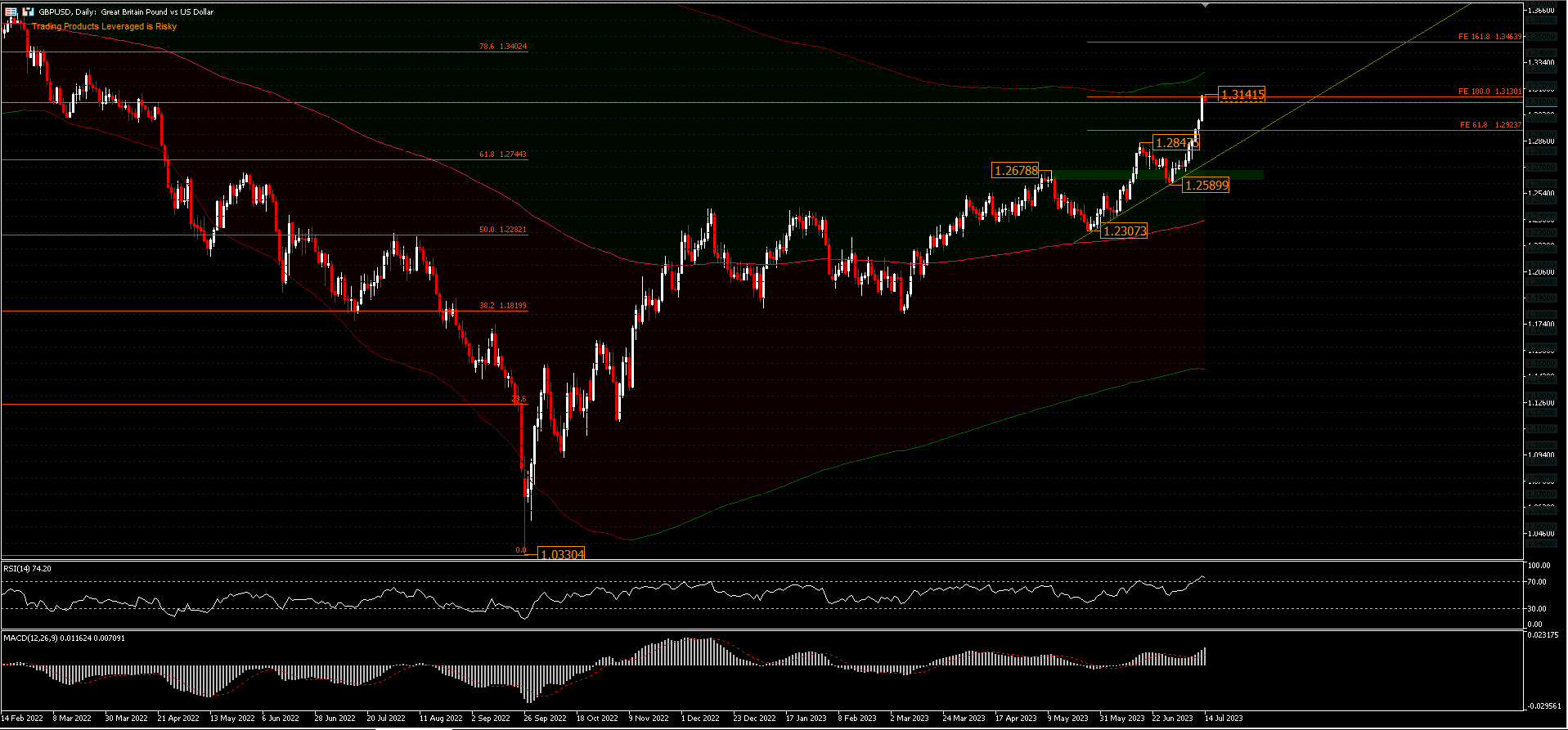

GBPUSD, D1 registered a fresh 15-month top (1.3141) on Friday, as the bulls started losing steam, having rallied 2.1% last week. A pause after six consecutive days of uninterrupted rally looks like a logical scenario, as traders look for partial profit-taking. However, the correction seems unlikely to be too deep, as the Dollar remains under increasing pressure with receding US inflation and growing signs, that the Fed will soon end its rate hikes, with expectations that easing will begin early next year.

Further GBPUSD upside is projected for FE 161.8% at 1.3463 from 1.23073-1.2847 and 1.2589 pullback. Breakout there will target January 2022 top at 1.3748. Currently it will remain the preferred case, as long as 1.2678 resistance turned support holds.

A decline on the downside is likely to be held above 1.2847 resistance-turned-support before trend favourability is re-established. RSI clearly looks very overbought and MACD remains still validating the direction of the last move.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.