Dollar bulls take control midweek as the DXY benefits from a broadly risk-averse investor sentiment.

Dollar

The Greenback rolls into midweek retreating from a monthly low to set the highest price for the month of May thus far. Factors driving this renewed optimism in the US currency can be attributed to stronger than expected economic data from April in the form of US Retail Sales and Industrial Production as well as the positive developments around the US debt ceiling issue, with Joe Biden and Kevin McCarthy agreeing that a deal to solve the issue might be concluded by the end of this week. Additionally, FED officials have collectively defended and held the narrative that they “aren’t at the hold rate” as yet.

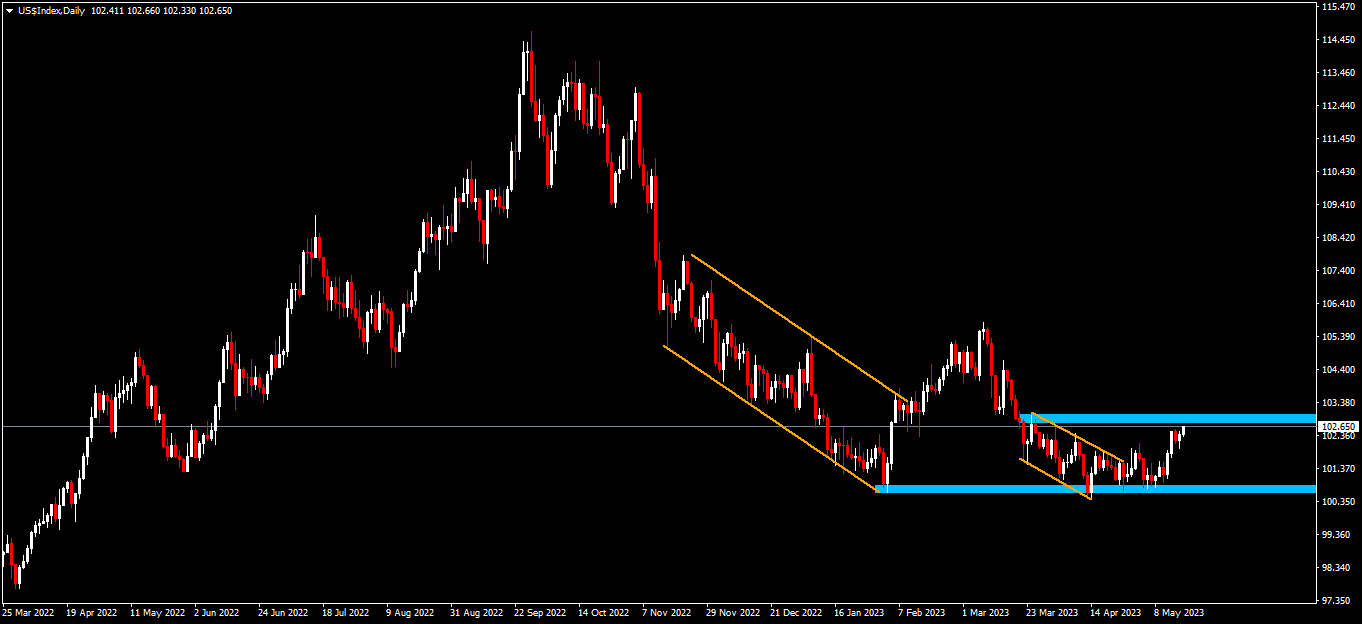

Technical Analysis (D1)

In terms of market structure, Current Price action could remain bullish if buyers can defend the potential descending channel continuation pattern that is currently being formed. A break above the 103 level will confirm bullish momentum. Conversely, if sellers break through the support level around 100.40, the narrative could shift towards the bears and break below the low of the year

Euro

The European common currency heads into the middle of the week on the back foot as it registers the lowest price thus far in the month. Factors driving this selling pressure can be attributed to the increased risk aversion underpinning the markets, leading to an increase in the demand for the safe-haven dollar. Adding to the selling pressure are comments from ECB official de Cos, which put forth the narrative that the ECB could be nearing the end of its hiking cycle, which put a cap on any bullish impetus on the currency.

Looking ahead, traders will be continuing to observe the approach of the FED in relation to the ECB as well as the EMU final inflation data due today (Wednesday.)

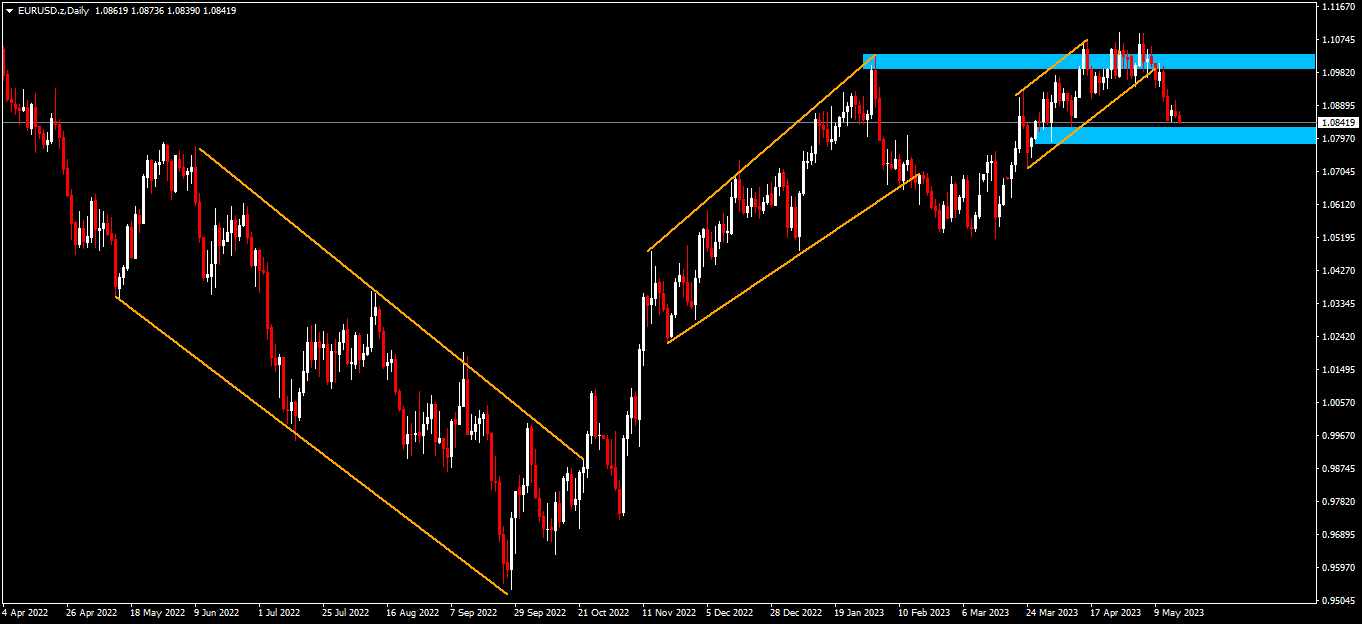

Technical Analysis (D1)

In terms of market structure, Current Price has approached an area with sell side pressure in the form of an ascending channel. This pattern gives bears the possibility of driving price if the current continuation pattern plays out successfully, which would confirm the larger double top reversal pattern potentially forming. A break below the 1.079 area will confirm bearish momentum. Conversely if the bulls can sustain the pressure, price could break above the double top and continue the uptrend if it invalidates the resistance area in an impulsive wave.

Pound

The Pound heads into the middle of the week licking its wounds as price dives to a three-week low. Factors driving this selling pressure can be attributed to weak employment data from the UK on Tuesday, which has increased the narrative that the BoE could implement fewer than expected rate increases to bring down inflation, as signs of a weaker jobs market are beginning to enter the spectrum, which is what monetary policy decision makers want to see before the rate pausing begins.

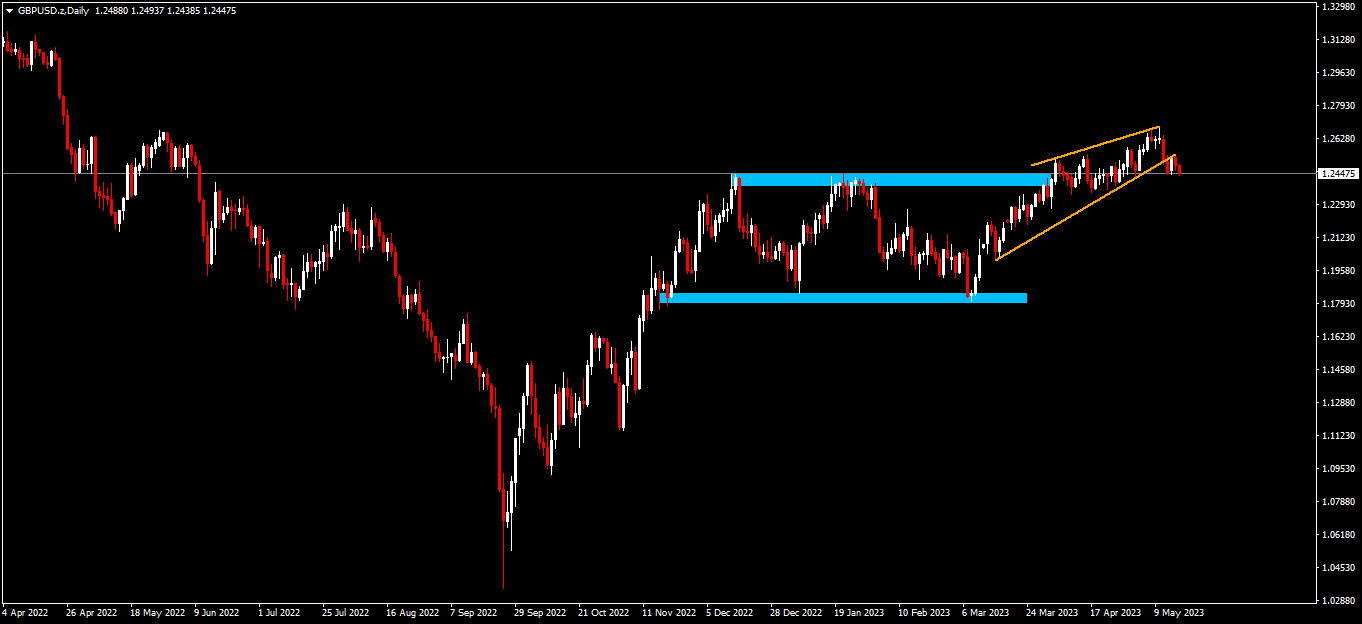

Technical Analysis (D1)

In terms of market structure, the bulls have been in control of the narrative and price has tested the key 1.244 level and has since pulled back forming a potential bearish triple top within a tight trading range. As price retests this peak formation again, in the form of a potential rising wedge reversal pattern, two scenarios present themselves. Namely, if the area is defended by sellers it could result in price making its way to the lower end of the range. Conversely, if buyers break above the area, price will continue to remain bullish in the near term.

Gold

Gold heads into the middle of the week under some significant pressure as it approaches the low of the month around the $1 976 level. Factors driving this enthusiasm from the bears can be linked to dollar dynamics, in the form of upbeat US economic data which has further fuelled the hawkish narrative from some FED officials and led to a risk-off mood which has been to the benefit of the dollar against the yellow metal.

Looking ahead, the US economic docket looks mild and may allow gold to rebound slightly, but second-tier housing data, combined with headlines around the US debt ceiling debacle, could potentially bring bears back into the fray.

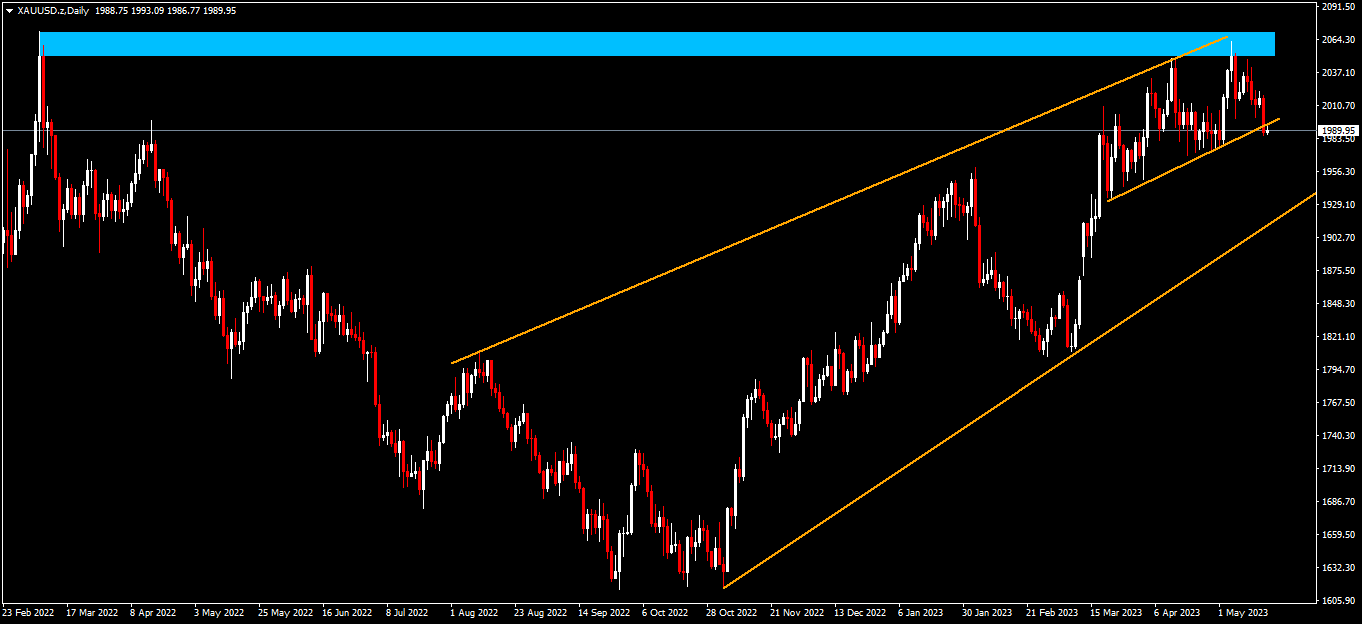

Technical Analysis (D1)

In terms of market structure, price action has been mostly bullish, with clear higher-highs and higher-lows being printed out. Current Price action is approaching the Feb 2022 high in a corrective wave associated with a potential rising channel reversal pattern. Henceforth price action should be given the chance to print itself out to either validate the reversal pattern or to invalidate it by continuing to move up impulsively towards the aforementioned high.

Click here to access our Economic Calendar

Ofentse Waisi

Financial Market Analyst

Disclaimer: This material is provided as a general marketing communication for information purposes only and does not constitute an independent investment research. Nothing in this communication contains, or should be considered as containing, an investment advice or an investment recommendation or a solicitation for the purpose of buying or selling of any financial instrument. All information provided is gathered from reputable sources and any information containing an indication of past performance is not a guarantee or reliable indicator of future performance. Users acknowledge that any investment in Leveraged Products is characterized by a certain degree of uncertainty and that any investment of this nature involves a high level of risk for which the users are solely responsible and liable. We assume no liability for any loss arising from any investment made based on the information provided in this communication. This communication must not be reproduced or further distributed without our prior written permission.