- FX – The USDIndex down to 103.33 the lowest since May 24. EUR holds above 1.0750, today at 1.0780. JPY briefly tested 138.70 lows from June 2. back to 139.40 now. Cable holds over the mighty 1.2500 at 1.2560.

- Stocks – Wall Street traded positively with tech bouncing back the NASDAQ gained over 1.00%, the DOW edged out a 0.50% gain. US500 (0.60%) closed 26.33pts at 4293, FUTS popped 4300, but are trading at 4290.

- Commodities – USOil – Futures tanked under $70.00 again, to $69.00 before bouncing back to $71.00. Gold – rallied to $1970 from below the key $1950 handle, and trades at $1965 now.

- Cryptocurrencies – BTC reversed from the $27k level to 26.5k again in the wake of the Binance and Coinbase rejections of the SEC accusations.

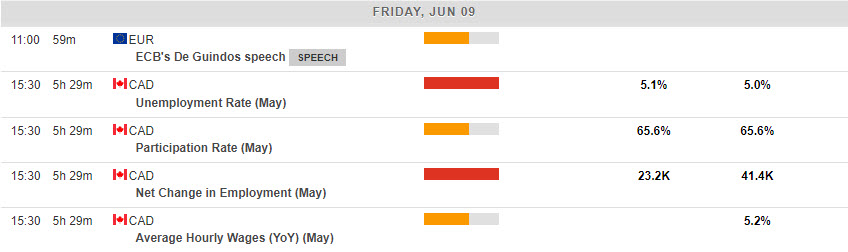

Today – Canadian Jobs Data & Speech from ECB’s de Guindos.

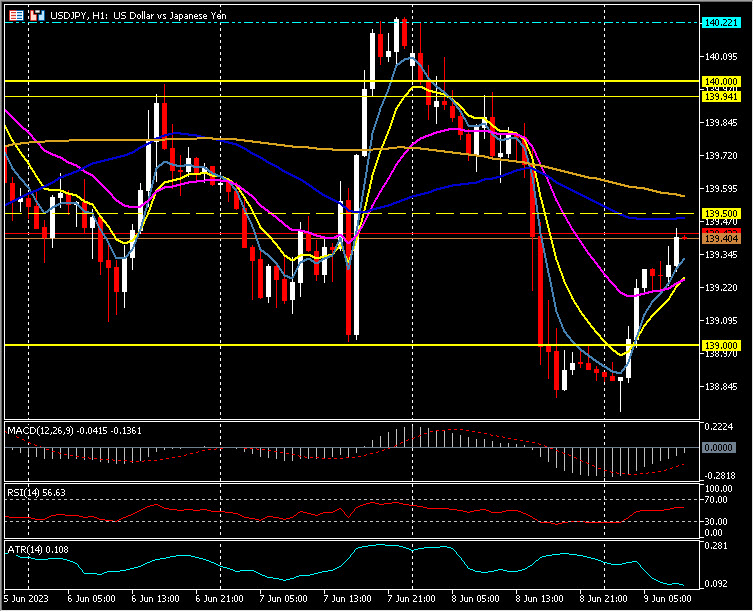

Biggest FX Mover @ (06:30 GMT) USDJPY (+0.57%) Rallied from 138.75 lows today to break 139.50, next resistance at 139.60. MA’s aligning higher, MACD histogram & signal line negative but rising, RSI 61.20 & rising, H1 ATR 0.121, Daily ATR 1.177.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.