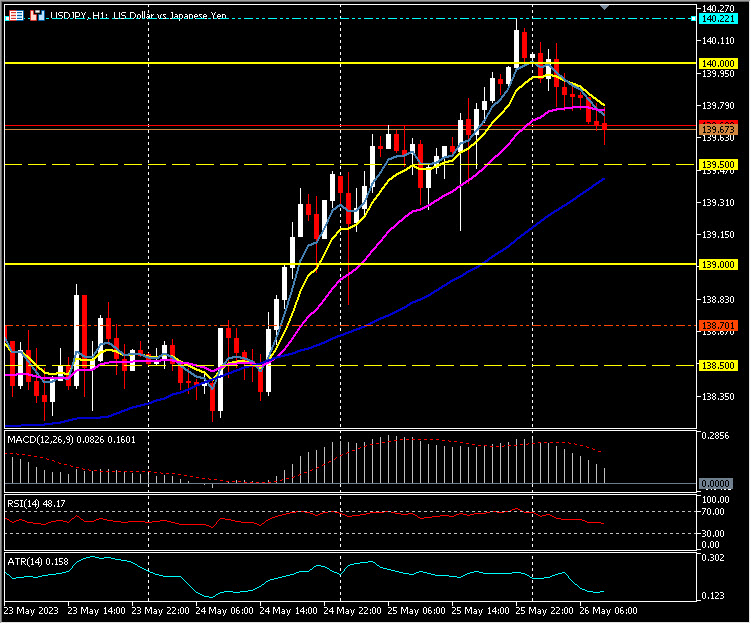

- FX – USDIndex has rallied to 104.22, another new 2-month high. A stronger USD continues to weigh on EUR which tested down to the 1.0700 zone yesterday, trades at 1.0730 now. JPY breached 140.00 & still holds over 139.50 at 139.65 now. Cable slipped again to 1.2310 lows yesterday, recovering a little to the 1.2350 handle.

- Stocks – Wall Street traded mixed all day and closed that way. (-0.11% to +1.71%). NVDA +24.37%, MRVL +7.6%, DLTR -12.00%. US500 (+0.88%) closed 36.34 pts at 4151, FUTS are trading at 4159, and a third day below the key resistance at 4175.

- Commodities – USOil – Futures declined into $71.00 zone from $74.25 following mixed news regarding Saudi output cut threats. Gold – moved lower again, to $1937, tbut has since recovered to the key $1950 handle.

- Cryptocurrencies–BTC pushed to test under $26k yesterday and remain capped at $26.5k today as USD strength persists.

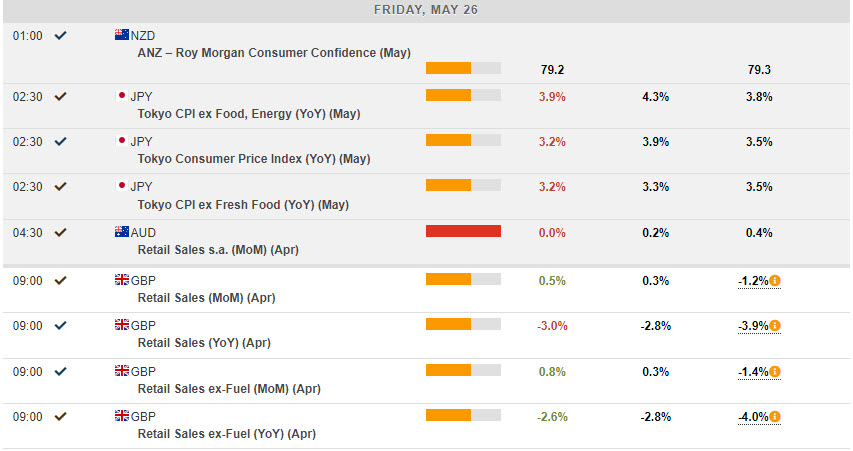

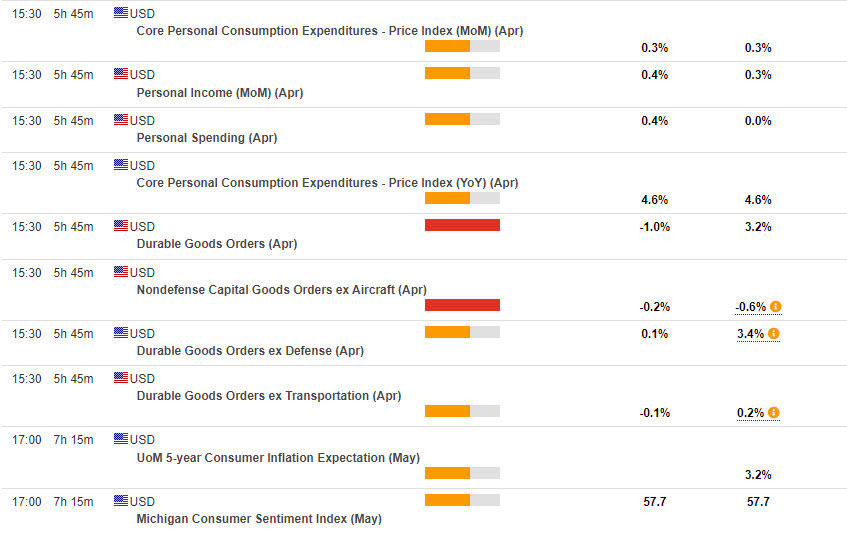

Today – Core PCE Price Index, Core Durable Goods Orders, Personal Income & Spending, UoM Consumer Sentiment & Inflation Expectations.

Biggest FX Mover @ (06:30 GMT) USDJPY (-0.24%) Following a strong rally to 140.22 giving back some gains today. MA’s aligning lower, MACD histogram & signal line positive but slipping, RSI 48.17 & neural, H1 ATR 0.152, Daily ATR 1.096.

Click here to access our Economic Calendar

Stuart Cowell

Head Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.