US stock indexes rose on Thursday (18/05), amid increasing optimism that the US will raise its debt ceiling and avoid default. House Speaker McCarthy said negotiators were in a much better position at the moment and he saw a debt limit deal being considered in the House next week. Stock indexes extended the rally with USA500 posting 9-month highs and gaining +1.07%, USA30 posting 1-week highs and gaining +0.48%, and USA100 posting 1-year highs and gaining +1.99%.

For now, share price gains tend to be influenced by positive sentiment over the debt ceiling, while economic data should limit stock gains. Weekly jobless claims fell more than expected and the Philadelphia Fed’s May business outlook survey rose more than expected. The jump in bond yields due to the Fed’s hawkish comments is negative for stocks.

Moving forward, markets will be watching Fed speakers closely for any further clues as to whether or not the Fed may raise interest rates in June. Fed speakers have recently adopted a hawkish stance. The Fed’s 40% chance (up from 36% yesterday) of raising rates by 25 bps at the June FOMC meeting is being weighed.

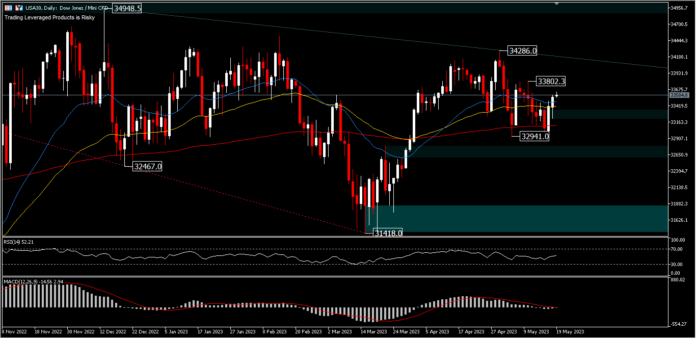

Technical Review – USA30, D1

Price action is trying to lift the price above the 200 day EMA (red line) since forming a double bottom. Currently, the index is trading above its 26 day EMA (blue line), with a possibility to test last week’s high of 33,802.30. A move above last week’s high will take the price higher to the minor top of 34,286.00. Failure to move above 33,802.30 could bring the outlook index into consolidation mode. While the movement has strong support at 29,410.00, the index could move sharply to test intermediate support at 31,418.00.

RSI is at 52 and MACD is yet to validate the move in the short term.

Click here to access our Economic Calendar

Ady Phangestu

Market Analyst – HF Educational Office – Indonesia

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.